Oklahoma Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act, also known as the Oklahoma Business Corporation Act (BCA), are significant provisions that govern the formation and operation of business corporations in the state of Minnesota. These statutory sections outline various key aspects related to the establishment, duties, and responsibilities of corporations pursuant to the law. Section 302A.471 of the BCA addresses the powers and limitations of Minnesota business corporations. It meticulously defines the scope of authority that corporations possess in conducting their business activities. Companies are granted the power to engage in lawful activities, including buying, selling, leasing, and holding assets. However, this section also details specific activities that may require further authorizations or approvals, such as mergers, consolidations, or dissolution of the corporation. Moreover, Section 302A.471 entails the restrictions on corporate powers meant to safeguard shareholder interests and maintain ethical business practices. The section outlines certain activities, such as engaging in fraudulent practices, excessive borrowing, or self-dealing, which may result in legal consequences and potential liability for corporate officials. Moving on to Section 302A.473 of the BCA, it specifically addresses the duties and liabilities of directors and officers within Minnesota business corporations. This section outlines the fiduciary responsibilities these individuals owe to the corporation and its shareholders. It emphasizes the importance of exercising due care, acting in good faith, and promoting the best interests of the corporation when making decisions or taking actions. Section 302A.473 also highlights the duty of loyalty, prohibiting directors and officers from placing their personal interests ahead of those of the company. It further establishes the responsibility of directors and officers to avoid conflicts of interest and disclose any potential conflicts that may arise while fulfilling their roles. In addition, it is worth noting that the different types of Oklahoma Sections 302A.471 and 302A.473 do not exist. These sections pertain solely to the Minnesota Business Corporation Act, and any reference to Oklahoma was unintentional in the question. Overall, Sections 302A.471 and 302A.473 of the Minnesota Business Corporation Act play a crucial role in regulating the formation, powers, liabilities, and responsibilities of business corporations in the state of Minnesota, ensuring they operate ethically, transparently, and in the best interests of their shareholders.

