Oklahoma Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp.

Description

How to fill out Sample Stock Purchase Agreement Regarding Acquisition By Finova Capital Corp. Of All Outstanding Shares Of Fremont Financial Corp.?

Choosing the best authorized file web template can be a have a problem. Of course, there are plenty of layouts accessible on the Internet, but how would you obtain the authorized kind you will need? Utilize the US Legal Forms website. The service offers 1000s of layouts, like the Oklahoma Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp., that can be used for organization and personal demands. Every one of the forms are inspected by professionals and fulfill state and federal specifications.

In case you are presently authorized, log in in your accounts and then click the Obtain button to get the Oklahoma Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp.. Utilize your accounts to look through the authorized forms you have ordered in the past. Check out the My Forms tab of your own accounts and have an additional backup of the file you will need.

In case you are a whole new end user of US Legal Forms, listed below are basic instructions so that you can follow:

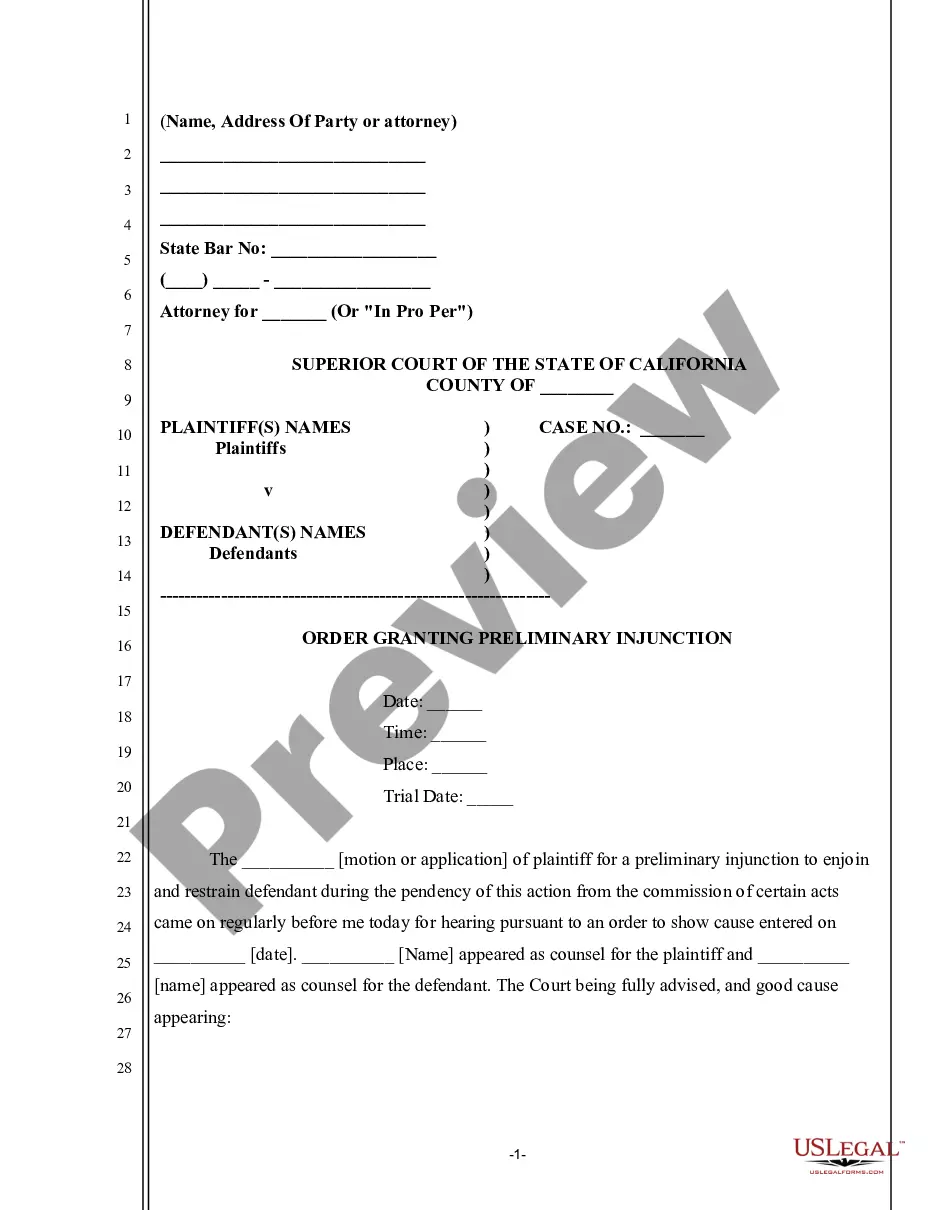

- Initial, be sure you have chosen the right kind to your area/state. You are able to examine the shape utilizing the Preview button and look at the shape description to ensure this is basically the best for you.

- In case the kind does not fulfill your preferences, utilize the Seach discipline to obtain the correct kind.

- Once you are positive that the shape is suitable, click the Get now button to get the kind.

- Choose the prices program you need and enter in the essential information. Build your accounts and pay for an order with your PayPal accounts or credit card.

- Choose the file format and obtain the authorized file web template in your gadget.

- Total, change and produce and indicator the acquired Oklahoma Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp..

US Legal Forms will be the greatest catalogue of authorized forms in which you can find various file layouts. Utilize the company to obtain expertly-made papers that follow status specifications.

Form popularity

FAQ

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.