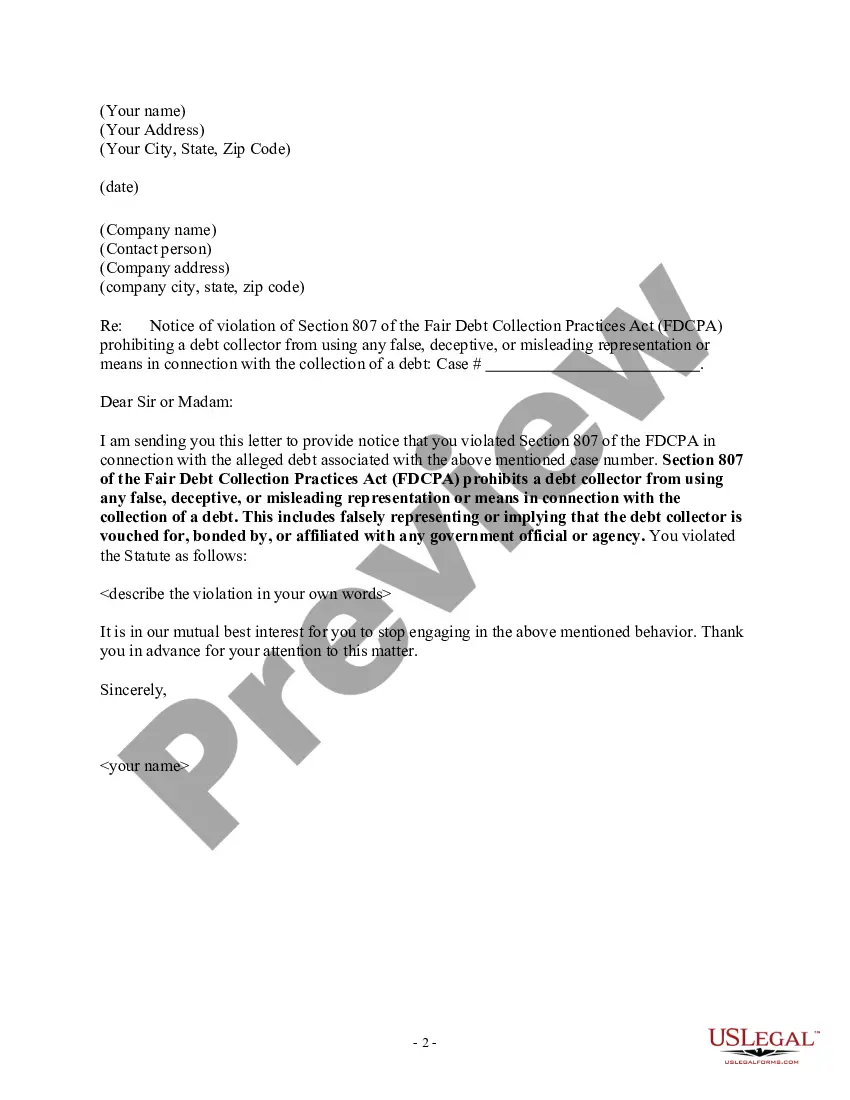

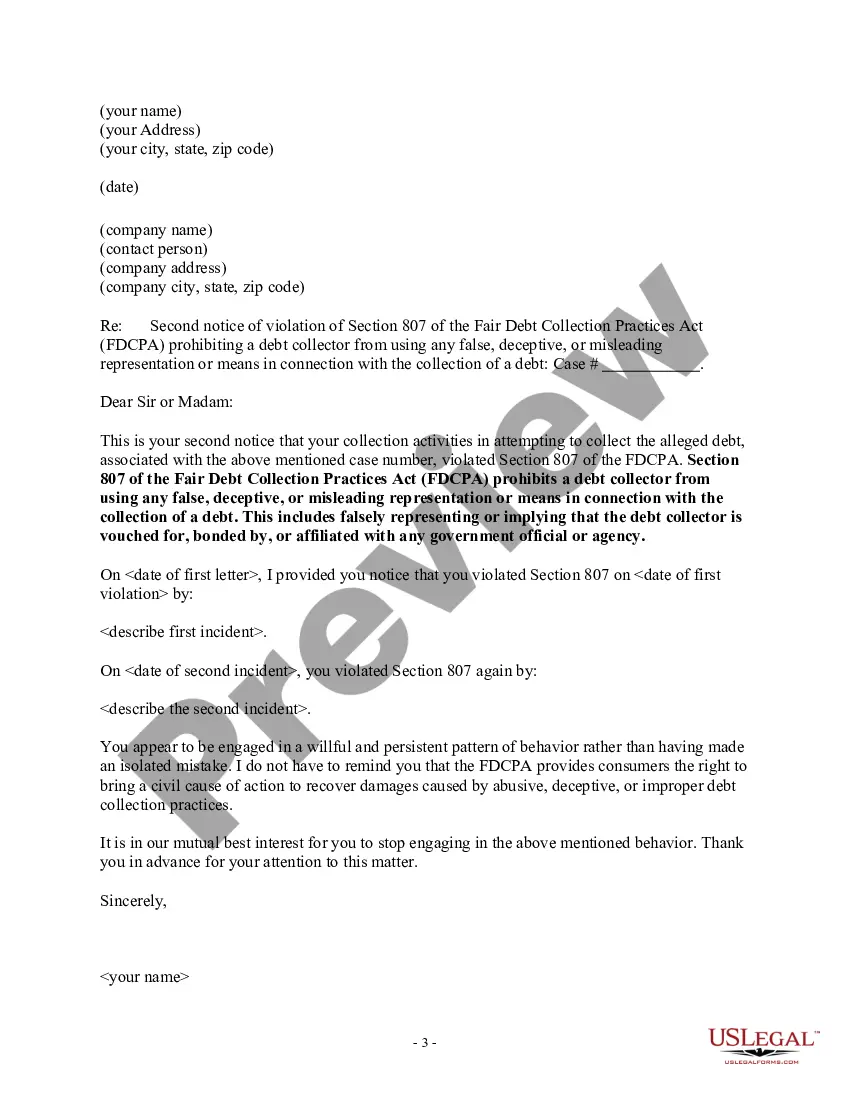

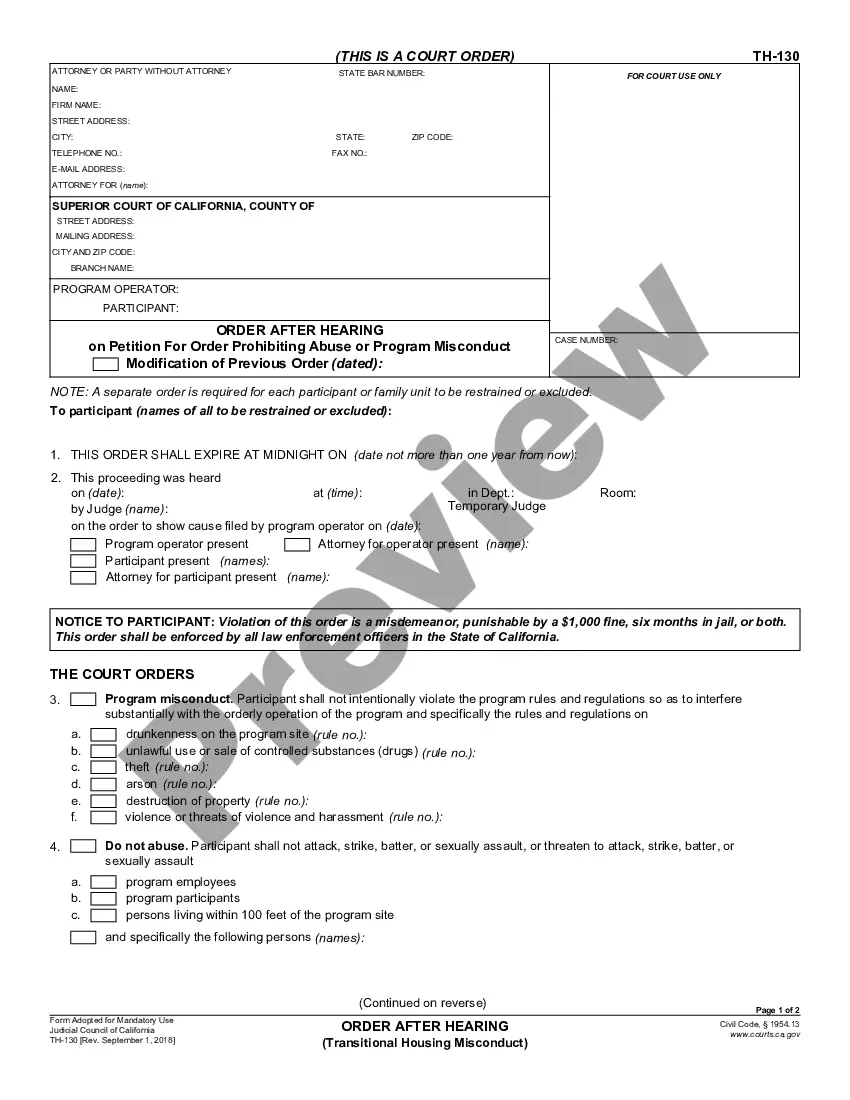

Oklahoma Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Oklahoma Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

US Legal Forms - one of many largest libraries of legitimate types in the USA - delivers a variety of legitimate file web templates you may acquire or print out. While using internet site, you will get 1000s of types for organization and specific purposes, sorted by types, says, or search phrases.You will find the most recent types of types much like the Oklahoma Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself in seconds.

If you have a monthly subscription, log in and acquire Oklahoma Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself through the US Legal Forms catalogue. The Download option can look on every develop you perspective. You have access to all in the past delivered electronically types in the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, listed here are straightforward guidelines to get you started out:

- Be sure you have chosen the correct develop for your metropolis/region. Select the Preview option to analyze the form`s content. See the develop outline to ensure that you have selected the appropriate develop.

