Oklahoma Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd

Description

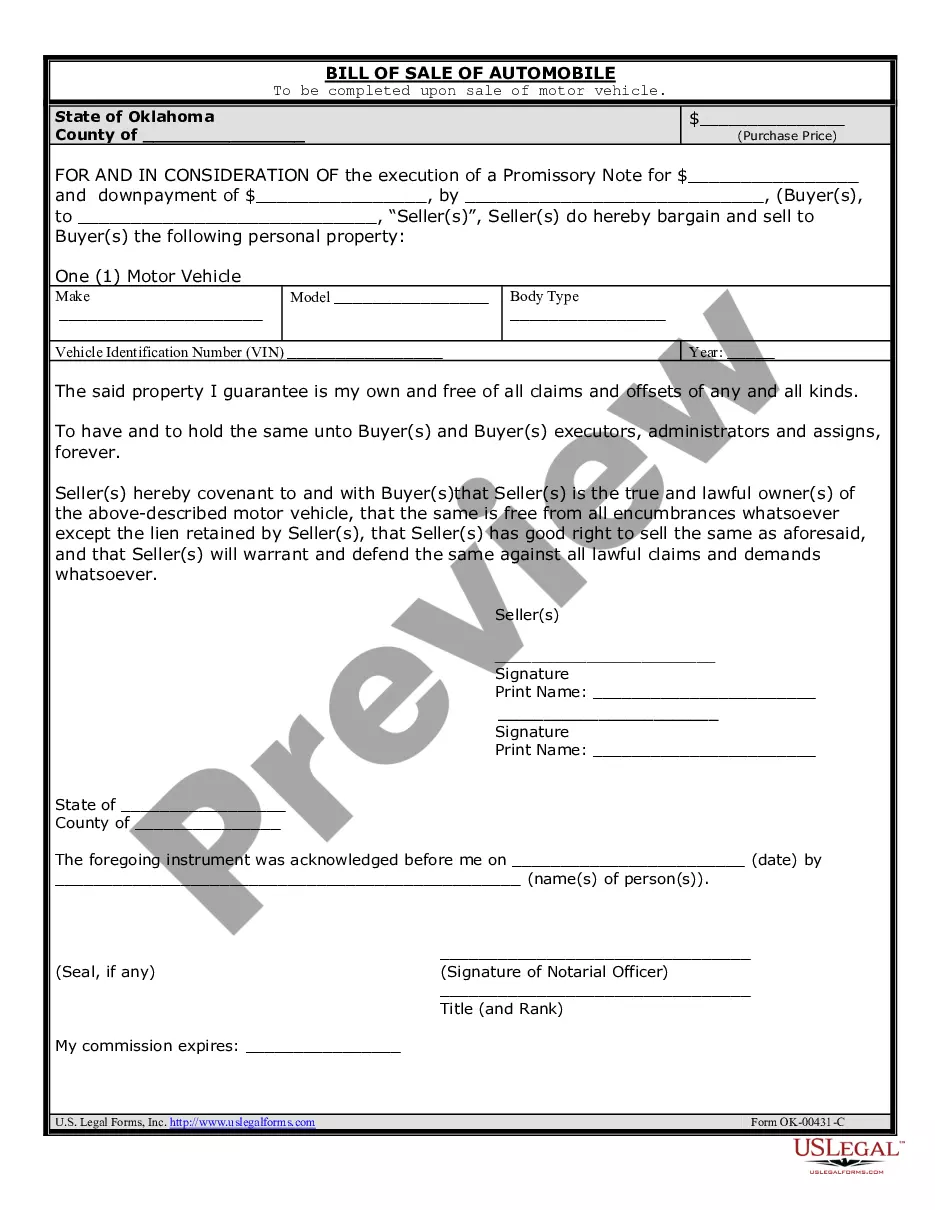

How to fill out Stock Option Agreement Between Shorewood Packaging Corp. And Jefferson Capital Group, Ltd?

If you have to complete, download, or print legal document layouts, use US Legal Forms, the biggest selection of legal types, that can be found online. Make use of the site`s simple and easy hassle-free research to discover the files you will need. A variety of layouts for business and person uses are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to discover the Oklahoma Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd within a handful of clicks.

In case you are currently a US Legal Forms client, log in to the accounts and then click the Obtain button to find the Oklahoma Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd. You may also access types you formerly delivered electronically within the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the shape to the appropriate area/land.

- Step 2. Take advantage of the Review method to look through the form`s articles. Never forget about to read the outline.

- Step 3. In case you are unsatisfied with the type, utilize the Look for area towards the top of the display screen to discover other versions from the legal type web template.

- Step 4. Once you have found the shape you will need, click the Get now button. Choose the pricing strategy you choose and add your references to sign up for the accounts.

- Step 5. Process the transaction. You may use your bank card or PayPal accounts to complete the transaction.

- Step 6. Pick the formatting from the legal type and download it on the gadget.

- Step 7. Full, revise and print or indicator the Oklahoma Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd.

Each and every legal document web template you purchase is yours forever. You might have acces to every single type you delivered electronically in your acccount. Click the My Forms portion and pick a type to print or download yet again.

Remain competitive and download, and print the Oklahoma Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd with US Legal Forms. There are many skilled and state-specific types you can use for your business or person requires.