The Oklahoma Proposed Amendment to Articles of Incorporation regarding the distribution of stock of a subsidiary is a significant legal modification to the existing corporate structure. This amendment primarily focuses on the distribution of stock held by a subsidiary company within the parent corporation. By incorporating relevant keywords, such as "Oklahoma Proposed Amendment," "Articles of Incorporation," "distribution of stock," and "subsidiary," we can highlight the key details and possible variations of this amendment. In Oklahoma, when a corporation holds a subsidiary company, there may arise a need to alter the distribution of subsidiary stock within the parent corporation. The Proposed Amendment to Articles of Incorporation ensures that appropriate modifications are made, adhering to the regulatory framework and governing laws. The primary aim of this amendment is to adjust the distribution of subsidiary stock in a manner that aligns with the company's objectives, strategy, and compliance requirements. It allows the parent corporation to reconfigure the ownership structure of its subsidiary entities to optimize shareholder value, operational efficiency, and capital management. Under this amendment, there may be different types of changes to the distribution of stock, depending on the specific circumstances and objectives of the company. These variations might include: 1. Stock Reallocation: In certain cases, the parent corporation might want to reallocate a portion of its subsidiary stock among existing shareholders or company officers. This type of amendment ensures an equitable distribution of subsidiary stock, providing additional ownership benefits to key stakeholders. 2. Stock Dividend Distribution: This amendment might allow for the distribution of subsidiary stock as a dividend to existing shareholders of the parent corporation. Such a distribution could be made proportionate to the shareholders' holdings in the parent company or on a predetermined basis. 3. Stock Sale or Transfer: This type of amendment might focus on allowing the parent corporation to sell or transfer a specific portion of subsidiary stock to external investors, strategic partners, or other interested parties. This enables the parent company to raise capital, form alliances, or divest from certain subsidiaries while adhering to legal guidelines. 4. Stock Cancellation: In some cases, the parent corporation may decide to cancel or reduce the total number of shares held by its subsidiary for various strategic or financial reasons. This amendment allows the company to modify the subsidiary's capital structure and eliminate unnecessary dilution or redundancy. It is essential to engage legal counsel to draft and enact this Oklahoma Proposed Amendment to Articles of Incorporation, ensuring compliance with state laws and stakeholder interests. By considering the company's unique circumstances, objectives, and shareholders' needs, this amendment can effectively optimize the distribution of subsidiary stock within the parent corporation.

