Title: Oklahoma Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit: An Essential Guide Introduction: In the state of Oklahoma, individuals have the right to request a free copy of their credit report from Equifax, one of the major credit reporting agencies, if they have been denied credit. This detailed guide highlights the process of drafting an Oklahoma Letter to Equifax for obtaining a complimentary credit report. We also explore various scenarios that may necessitate different types of letters. What is a Denial of Credit? A denial of credit occurs when a lender, such as a bank or credit card company, refuses to extend credit to an individual based on their creditworthiness. Reasons for denial may include a poor credit score, previous delinquencies, or errors in the credit report. Importance of Requesting Your Credit Report: Reviewing your credit report is crucial for understanding your financial standing and ensuring the accuracy of its contents. By examining the report, you can identify any inaccuracies, dispute errors, or take necessary actions to improve your creditworthiness. Drafting an Oklahoma Letter to Equifax: When requesting a free copy of your credit report from Equifax in Oklahoma, it is important to follow a specific format. The letter should include relevant details while asserting your legal rights. Here are the key components to include: 1. Your Personal Information: Funnymanam— - Current address (including city, state, and zip code) — Previous addresses (if applicable— - Social Security number — Date of birt— - Contact information (phone number and email address) 2. Statement of Denial of Credit: — Clearly state that you have recently been denied credit by a lender based on information within your Equifax credit report. — Provide details regarding the lender's name, date of denial, and the type of credit sought (e.g., mortgage loan, credit card, personal loan). 3. Request for Free Credit Report: — Assert your rights under the Fair Credit Reporting Act (FCRA) to obtain a complimentary copy of your Equifax credit report. — Specify that the request is based on the denial of credit you experienced. 4. Additional Contact Information: — Encourage Equifax to communicate with you via mail or email for any necessary correspondence. — Include your preferred contact details for ease of communication. 5. Enclosures: — Enclose a copy of the denial letter received from the lender. — Optionally, provide any supporting documentation that may strengthen your request (e.g., proof of identity or residence). Types of Oklahoma Letters to Equifax Requesting Free Copy of Credit Report: 1. Initial Credit Denial Letter: — This letter is sent when you have been denied credit for the first time and need to request a free copy of your credit report from Equifax. 2. Additional Denial Letters: — If you face repeated denials from various lenders based on your credit report, you can send additional letters to Equifax each time you are denied credit. Conclusion: Understanding the process of drafting an Oklahoma Letter to Equifax for obtaining a free credit report is vital. By sending a well-crafted letter, you assert your rights and gain access to your credit information while taking appropriate measures to improve your financial standing. Always remember to adhere to the specific guidelines provided by Equifax and the FCRA to ensure a successful credit report request.

