Oklahoma Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

Discovering the right legal document format might be a have a problem. Naturally, there are a variety of web templates available on the Internet, but how would you obtain the legal develop you need? Use the US Legal Forms internet site. The support offers a large number of web templates, such as the Oklahoma Investment Transfer Affidavit and Agreement, which you can use for company and personal demands. All the forms are examined by professionals and meet state and federal demands.

In case you are presently signed up, log in to your account and then click the Down load key to get the Oklahoma Investment Transfer Affidavit and Agreement. Make use of your account to search through the legal forms you may have acquired formerly. Go to the My Forms tab of your own account and have one more backup of your document you need.

In case you are a new user of US Legal Forms, allow me to share straightforward directions that you can adhere to:

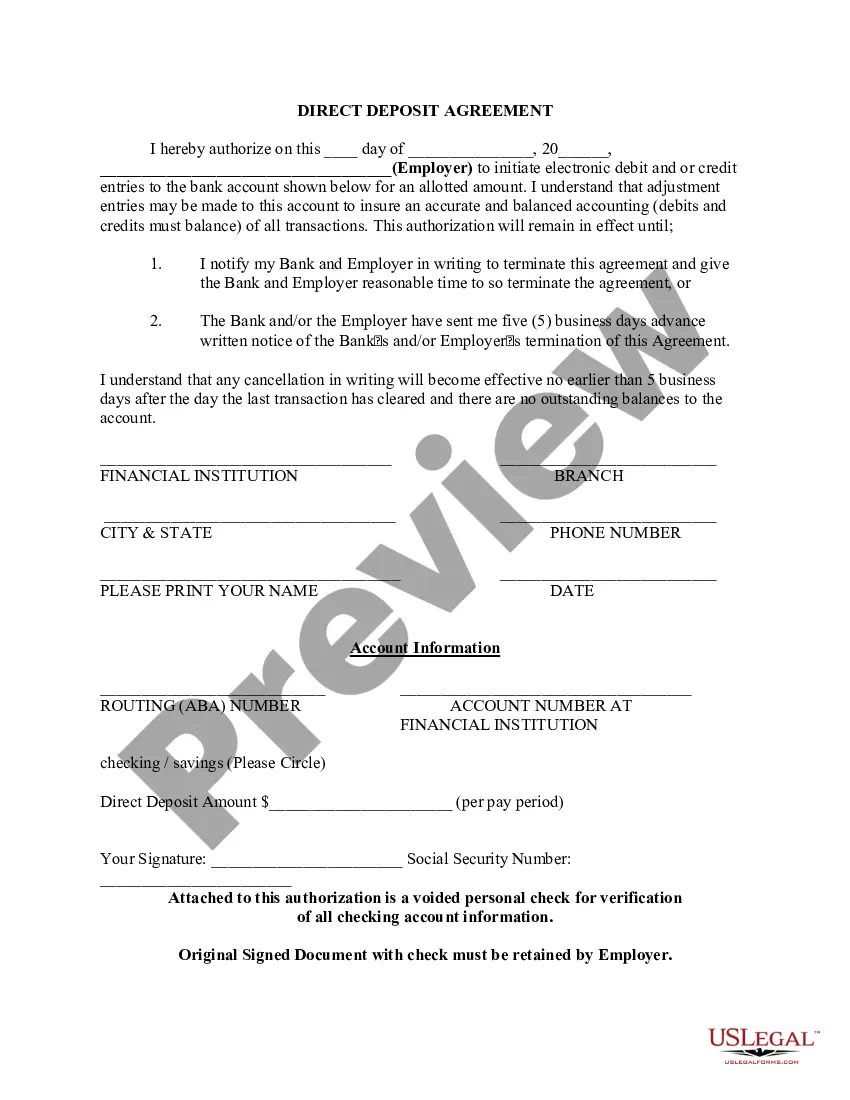

- Initially, make certain you have selected the correct develop to your metropolis/area. You can check out the shape utilizing the Review key and look at the shape description to guarantee it is the best for you.

- If the develop is not going to meet your expectations, take advantage of the Seach discipline to discover the proper develop.

- When you are certain that the shape would work, select the Acquire now key to get the develop.

- Pick the prices strategy you would like and enter the required info. Make your account and buy the transaction with your PayPal account or credit card.

- Pick the submit formatting and down load the legal document format to your product.

- Full, revise and produce and signal the attained Oklahoma Investment Transfer Affidavit and Agreement.

US Legal Forms is the greatest catalogue of legal forms that you can find a variety of document web templates. Use the service to down load appropriately-made documents that adhere to state demands.

Form popularity

FAQ

Oklahoma's apportionment formula consists of sales, payroll and property weighted equally and a throwback rule which takes out-of-state sales and lumps them into a corporation's Oklahoma income when the corporation makes sales in a state that does not tax the income.

The tax rate is 4.75%. Part 2 ? Enter members who are corporations, S corporations and partnerships. The tax rate is 4%. Enter the Federal Employer Identification Number or Social Security Number of each member of the electing PTE.

You can change your filing date by filing Form 200-F (Request to Change Franchise Tax Filing Period) by mail or online using OkTAP, Oklahoma's online filing system, by July 1st. After you have filed the request to change your filing period, you will not need to file this form again.

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

If you wish to make an election to change your filing frequency for your next reporting period, please complete OTC Form 200F: Request to. Change Franchise Tax Filing Period. You can download this form from the Oklahoma Tax Commission website @ .tax.ok.gov. ? Franchise Tax Computation.

¶5-401, Rate of Tax 1203 ) and foreign ( 68 O.S. Sec. 1204 ) corporations pay franchise tax at the rate of $1.25 for each $1,000 or portion thereof of capital used in the state. The minimum franchise tax is $250, and the maximum franchise tax is $20,000.

Oklahoma Franchise Tax While Oklahoma does have a franchise tax, it only applies to corporations. Limited liability companies are exempt from paying the Oklahoma Franchise Tax.

The documentary stamp tax can be paid by the seller or the buyer, and the county clerk is the agent for the state for the sale of documentary tax stamps.