Oklahoma Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

You may invest hrs on the web looking for the legal file template which fits the state and federal demands you will need. US Legal Forms provides thousands of legal varieties that happen to be reviewed by pros. It is possible to download or printing the Oklahoma Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. from my assistance.

If you have a US Legal Forms account, you are able to log in and then click the Download key. Afterward, you are able to complete, edit, printing, or signal the Oklahoma Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Each and every legal file template you acquire is your own property for a long time. To get yet another version of any obtained type, visit the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms site the very first time, adhere to the easy directions beneath:

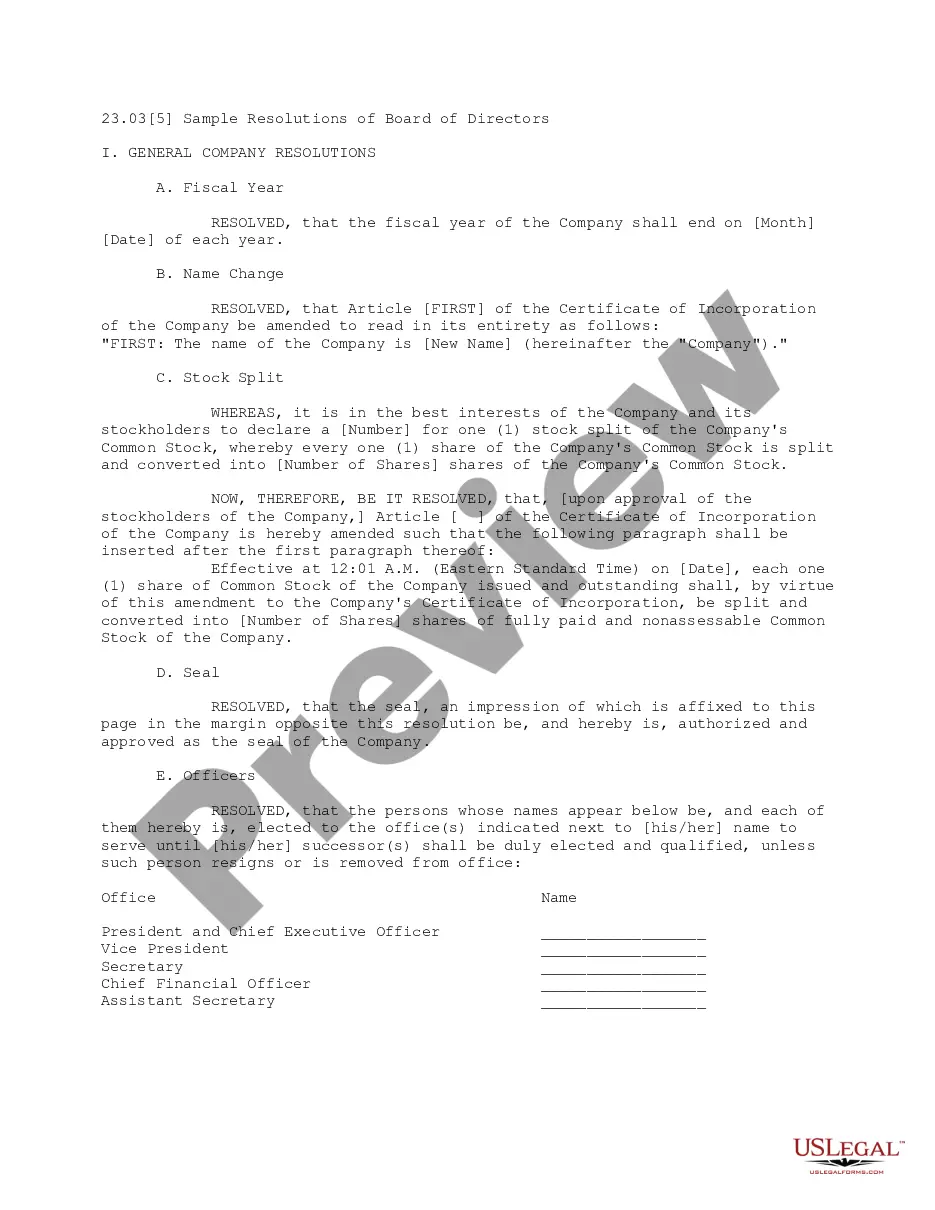

- Very first, make sure that you have selected the best file template for that county/town of your choosing. Browse the type description to make sure you have chosen the proper type. If accessible, use the Review key to search with the file template too.

- If you want to find yet another model in the type, use the Search industry to obtain the template that meets your requirements and demands.

- When you have found the template you would like, click Buy now to carry on.

- Choose the costs program you would like, type in your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You can utilize your credit card or PayPal account to cover the legal type.

- Choose the formatting in the file and download it in your product.

- Make modifications in your file if necessary. You may complete, edit and signal and printing Oklahoma Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Download and printing thousands of file web templates utilizing the US Legal Forms Internet site, which provides the most important collection of legal varieties. Use professional and status-certain web templates to take on your business or person requires.