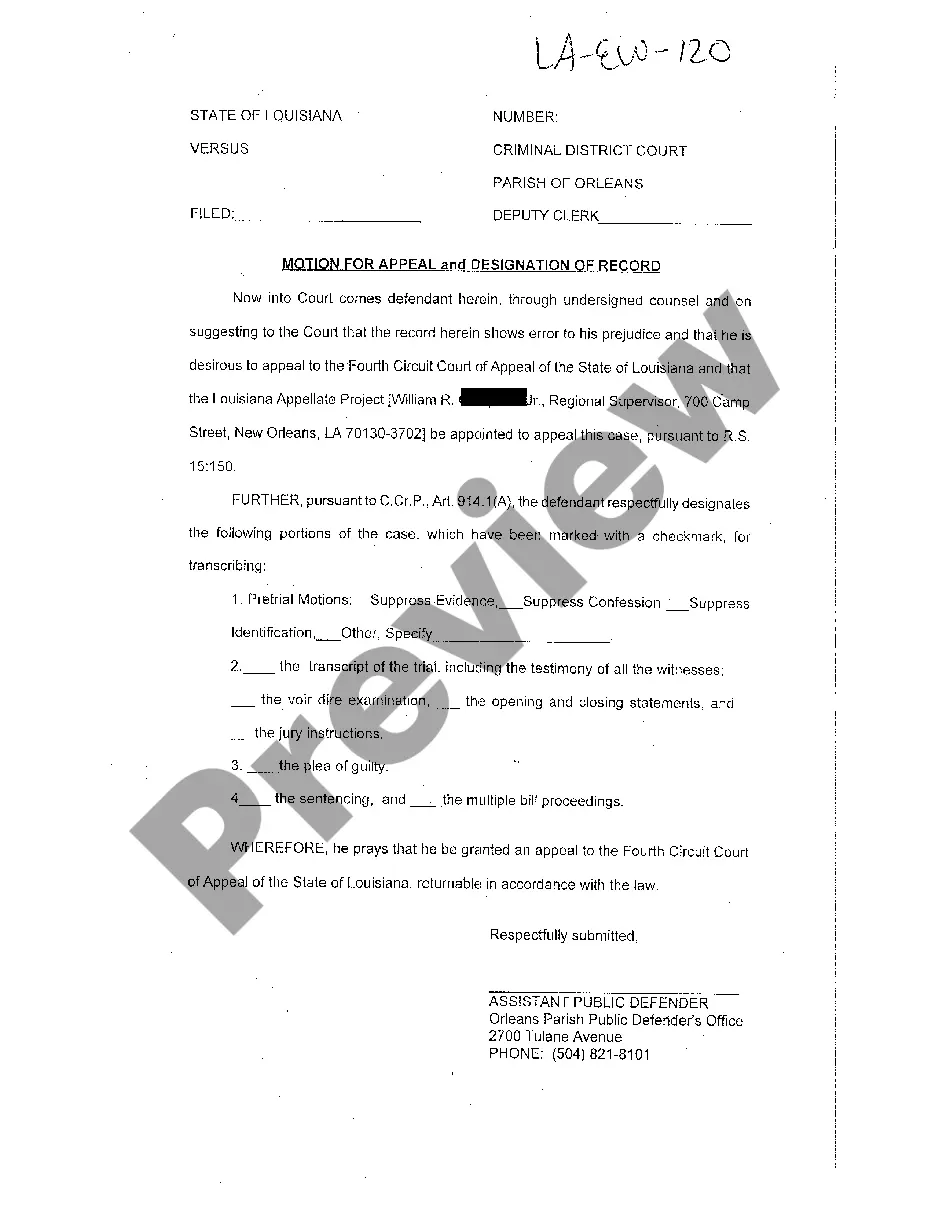

Oklahoma Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out Oklahoma Letter To Equifax Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

US Legal Forms - among the greatest libraries of authorized varieties in the States - gives a wide array of authorized papers themes it is possible to down load or print out. Using the website, you will get a large number of varieties for enterprise and specific reasons, categorized by types, says, or keywords.You can find the latest versions of varieties like the Oklahoma Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit within minutes.

If you already have a monthly subscription, log in and down load Oklahoma Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit from the US Legal Forms collection. The Download option can look on every single form you look at. You have accessibility to all previously downloaded varieties in the My Forms tab of the bank account.

If you wish to use US Legal Forms the first time, listed here are straightforward directions to obtain started off:

- Ensure you have picked out the right form for the town/area. Click the Review option to analyze the form`s articles. Look at the form explanation to ensure that you have selected the right form.

- When the form does not suit your requirements, make use of the Lookup area at the top of the screen to find the the one that does.

- In case you are content with the shape, affirm your selection by clicking on the Buy now option. Then, pick the rates program you like and offer your references to sign up for an bank account.

- Method the transaction. Make use of Visa or Mastercard or PayPal bank account to complete the transaction.

- Select the structure and down load the shape in your product.

- Make adjustments. Fill up, edit and print out and indicator the downloaded Oklahoma Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit.

Each and every web template you put into your account does not have an expiration day and is also your own property for a long time. So, if you wish to down load or print out another duplicate, just go to the My Forms portion and then click about the form you want.

Get access to the Oklahoma Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit with US Legal Forms, one of the most considerable collection of authorized papers themes. Use a large number of expert and status-distinct themes that meet up with your business or specific requires and requirements.