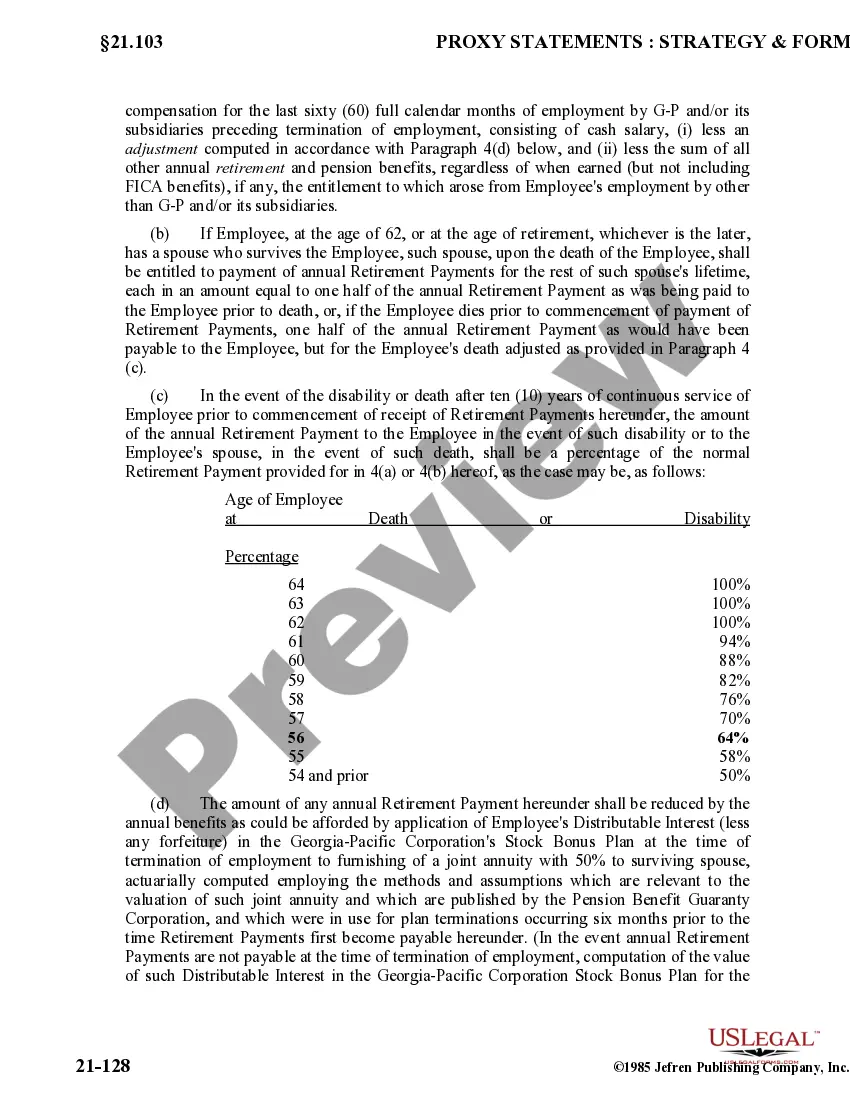

The Oklahoma Executive Retirement Agreement of Georgia Pacific Corp. is a legally binding contract between the company and its executive employees in the state of Oklahoma. This agreement outlines the terms and conditions of retirement benefits provided by Georgia Pacific Corp. to its executives upon reaching their retirement age or meeting specific criteria. Keywords: Oklahoma Executive Retirement Agreement, Georgia Pacific Corp., executive employees, retirement benefits, terms and conditions, retirement age, specific criteria. This retirement agreement serves as a comprehensive package that ensures a smooth transition into retirement and guarantees financial security for executives who have dedicated a significant portion of their careers to the success and growth of Georgia Pacific Corp. There may be different types or variations of the Oklahoma Executive Retirement Agreement based on factors such as the executive's job position, length of service, and accumulated pension contributions. These variations can be tailored to meet the individual needs and circumstances of each executive. The agreement typically covers essential aspects such as the calculation and payment of retirement benefits, including pension or retirement plan distributions, supplemental executive retirement plans (SERPs), and other post-employment benefits like healthcare coverage or life insurance policies. Furthermore, the agreement may detail the vesting schedule, which determines the percentage of retirement benefits an executive is entitled to, based on their years of service or performance milestones. It may also outline any conditions or contingencies that must be met for the benefits to be fully realized, such as non-competition or non-disclosure agreements. The Oklahoma Executive Retirement Agreement of Georgia Pacific Corp. may also contain provisions regarding the payment method, whether through a lump-sum distribution or periodic payments structured to provide a stream of income during retirement. Additionally, the agreement may address other crucial matters, such as survivor benefits, disability provisions, and how potential changes in tax laws or regulations could affect the executive's retirement benefits. Executives entering into the Oklahoma Executive Retirement Agreement with Georgia Pacific Corp. should carefully review and consider their personal financial goals and objectives as well as seek independent legal and financial advice before signing the agreement. This ensures that they fully understand the rights, benefits, and obligations associated with their retirement package and can make informed decisions regarding their future. In summary, the Oklahoma Executive Retirement Agreement of Georgia Pacific Corp. outlines the retirement benefits provided by the company to its executive employees in Oklahoma. It covers various aspects such as pensions, SERPs, post-employment benefits, vesting schedules, payment methods, and other provisions necessary to ensure a smooth and secure transition into retirement.

Oklahoma Executive Retirement Agreement of Georgia Pacific Corp.

Description

How to fill out Oklahoma Executive Retirement Agreement Of Georgia Pacific Corp.?

