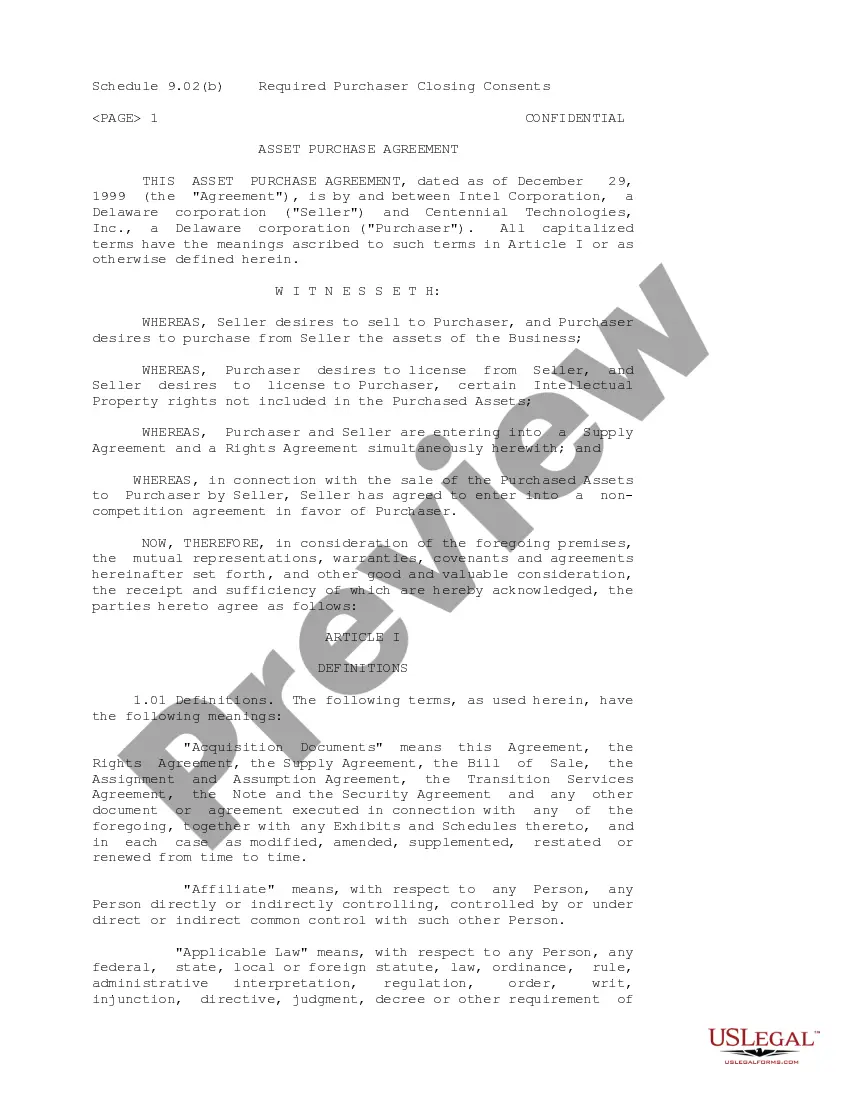

Oklahoma Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

Choosing the right legal document web template can be a have a problem. Of course, there are tons of themes available on the net, but how would you obtain the legal type you want? Take advantage of the US Legal Forms web site. The support gives a large number of themes, including the Oklahoma Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample, that can be used for company and private demands. Each of the forms are inspected by pros and meet up with state and federal specifications.

When you are presently signed up, log in for your accounts and click on the Acquire button to find the Oklahoma Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample. Use your accounts to look through the legal forms you might have purchased previously. Go to the My Forms tab of your accounts and acquire another copy in the document you want.

When you are a fresh customer of US Legal Forms, here are straightforward instructions that you should adhere to:

- First, be sure you have chosen the correct type for the area/region. You are able to look through the shape while using Review button and look at the shape information to guarantee this is the best for you.

- In case the type fails to meet up with your expectations, take advantage of the Seach field to get the correct type.

- Once you are certain the shape is suitable, select the Get now button to find the type.

