Oklahoma Proposed Amendment to Article 4 of Certificate of Incorporation: Authorizing Issuance of Preferred Stock In the state of Oklahoma, a proposed amendment to Article 4 of a corporation's certificate of incorporation has emerged. This amendment aims to authorize the issuance of preferred stock, thereby allowing the corporation to offer this additional class of shares to potential investors or existing stakeholders. Preferred stock, as the name suggests, grants certain preferences and privileges to its holders compared to common stockholders. This type of stock often comes with specific rights, such as priority in receiving dividends and distribution of assets in the event of liquidation. By adding this amendment to the corporation's certificate of incorporation, Oklahoma-based companies can enhance their flexibility in attracting investment and optimizing their capital structure. The proposed amendment is a crucial step for corporations to adapt to changing market conditions and potential financing needs. Companies can issue preferred stock to cater to investors seeking steady income or a particular level of security and preferential treatment. Investors in preferred stock often value the assured dividends and preferential treatment in terms of asset distribution. It is important to note that there might be various types of preferred stock within the Oklahoma Proposed Amendment to Article 4 of the certificate of incorporation. These types can be classified based on several factors, including dividend rights, liquidation preferences, conversion options, and voting rights. Common variants of preferred stock include: 1. Cumulative Preferred Stock: This class of preferred stock ensures that, even if the corporation fails to pay dividends in a particular year, the unpaid dividends accumulate and must be paid before any common stock dividend distribution. 2. Convertible Preferred Stock: With this type of preferred stock, shareholders have the option to convert their holdings into a predetermined number of common shares, providing potential benefits if the value of the common stock rises above the conversion price. 3. Participating Preferred Stock: Holders of participating preferred stock can receive additional dividends on top of their fixed dividend rate, based on predetermined conditions, such as the dividend paid to common stockholders. 4. Non-Cumulative Preferred Stock: Unlike cumulative preferred stock, this type does not accumulate unpaid dividends. If a corporation fails to pay dividends in a given year, the preferred stockholders will not receive them in the future. These are just a few examples of the potential types of preferred stock that may be authorized under the proposed Oklahoma amendment to Article 4 of the certificate of incorporation. Depending on the specific needs and objectives of the corporation, other variants may be included or specific provisions may be tailored to match unique circumstances. To review the proposed amendment in detail, including a copy of the actual amendment language, stakeholders and interested parties can refer to the official documentation provided by the corporation or consult legal professionals for clarification and advice specific to their situation.

Oklahoma Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment

Description

How to fill out Oklahoma Proposed Amendment To Article 4 Of Certificate Of Incorporation To Authorize Issuance Of Preferred Stock With Copy Of Amendment?