Have you been in a situation the place you require files for both enterprise or specific purposes almost every day? There are tons of lawful file templates available on the net, but discovering kinds you can depend on isn`t easy. US Legal Forms delivers a large number of develop templates, much like the Oklahoma Executive Retirement Agreement of Georgia Pacific Corp., which can be written to meet state and federal demands.

Should you be already knowledgeable about US Legal Forms internet site and possess a free account, basically log in. After that, you may down load the Oklahoma Executive Retirement Agreement of Georgia Pacific Corp. template.

Unless you come with an bank account and need to start using US Legal Forms, abide by these steps:

- Get the develop you will need and make sure it is to the proper town/state.

- Take advantage of the Preview button to check the shape.

- Browse the information to actually have selected the appropriate develop.

- In the event the develop isn`t what you`re trying to find, use the Look for discipline to get the develop that fits your needs and demands.

- If you find the proper develop, just click Acquire now.

- Select the rates strategy you would like, submit the required info to produce your bank account, and pay money for your order utilizing your PayPal or bank card.

- Select a handy file formatting and down load your duplicate.

Discover each of the file templates you possess bought in the My Forms menu. You can obtain a extra duplicate of Oklahoma Executive Retirement Agreement of Georgia Pacific Corp. at any time, if possible. Just go through the required develop to down load or print the file template.

Use US Legal Forms, one of the most comprehensive selection of lawful varieties, to conserve efforts and stay away from mistakes. The services delivers expertly created lawful file templates that can be used for a variety of purposes. Produce a free account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

The Georgia State Employees' Pension and Savings Plan (GSEPS) combines a traditional pension plan with a 401(k) plan that includes an employer match. The 401(k) plan offers flexibility and ?portability? and the pension plan rewards state career longevity.

All contributions are pooled together and are invested and managed by a team of investment experts. As you work, you earn credited service in the Plan. When you retire, your monthly pension is calculated ing to a benefit formula that takes into account your credited service and contribution rates.

GEORGIA-PACIFIC CORPORATION PENSION PLAN FOR HOURLY-RATED EMPLOYEES is a Defined Benefit Plan providing retirees with a predetermined monthly retirement benefit upon reaching a specific age.

Georgia-Pacific Retirement Plan A retirement plan is available. Competitive 401k match and good tools to manage program. Great retirement options and variety.

Georgia-Pacific Corporation offers medical insurance, life insurance, dependent life insurance, and short/long-term disability.

GEORGIA-PACIFIC CORPORATION PENSION PLAN FOR HOURLY-RATED EMPLOYEES is a Defined Benefit Plan providing retirees with a predetermined monthly retirement benefit upon reaching a specific age.