- Pick the prices plan you need and enter the necessary details. Make your accounts and pay money for the order with your PayPal accounts or bank card.

- Choose the file format and obtain the legal document web template for your product.

- Complete, change and print out and sign the acquired Oklahoma Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample.

US Legal Forms will be the most significant collection of legal forms in which you can discover various document themes. Take advantage of the company to obtain skillfully-produced documents that adhere to state specifications.

Form popularity

FAQ

The asset purchase agreement is typically prepared by the buyer's lawyer. However, it is important to have the agreement reviewed by a business lawyer to ensure that all assets are properly transferred and that the purchase price is fair.

In an asset sale, the employment relationship is terminated and a new one is created. This means that the seller needs to do all the things that an employer would normally do when terminating an employee, including paying out final wages and vacation pay (where required by contract or state law).

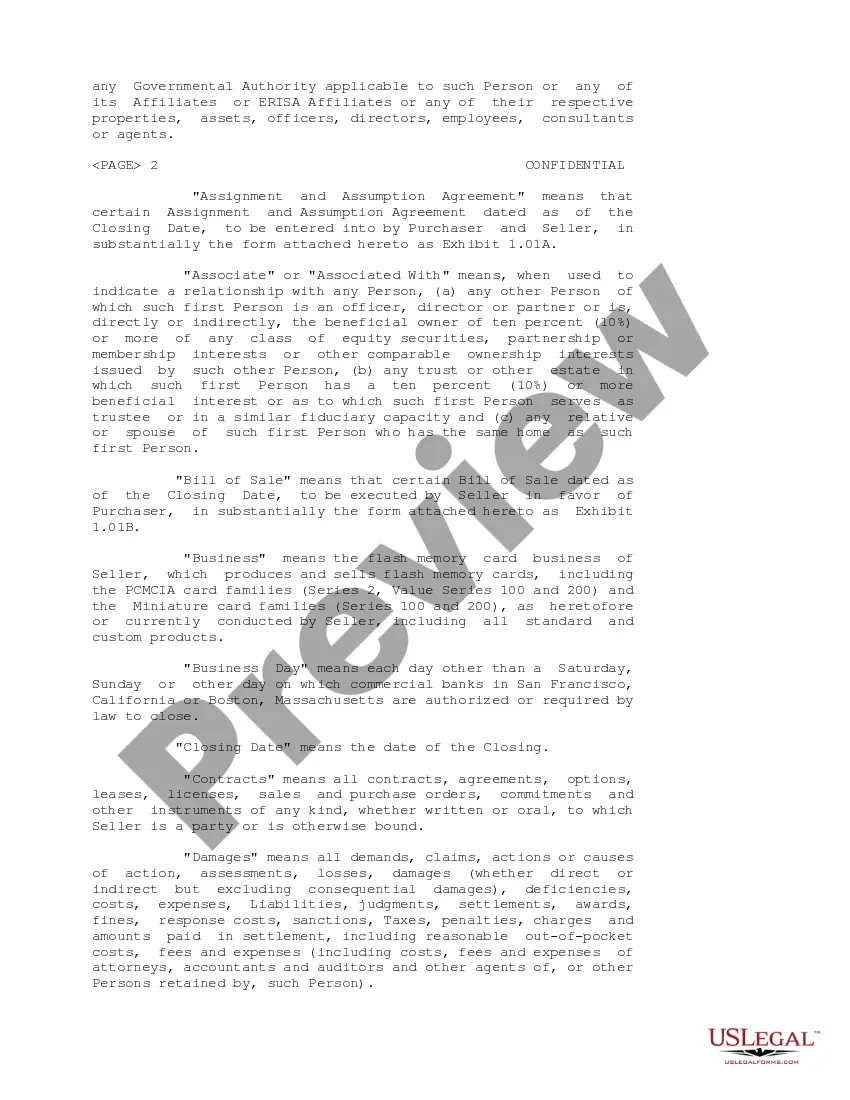

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset purchase (or asset sale) is when a buyer purchases the assets owned by the selling entity. After signing the APA, the seller's business entity transfers ownership of its assets to the buyer's entity, while the seller retains legal ownership of the surviving entity.

What is an asset purchase agreement? An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.