Oklahoma Proposal for Stock Split and Increase in Authorized Number of Shares Introduction: The Oklahoma Proposal for Stock Split and Increase in Authorized Number of Shares refers to a formal proposition put forth by a company or its board of directors to its shareholders in the state of Oklahoma, United States. This proposal aims to enact a stock split and expand the company's authorized share capital. Keywords: Oklahoma, proposal, stock split, increase, authorized number of shares Types of Oklahoma Proposals for Stock Split and Increase in Authorized Number of Shares: 1. Oklahoma Proposal for a Forward Stock Split: In this type of proposal, the company suggests splitting its existing shares into multiple units. For example, a 2-for-1 stock split would result in every shareholder receiving two new shares for each original share owned. The purpose of a forward stock split is usually to make the shares more affordable and enhance market liquidity. 2. Oklahoma Proposal for a Reverse Stock Split: Contrary to a forward stock split, a reverse stock split involves reducing the number of outstanding shares by consolidating them into a smaller number. For instance, in a 1-for-5 reverse stock split, every five existing shares would be combined into one new share. This type of proposal is often considered when a company's stock price has become too low, potentially hindering investment opportunities. 3. Oklahoma Proposal for an Increase in Authorized Share Capital: This type of proposal suggests raising the maximum number of shares authorized by the company's articles of incorporation. By increasing the authorized share capital, the company gains flexibility to issue additional shares, whether for financing purposes, acquisitions, or employee stock options. Shareholder approval is typically required for such proposals, protecting the investors' interests. Benefits of Oklahoma Proposal for Stock Split and Increase in Authorized Number of Shares: 1. Enhanced Marketability and Liquidity: Stock splits make shares more accessible to a broader investor base due to reduced share prices. Smaller investors may find it more affordable to purchase shares, increasing market participation and overall liquidity. 2. Price Stability: Reverse stock splits can help stabilize a company's stock price, potentially attracting long-term investors. Higher share prices may also make the company appear more valuable and attract institutional investors. 3. Flexible Capital Structure: Increasing the authorized share capital allows the company to adapt to changing financial needs without requiring extensive legal procedures. It provides a cushion for future capital raising endeavors, facilitating growth and expansion. Conclusion: The Oklahoma Proposal for Stock Split and Increase in Authorized Number of Shares encompasses various types of propositions aimed at improving the company's capital structure, marketability, and flexibility. Whether through forward or reverse stock splits or expanding authorized share capital, these proposals aim to benefit the company and its shareholders by enhancing market liquidity, stabilizing share prices, and facilitating growth.

Oklahoma Proposal for the Stock Split and Increase in the Authorized Number of Shares