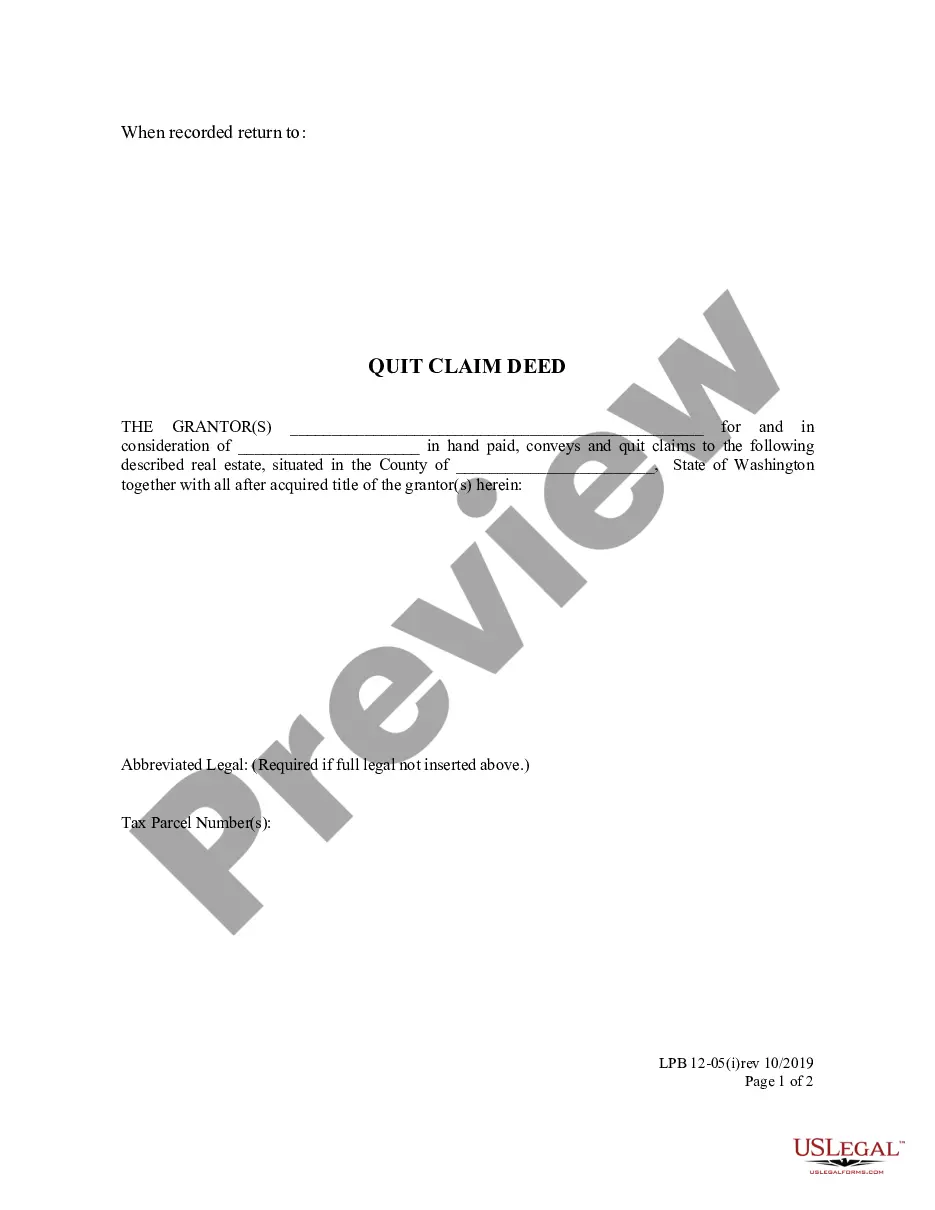

You may spend hours on the web attempting to find the authorized document format that fits the federal and state demands you require. US Legal Forms provides thousands of authorized types that are examined by experts. You can actually acquire or print the Oklahoma Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment from my service.

If you have a US Legal Forms accounts, you can log in and then click the Down load button. Afterward, you can complete, revise, print, or indicator the Oklahoma Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment. Every authorized document format you get is the one you have forever. To acquire another copy associated with a obtained kind, proceed to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site the very first time, stick to the easy recommendations under:

- Initial, make certain you have selected the proper document format for that region/area of your choice. Read the kind explanation to ensure you have picked the appropriate kind. If available, use the Review button to search from the document format also.

- If you want to discover another model from the kind, use the Lookup field to obtain the format that fits your needs and demands.

- Once you have found the format you need, simply click Buy now to move forward.

- Find the prices plan you need, type your credentials, and register for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal accounts to fund the authorized kind.

- Find the formatting from the document and acquire it for your device.

- Make changes for your document if needed. You may complete, revise and indicator and print Oklahoma Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment.

Down load and print thousands of document templates making use of the US Legal Forms Internet site, that provides the largest assortment of authorized types. Use professional and express-specific templates to deal with your business or personal needs.

Form popularity

FAQ

The Oklahoma Secretary of State enables an online name search for registered businesses. Using this tool, one can discover whether a business name has been used for some time and some basic details about that entity. Additional information is available once the tool's user submits some contact information.

To make amendments to the organization of your limited liability company in Oklahoma, you file the Amended Articles of Organization of an Oklahoma Limited Liability Company form with the Secretary of State by mail, in person or by fax and with the filing fee.

To obtain your Oklahoma Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

The Secretary of State assigns a 10-digit filing number to each business entity on file with the state. On the web page, open ?Advanced Search? and select the option for "Filing Number Search."

PLEASE NOTE: Title 18, O.S., Section 552.4 pertains to persons and organizations that are exempt from the requirement to register with the Secretary of State. Be advised that this office CANNOT make the determination as to whether a person or organization conforms to one of the exemptions listed.

Oklahoma certified copies are a true and correct copy of business filings, which can obtained from the Oklahoma Secretary of State - Business Filing Department. Articles of incorporation are the most commonly certified document.

The conversion of any entity into a domestic limited liability company shall not be deemed to affect any obligations or liabilities of the entity incurred before its conversion to a domestic limited liability company or the personal liability of any person incurred before the conversion. F.

Nonprofit articles of incorporation is the document filed to create a Oklahoma nonprofit corporation. Preparing and filing your articles of incorporation is the first step in starting your nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the nonprofit.