Oklahoma Term Loan Agreement: A Comprehensive Overview of Loan Agreements in Oklahoma, a term loan agreement refers to a legally binding contract between a lender and a borrower for the provision of a loan with a specified term and interest rate. This agreement outlines the terms and conditions under which the borrower can access and repay the loan, ensuring a clear understanding and compliance from both parties involved. Key Features of an Oklahoma Term Loan Agreement: 1. Loan Term: The term loan agreement in Oklahoma specifies the duration within which the borrower is expected to repay the loan. Common terms range from a few months to several years, depending on the nature of the loan and the borrower's repayment capacity. 2. Interest Rates: The agreement stipulates the interest rate to be charged on the loan. Oklahoma allows for both fixed and variable interest rates, depending on the agreement between the lender and the borrower. Fixed rates remain constant throughout the loan term, while variable rates may fluctuate based on market conditions. 3. Loan Amount: The term loan agreement defines the principal amount that the lender agrees to loan to the borrower. This amount may vary based on the borrower's creditworthiness, financial stability, and the purpose of the loan. 4. Repayment Schedule: The agreement sets out the repayment schedule, detailing the frequency and amount of installments the borrower must make to repay the loan. This ensures clarity and helps the borrower plan for timely repayments. 5. Prepayment Options: Oklahoma term loan agreements may include provisions for prepayment. These options allow borrowers to repay the loan before the specified term ends, often featuring prepayment penalties or fees as determined by the agreement. Types of Oklahoma Term Loan Agreements: 1. Personal Term Loan Agreement: This type of agreement caters to individuals seeking financial assistance for personal purposes, such as home renovations, debt consolidation, or education. Personal term loan agreements typically have varying interest rates and terms based on the borrower's creditworthiness. 2. Business Term Loan Agreement: Businesses in Oklahoma often utilize term loan agreements to fund operational expenses, expansion initiatives, or equipment purchases. These agreements may involve higher loan amounts and longer terms to accommodate the specific needs of businesses. 3. Agricultural Term Loan Agreement: Designed for farmers and agricultural enterprises, this type of loan agreement provides financial support for farming-related needs, such as buying equipment, acquiring livestock, or covering operating costs during different seasons. Agricultural term loan agreements may have unique provisions tailored to the specific requirements of the agricultural sector. It is essential for both lenders and borrowers in Oklahoma to thoroughly review and understand the terms and conditions outlined in the term loan agreement. Seeking professional legal advice is encouraged to ensure compliance with state laws and protect the interests of all parties involved in the lending process.

Oklahoma Term Loan Agreement

Description

How to fill out Term Loan Agreement?

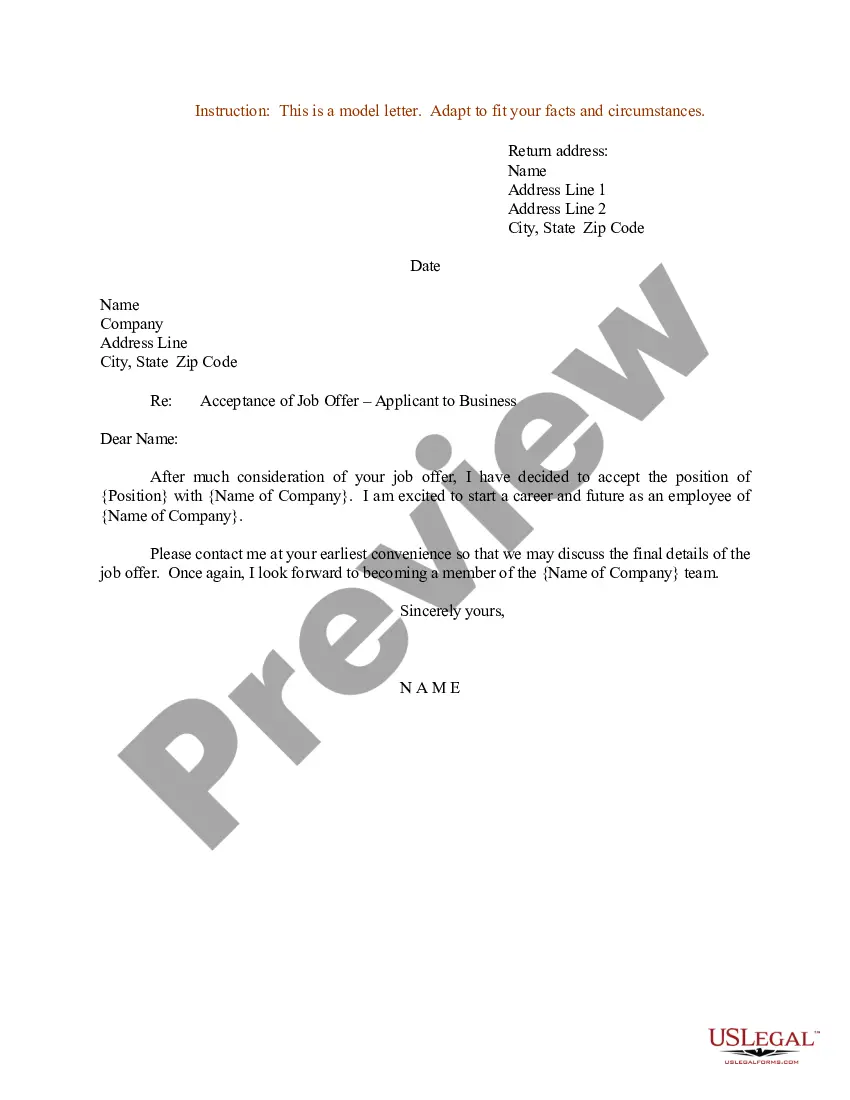

If you want to full, download, or printing legitimate record layouts, use US Legal Forms, the biggest assortment of legitimate forms, which can be found online. Use the site`s basic and handy search to obtain the documents you need. Various layouts for business and individual uses are categorized by classes and suggests, or search phrases. Use US Legal Forms to obtain the Oklahoma Term Loan Agreement in a few clicks.

If you are currently a US Legal Forms consumer, log in for your account and click the Acquire key to obtain the Oklahoma Term Loan Agreement. You can even entry forms you earlier saved in the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the shape for that right metropolis/country.

- Step 2. Take advantage of the Preview choice to examine the form`s information. Never overlook to learn the outline.

- Step 3. If you are not satisfied with the kind, utilize the Look for field at the top of the display screen to discover other models from the legitimate kind web template.

- Step 4. Upon having found the shape you need, click on the Acquire now key. Pick the rates plan you choose and add your qualifications to register on an account.

- Step 5. Method the transaction. You can use your credit card or PayPal account to perform the transaction.

- Step 6. Choose the formatting from the legitimate kind and download it on the device.

- Step 7. Full, change and printing or indication the Oklahoma Term Loan Agreement.

Each and every legitimate record web template you purchase is your own forever. You might have acces to each kind you saved with your acccount. Click on the My Forms portion and choose a kind to printing or download once more.

Contend and download, and printing the Oklahoma Term Loan Agreement with US Legal Forms. There are thousands of skilled and state-specific forms you may use for the business or individual requires.

Form popularity

FAQ

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

How to Write a Loan Agreement Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate. ... Step 7 ? Include Late Fees (Optional)

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

form, bilateral, secured or unsecured, sterling, term facility agreement (or loan agreement) between a single lender and a single borrower with interest charged at a margin over base rate.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.