Description

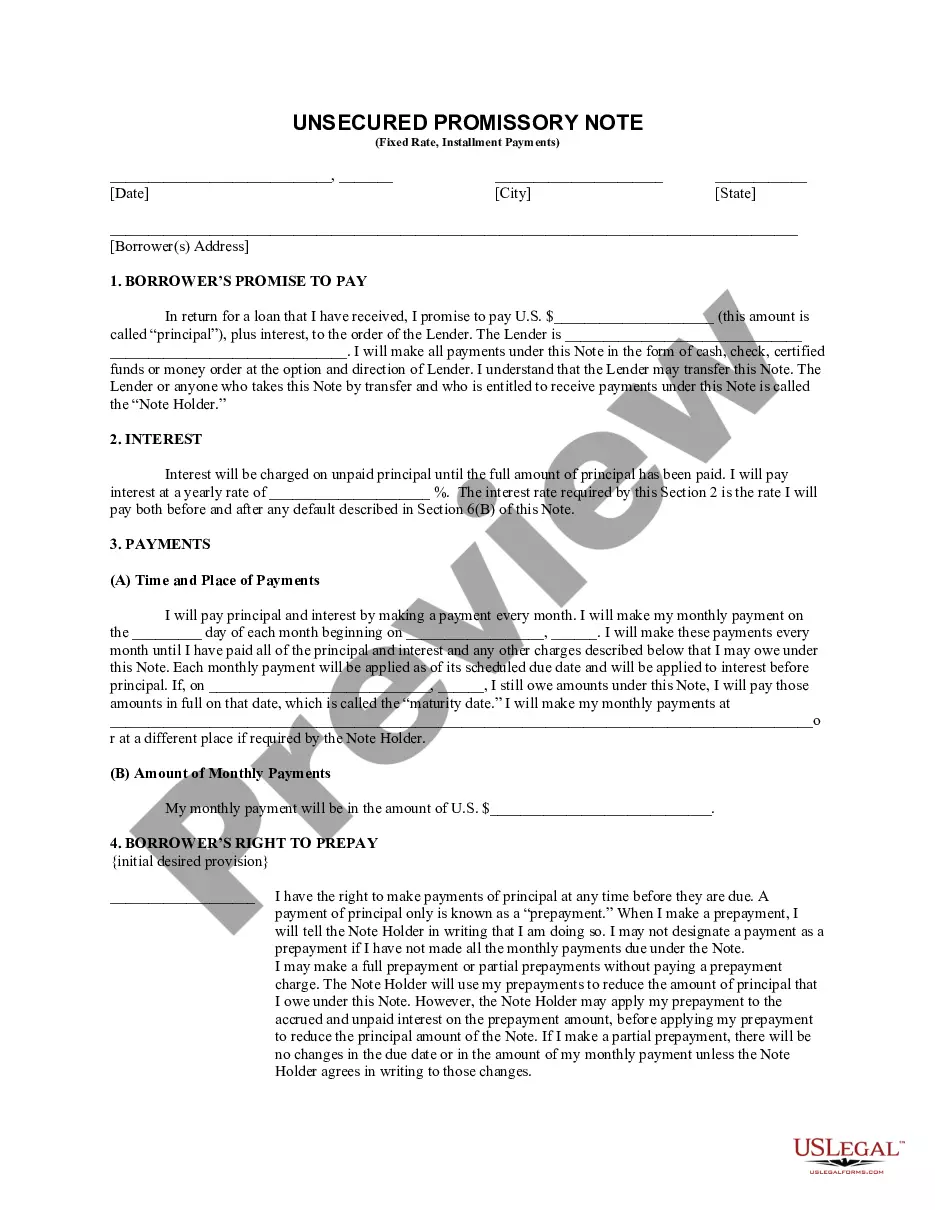

How to fill out Oklahoma Proposal For The Stock Split And Increase In The Authorized Number Of Shares?

Choosing the best lawful document format might be a have a problem. Obviously, there are a variety of layouts accessible on the Internet, but how will you obtain the lawful form you want? Use the US Legal Forms website. The services delivers 1000s of layouts, like the Oklahoma Proposal for the Stock Split and Increase in the Authorized Number of Shares, that you can use for business and personal needs. All the varieties are checked out by experts and meet federal and state requirements.

In case you are presently listed, log in for your account and click on the Acquire button to find the Oklahoma Proposal for the Stock Split and Increase in the Authorized Number of Shares. Make use of your account to search through the lawful varieties you possess acquired formerly. Check out the My Forms tab of the account and get yet another duplicate from the document you want.

In case you are a new customer of US Legal Forms, here are basic instructions that you can adhere to:

- Initially, be sure you have chosen the proper form for the area/area. You are able to check out the shape utilizing the Review button and read the shape outline to guarantee this is basically the best for you.

- When the form will not meet your needs, utilize the Seach discipline to discover the proper form.

- Once you are certain that the shape would work, click the Acquire now button to find the form.

- Pick the rates program you would like and type in the needed information. Design your account and pay money for the order making use of your PayPal account or charge card.

- Pick the submit file format and down load the lawful document format for your system.

- Total, modify and print out and sign the obtained Oklahoma Proposal for the Stock Split and Increase in the Authorized Number of Shares.

US Legal Forms will be the largest library of lawful varieties where you can find various document layouts. Use the service to down load expertly-made files that adhere to state requirements.