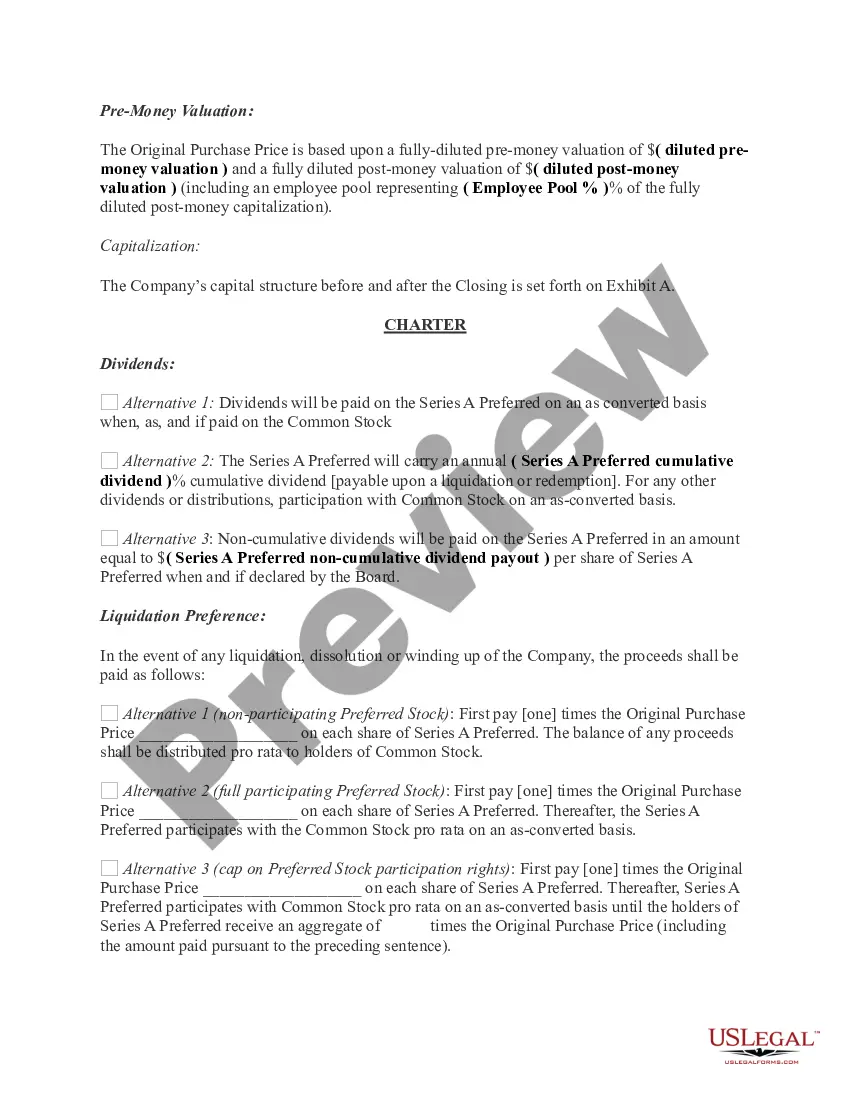

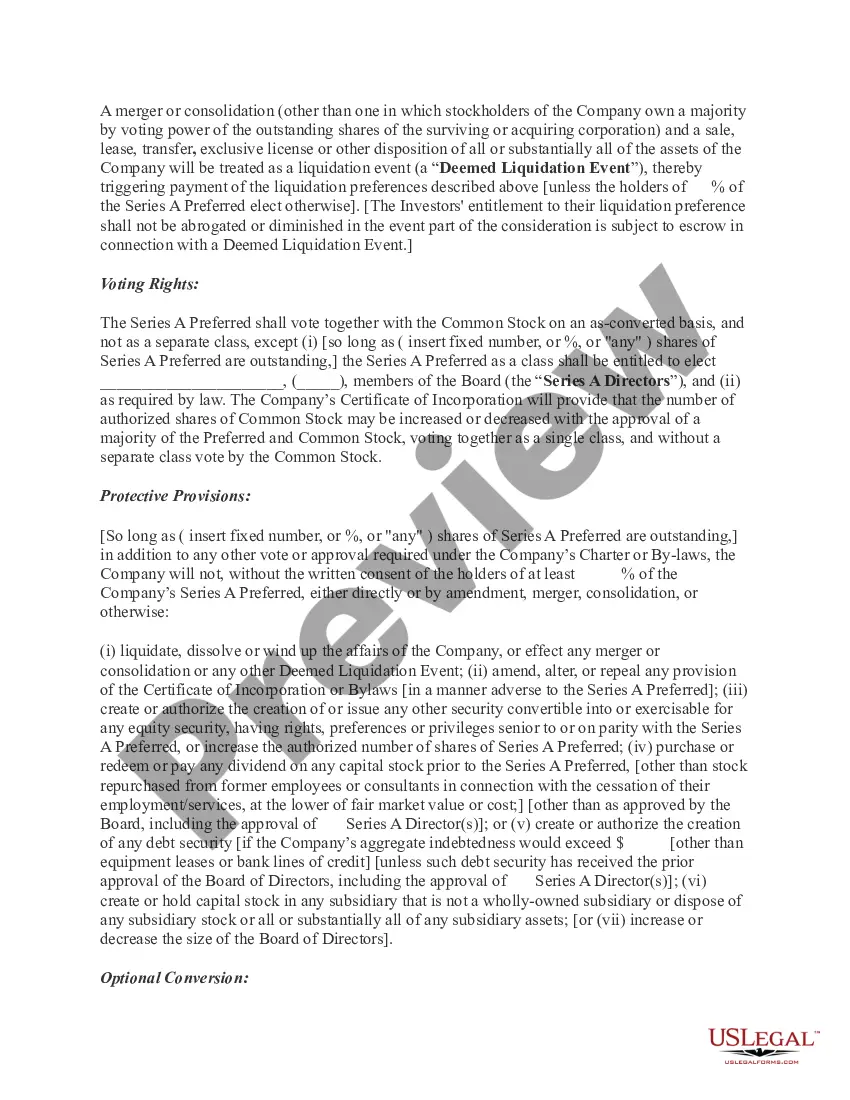

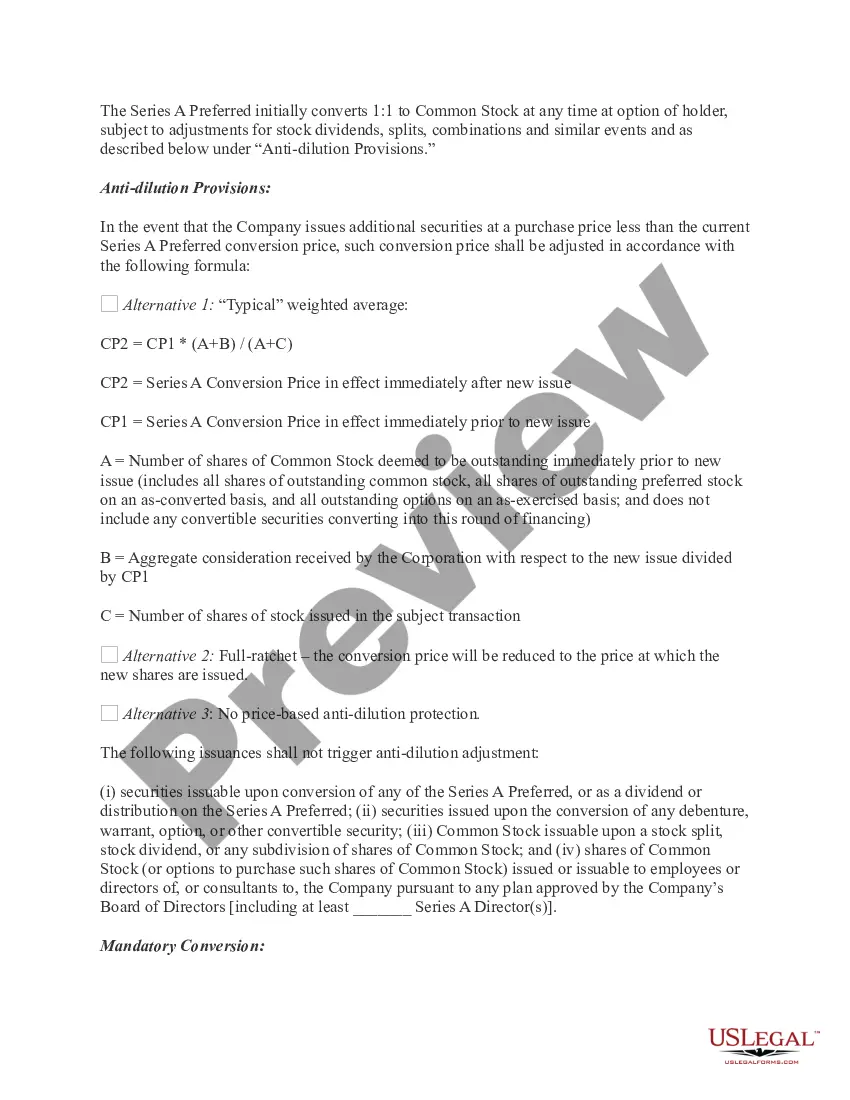

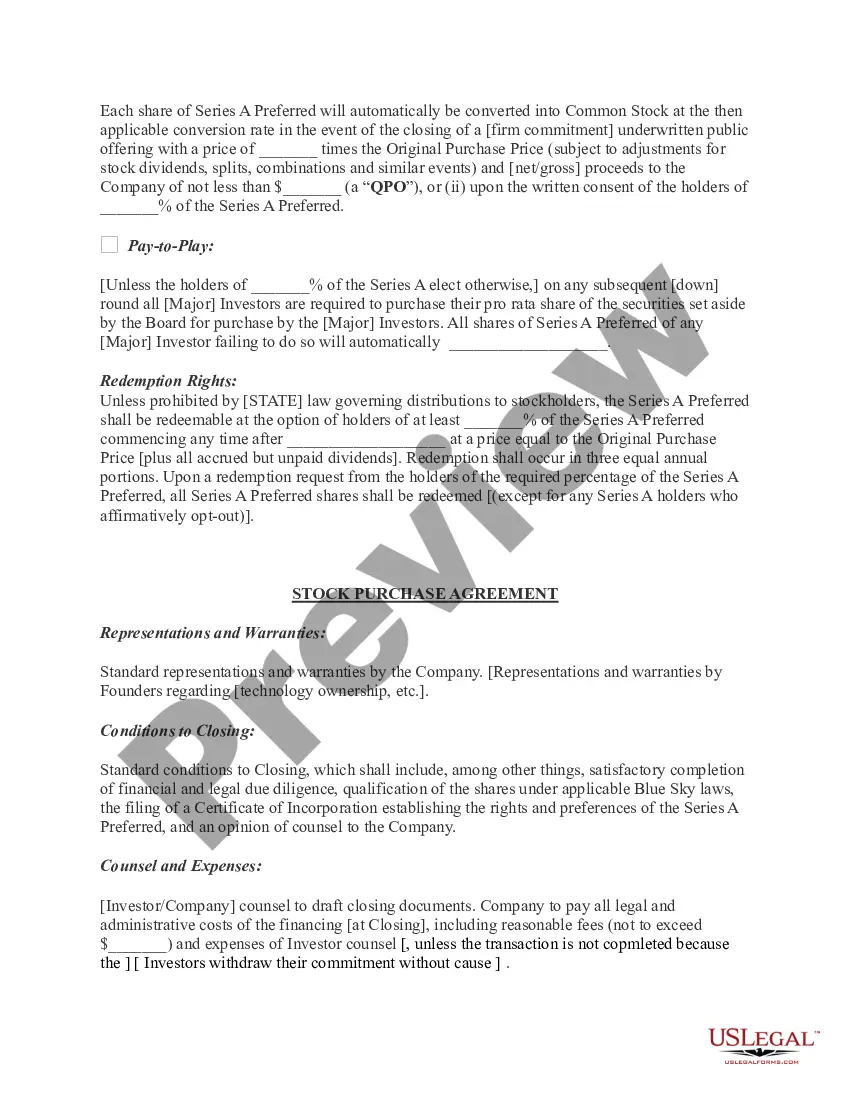

Oklahoma Term Sheet — Series A Preferred Stock Financing of a Company In Oklahoma, a term sheet for Series A Preferred Stock Financing outlines the terms and conditions under which a company seeks to raise funds from investors in exchange for issuing preferred stock. This type of financing is typically provided to early-stage companies looking to scale their operations and propel their growth. The term sheet for Series A Preferred Stock Financing in Oklahoma usually includes several key components: 1. Valuation and Investment Amount: The term sheet specifies the pre-money valuation of the company and the total amount of investment sought during the financing round. 2. Preferred Stock: The document details the terms and rights associated with the preferred stock being issued. This includes preferences, voting rights, liquidation preferences, conversion rights, anti-dilution provisions, and other relevant provisions that protect the interests of the preferred stockholders. 