Oklahoma Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act

Description

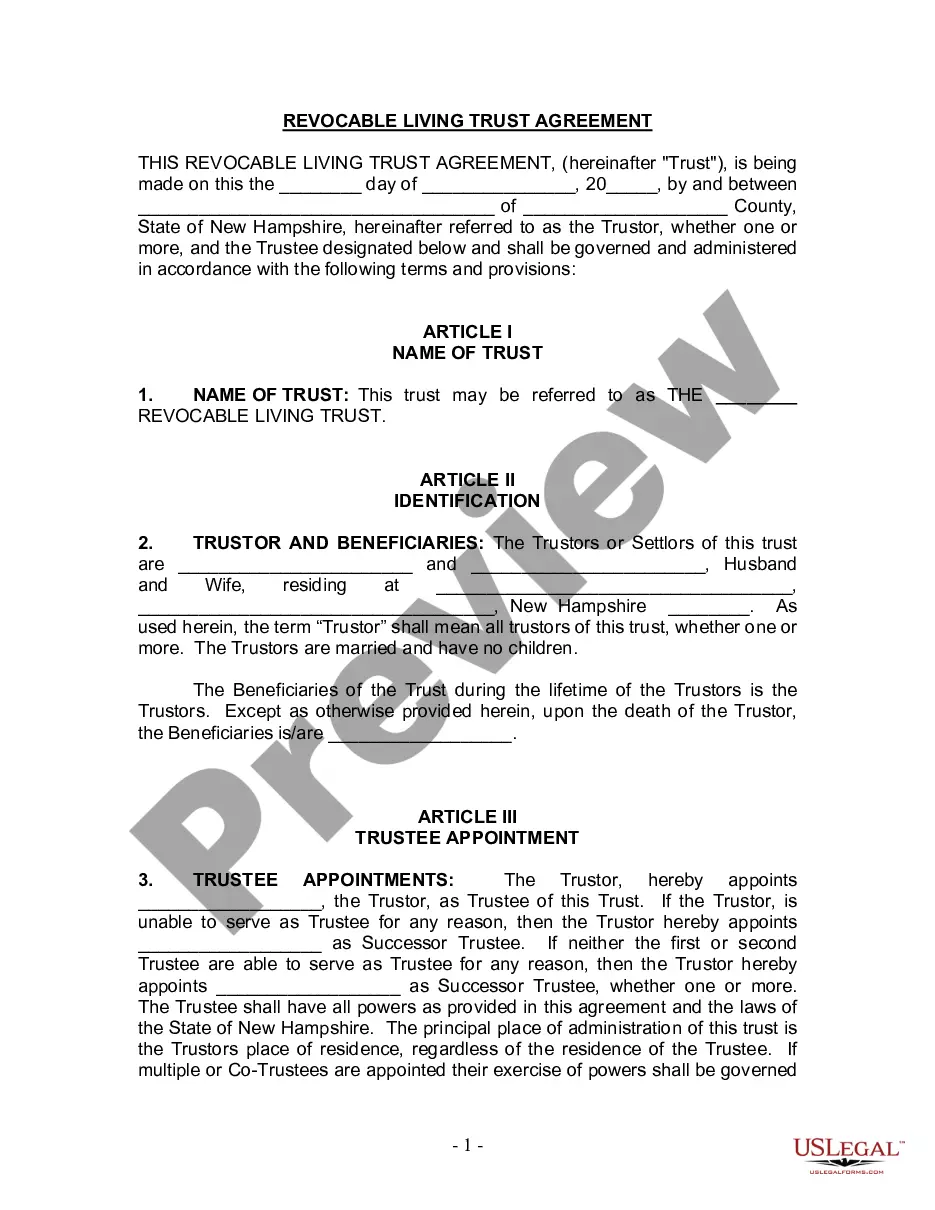

How to fill out Oklahoma Sections 302A.471 And 302A.473 Of Minnesota Business Corporation Act?

If you want to full, download, or printing lawful file templates, use US Legal Forms, the greatest assortment of lawful kinds, that can be found on-line. Use the site`s simple and easy hassle-free search to obtain the papers you want. A variety of templates for organization and specific reasons are categorized by types and states, or keywords. Use US Legal Forms to obtain the Oklahoma Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act with a couple of clicks.

In case you are presently a US Legal Forms consumer, log in to the account and click on the Obtain switch to have the Oklahoma Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act. Also you can entry kinds you formerly acquired inside the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate area/country.

- Step 2. Make use of the Review option to check out the form`s articles. Never forget to read through the explanation.

- Step 3. In case you are not happy with all the form, utilize the Research industry on top of the screen to discover other versions from the lawful form design.

- Step 4. Upon having found the shape you want, select the Get now switch. Select the rates strategy you like and put your accreditations to sign up for the account.

- Step 5. Procedure the financial transaction. You can use your charge card or PayPal account to perform the financial transaction.

- Step 6. Select the format from the lawful form and download it on your own gadget.

- Step 7. Total, revise and printing or sign the Oklahoma Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act.

Each and every lawful file design you get is your own property forever. You may have acces to every form you acquired in your acccount. Click on the My Forms portion and choose a form to printing or download once more.

Contend and download, and printing the Oklahoma Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act with US Legal Forms. There are thousands of specialist and state-distinct kinds you can utilize for the organization or specific needs.

Form popularity

FAQ

In discharging the duties of the position of director, a director may, in considering the best interests of the corporation, consider the interests of the corporation's employees, customers, suppliers, and creditors, the economy of the state and nation, community and societal considerations, and the long-term as well ...

An action required or permitted to be taken at a board meeting may be taken by written action signed, or consented to by authenticated electronic communication, by all of the directors.

A shareholder, beneficial owner, or holder of a voting trust certificate who has gained access under this section to any corporate record including the share register may not use or furnish to another for use the corporate record or a portion of the contents for any purpose other than a proper purpose.

A shareholder, beneficial owner, or holder of a voting trust certificate who has gained access under this section to any corporate record including the share register may not use or furnish to another for use the corporate record or a portion of the contents for any purpose other than a proper purpose.

An action required or permitted to be taken at a board meeting may be taken by written action signed, or consented to by authenticated electronic communication, by all of the directors.

A prohibition or limit on indemnification or advances may not apply to or affect the right of a person to indemnification or advances of expenses with respect to any acts or omissions of the person occurring prior to the effective date of a provision in the articles or the date of adoption of a provision in the bylaws ...

When written action is permitted to be taken by less than all shareholders, all shareholders who did not sign or consent to the written action must be notified of its text and effective time no later than five days after the effective time of the action.

(a) A shareholder shall not assert dissenters' rights as to less than all of the shares registered in the name of the shareholder, unless the shareholder dissents with respect to all the shares that are beneficially owned by another person but registered in the name of the shareholder and discloses the name and address ...