- In the event the develop does not match your requirements, use the Research discipline towards the top of the display screen to find the the one that does.

- In case you are happy with the form, confirm your selection by simply clicking the Buy now option. Then, opt for the prices plan you like and supply your references to register to have an bank account.

- Procedure the purchase. Utilize your bank card or PayPal bank account to finish the purchase.

- Pick the formatting and acquire the form on your own gadget.

- Make modifications. Fill out, change and print out and signal the delivered electronically Oklahoma Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

Each design you put into your money lacks an expiration time and is also yours forever. So, if you would like acquire or print out an additional duplicate, just go to the My Forms area and then click on the develop you need.

Obtain access to the Oklahoma Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself with US Legal Forms, by far the most considerable catalogue of legitimate file web templates. Use 1000s of professional and state-certain web templates that satisfy your business or specific requirements and requirements.

Form popularity

FAQ

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Know your rights. You cannot go to jail for not paying a consumer debt, even if a judgment is entered. Your house, social security, and most pensions cannot be foreclosed upon or garnished to pay consumer debts.

In Oklahoma, for most debts, a creditor is afforded five years to take legal action on a debt. After the statute of limitations has expired, a creditor or debt collector can no longer sue you for the debt.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

How long does a judgment lien last in Oklahoma? A judgment lien in Oklahoma will remain attached to the debtor's property (even if the property changes hands) for five years.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Statute of Limitations and Your Credit ReportCollection accounts can remain on your report for seven years and 180 days from the original delinquency. Depending on the type of account and your location, this can be more than or less than the statute of limitations.

Once you dispute the debt, the debt collector can't call or contact you to collect the debt or the disputed part until the debt collector has provided verification of the debt in writing to you. Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.