Oklahoma Adoption of incentive compensation plan

Description

How to fill out Adoption Of Incentive Compensation Plan?

Have you been in a placement where you require files for either business or individual uses nearly every day time? There are a lot of legitimate papers layouts available on the Internet, but getting types you can rely isn`t straightforward. US Legal Forms gives 1000s of kind layouts, such as the Oklahoma Adoption of incentive compensation plan, which are created to fulfill federal and state demands.

If you are currently informed about US Legal Forms internet site and also have a merchant account, basically log in. Afterward, you are able to download the Oklahoma Adoption of incentive compensation plan design.

Unless you offer an accounts and wish to start using US Legal Forms, adopt these measures:

- Discover the kind you require and ensure it is for that right city/region.

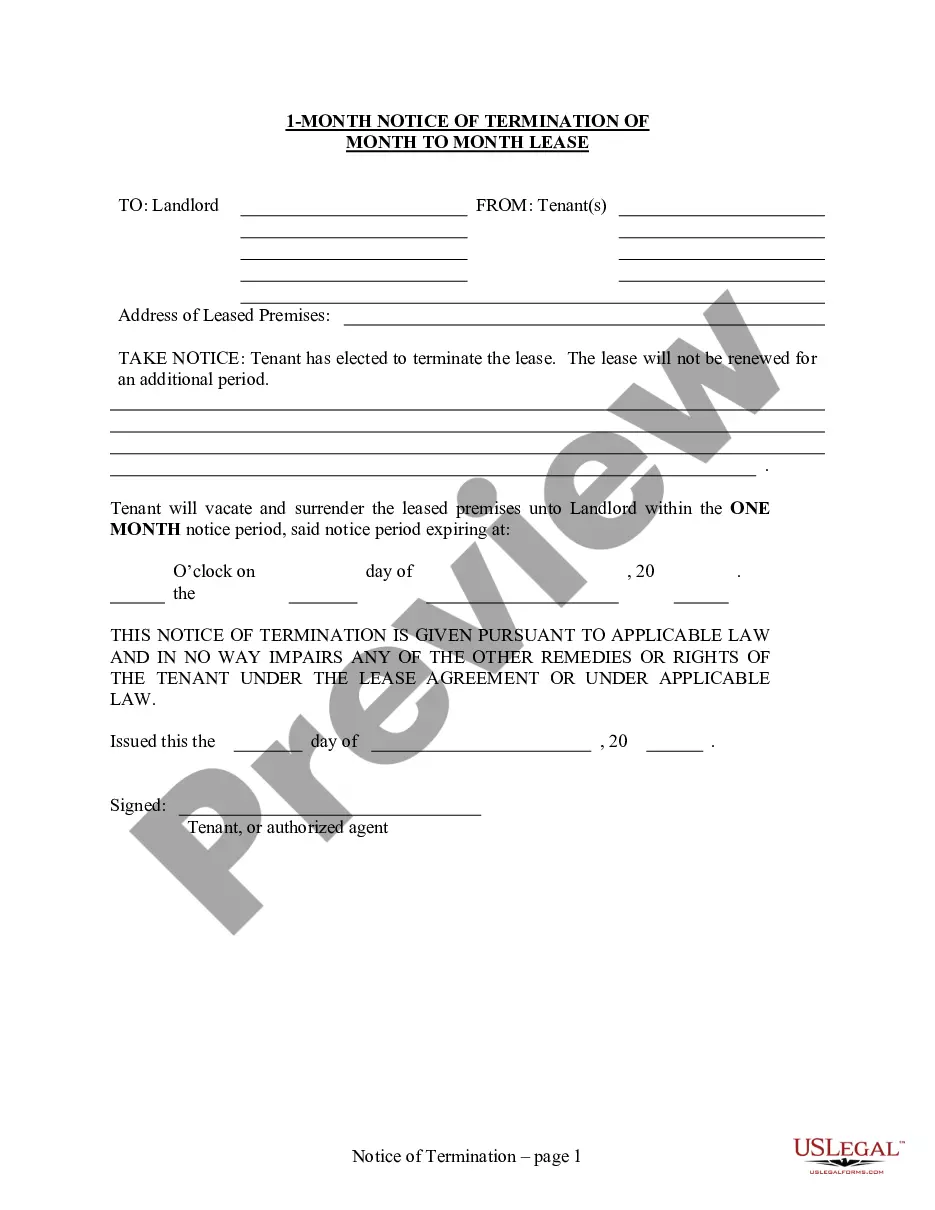

- Utilize the Review option to review the form.

- Look at the explanation to actually have chosen the correct kind.

- When the kind isn`t what you are looking for, take advantage of the Lookup area to obtain the kind that meets your requirements and demands.

- If you find the right kind, simply click Purchase now.

- Choose the costs plan you want, fill in the required information and facts to make your account, and pay for an order utilizing your PayPal or credit card.

- Choose a practical file file format and download your duplicate.

Discover every one of the papers layouts you may have purchased in the My Forms menu. You can get a further duplicate of Oklahoma Adoption of incentive compensation plan whenever, if necessary. Just select the required kind to download or print out the papers design.

Use US Legal Forms, the most substantial assortment of legitimate forms, to save lots of time and stay away from errors. The service gives skillfully produced legitimate papers layouts which you can use for a range of uses. Produce a merchant account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

Start at the Top ?Talk about what kind of behavior you want to reward," Coates said. ?Make sure you're rewarding behaviors that will help your business financially and that will be positive for your clients as well." Leaders also need to discuss which employees will be eligible for incentive compensation.

10 Tips for Successful Incentive Plans Understand the need for incentives. ... Involve the employees. ... Simple is best. ... Include all employees. ... Use work methods and labor standards. ... Reward direct work. ... Consider other factors. ... Communicate the program.

Below are the steps you can use when developing and implementing an incentive program for employees: Involve the right people. ... Set goals for the program. ... Identify the incentive audience. ... Increase participant engagement. ... Choose a program structure and budget. ... Determine the rewards. ... Decide how you plan to track involvement.

Incentives like restricted stock-based packages and cash bonuses ? awarded to employees after reaching certain long-term goals or staying on at the company for specified time frames ? are examples of long-term incentive compensation.

Structured incentive pay is set by specific sales or production goals and paid to employees at a percentage or flat rate. For example, you set a goal for $50,000 in sales for the fiscal year. If you reach that goal, you give each employee a bonus equaling 2% of their annual salary.

Incentive awards could be made for achieving sales goals, projects completion, referrals, or other goals an organization wants to encourage employees to meet. The awards may take the form of cash payments, profit sharing, stock options, equity, or other monetary or non-monetary rewards.