The Oklahoma Plan of Reorganization is a legal framework that outlines the process by which an entity or organization can restructure its debts, assets, and operations in order to regain financial stability and continue its operations. This plan is typically utilized by businesses, municipalities, or government entities in Oklahoma that are facing financial distress or insolvency. One of the key objectives of the Oklahoma Plan of Reorganization is to provide a roadmap for the entity to repay its debts while also protecting the interests of its stakeholders, such as creditors, employees, and shareholders. This plan allows the entity to negotiate and modify its existing financial obligations, potentially reducing the debt load, adjusting interest rates, extending repayment periods, or even forgiving a portion of the debt altogether. There are different types of Oklahoma Plans of Reorganization that can be pursued depending on the specific circumstances of the entity seeking to restructure. Some common types include: 1. Chapter 11 Reorganization: This is a type of bankruptcy filing under the United States Bankruptcy Code that allows a business to continue its operations while restructuring its debts and assets. The Chapter 11 process provides the entity with an opportunity to develop a reorganization plan that outlines how it intends to repay its debts and regain financial health. 2. Municipal Reorganization: Municipalities, such as cities or towns in Oklahoma, may utilize the Oklahoma Plan of Reorganization to manage their debts and financial obligations. This allows them to address financial distress and prevent bankruptcy, ultimately safeguarding essential public services and maintaining the overall well-being of the community. 3. Corporate Restructuring: Private businesses or corporations in Oklahoma facing financial challenges can also utilize the Oklahoma Plan of Reorganization to restructure their operations. This may involve downsizing, selling non-core assets, renegotiating contracts, or seeking additional financing to alleviate financial burdens and restore profitability. 4. Non-profit Organization Restructuring: Non-profit organizations in Oklahoma may also utilize the Oklahoma Plan of Reorganization to address financial difficulties and ensure the continuity of their charitable activities. This plan may involve seeking philanthropic support, implementing cost-saving measures, or exploring mergers and collaborations with other organizations. When implementing an Oklahoma Plan of Reorganization, it is crucial to engage legal and financial professionals who specialize in restructuring and bankruptcy matters. These experts will help navigate the complex legal requirements, negotiate with creditors, and develop a feasible reorganization plan that meets the unique needs and objectives of the entity in question.

Oklahoma Plan of Reorganization

Description

How to fill out Oklahoma Plan Of Reorganization?

Are you presently within a placement in which you need to have paperwork for possibly company or individual reasons virtually every working day? There are a lot of lawful document themes available online, but discovering types you can trust is not effortless. US Legal Forms gives a large number of kind themes, just like the Oklahoma Plan of Reorganization, which are written to satisfy state and federal needs.

If you are already informed about US Legal Forms website and get your account, basically log in. Next, it is possible to down load the Oklahoma Plan of Reorganization template.

Unless you provide an profile and need to start using US Legal Forms, adopt these measures:

- Discover the kind you need and ensure it is for that correct area/county.

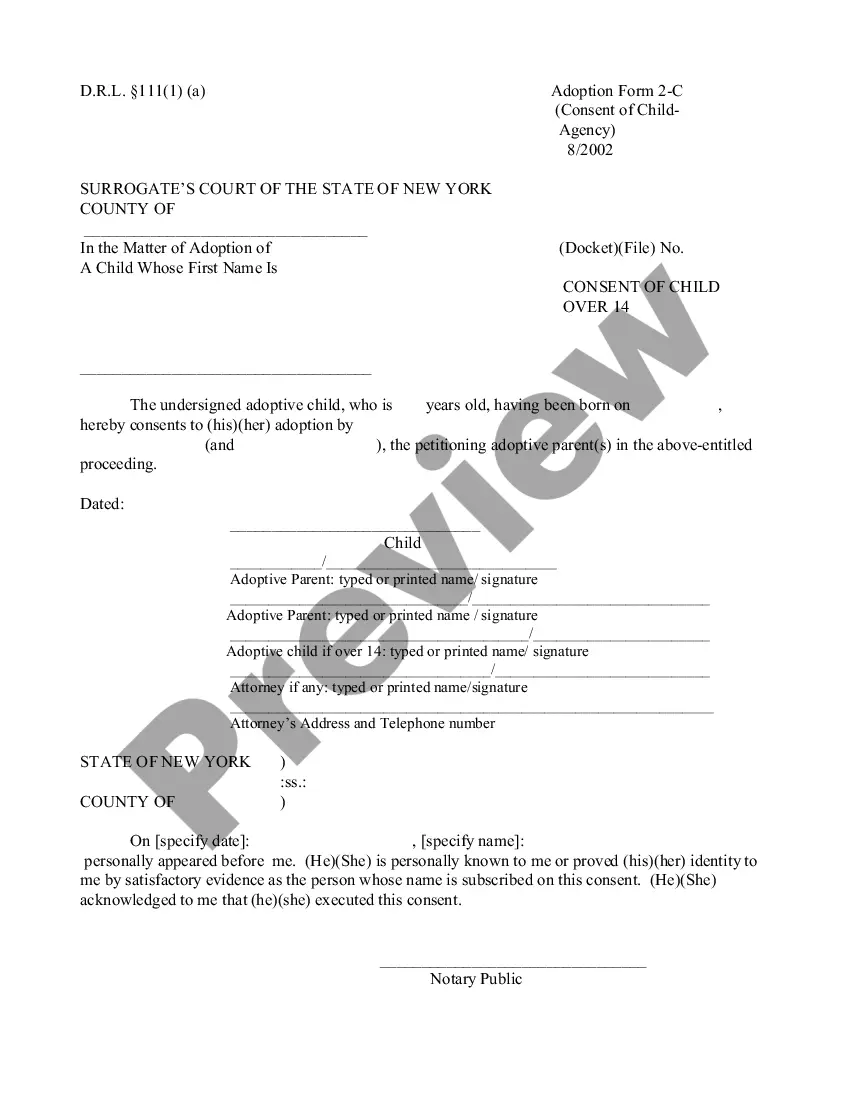

- Use the Review key to check the shape.

- Look at the information to actually have chosen the appropriate kind.

- In case the kind is not what you`re searching for, use the Look for field to obtain the kind that meets your requirements and needs.

- When you get the correct kind, just click Acquire now.

- Pick the pricing plan you want, complete the specified info to generate your bank account, and pay money for an order with your PayPal or Visa or Mastercard.

- Pick a handy file format and down load your duplicate.

Discover all of the document themes you have bought in the My Forms food list. You can obtain a more duplicate of Oklahoma Plan of Reorganization at any time, if necessary. Just click the essential kind to down load or produce the document template.

Use US Legal Forms, the most substantial selection of lawful forms, to conserve time as well as prevent mistakes. The services gives expertly manufactured lawful document themes which can be used for a range of reasons. Produce your account on US Legal Forms and start producing your life easier.