Oklahoma Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary

Description

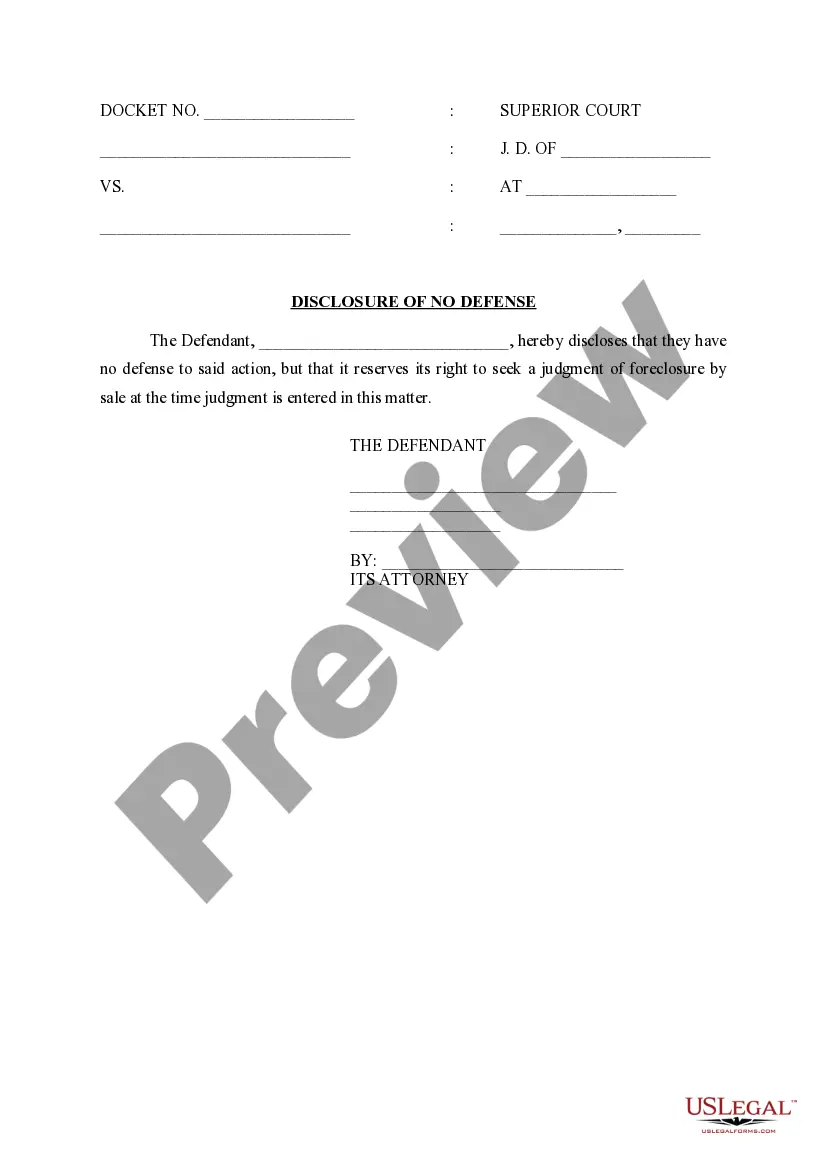

How to fill out Proposed Amendment To Articles Of Incorporation Regarding Distribution Of Stock Of A Subsidiary?

If you need to total, down load, or print out lawful record layouts, use US Legal Forms, the greatest variety of lawful types, that can be found online. Utilize the site`s simple and hassle-free research to discover the files you will need. Different layouts for organization and individual purposes are categorized by groups and claims, or key phrases. Use US Legal Forms to discover the Oklahoma Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary in a number of mouse clicks.

Should you be already a US Legal Forms customer, log in in your bank account and click on the Download key to find the Oklahoma Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary. You can also accessibility types you earlier delivered electronically from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for your right metropolis/nation.

- Step 2. Take advantage of the Review choice to look through the form`s information. Never overlook to learn the information.

- Step 3. Should you be not satisfied with the form, use the Look for area on top of the monitor to get other types from the lawful form design.

- Step 4. Upon having identified the shape you will need, click the Acquire now key. Select the pricing strategy you prefer and include your credentials to sign up for an bank account.

- Step 5. Process the deal. You can utilize your bank card or PayPal bank account to perform the deal.

- Step 6. Pick the formatting from the lawful form and down load it on your gadget.

- Step 7. Total, modify and print out or signal the Oklahoma Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary.

Each lawful record design you purchase is your own eternally. You have acces to every form you delivered electronically in your acccount. Go through the My Forms area and decide on a form to print out or down load yet again.

Remain competitive and down load, and print out the Oklahoma Proposed amendment to articles of incorporation regarding distribution of stock of a subsidiary with US Legal Forms. There are millions of professional and condition-particular types you can use for your personal organization or individual requirements.

Form popularity

FAQ

A domestic limited liability company that has ceased to be in good standing or a foreign limited liability company that has ceased to be registered in this state may not maintain any action, suit or proceeding in any court of this state until the domestic limited liability company has been reinstated as a domestic ...

The conversion of any entity into a domestic limited liability company shall not be deemed to affect any obligations or liabilities of the entity incurred before its conversion to a domestic limited liability company or the personal liability of any person incurred before the conversion. F.

Title 18, Section 2049 The following activities of a foreign limited liability company, among others, do not constitute transacting business within the meaning of this act: 1. Maintaining, defending, or settling any proceeding; 2.

PLEASE NOTE: Title 18, O.S., Section 552.4 pertains to persons and organizations that are exempt from the requirement to register with the Secretary of State. Be advised that this office CANNOT make the determination as to whether a person or organization conforms to one of the exemptions listed.

Title 18, Section 2049 The following activities of a foreign limited liability company, among others, do not constitute transacting business within the meaning of this act: 1. Maintaining, defending, or settling any proceeding; 2.

Any one or more domestic corporations may merge or consolidate with one or more domestic or foreign entities, unless the laws of the jurisdiction or jurisdictions under which such entity or entities are formed prohibit the merger or consolidation.

Oklahoma Statutes Title 18, Chapter 22 The Act also outlines the rights, duties, and liabilities of homeowners associations, as well as the powers and authority of the board of directors, members, and officers.