3. Dividend Provisions: The term sheet may outline any dividend obligations or preferences attached to the preferred stock, including whether cumulative or non-cumulative dividends will be paid. 4. Investor Rights: It covers the rights granted to the investors, such as information rights, participation rights, tag-along rights, and rights to consent to certain corporate actions or board matters. 5. Board Composition: The term sheet may specify the number of preferred stockholders who will have the right to appoint directors to the company's board, ensuring their active involvement in strategic decision-making. 6. Conditions and Closing: It outlines conditions precedent for closing the financing round, including the completion of due diligence, finalizing legal documentation, and any regulatory or approval requirements. Different types of Series A Preferred Stock Financing term sheets that may exist in Oklahoma include: 1. Preferred Stock with Cumulative Dividends: This type of preferred stock entitles the holders to receive unpaid dividends from previous periods along with the current dividend, creating an accumulation effect. 2. Preferred Stock with Non-Cumulative Dividends: Here, the preferred stockholders are entitled to receive dividends only for the current period, and any unpaid dividends are not carried forward. 3. Fully Participating Preferred Stock: This type of preferred stock allows the holders to participate in any remaining funds after the initial liquidation preference has been satisfied, effectively treating them on par with common stockholders. 4. Senior Preferred Stock: In certain cases, senior preferred stock may be offered, which grants the holders higher priority in terms of liquidation and distribution of assets compared to other classes of stock. 5. Convertible Preferred Stock: This form of preferred stock can be converted into common stock at a predetermined ratio, typically triggered by specific events like an initial public offering (IPO) or a subsequent financing round. 6. Redeemable Preferred Stock: Redeemable preferred stock includes provisions that allow the company to repurchase the shares at a specific price or upon a particular event, providing an exit option for the investors. These are just a few examples, and the specific terms and provisions within a Series A Preferred Stock Financing term sheet may vary based on the preferences and negotiation between the company and the investors in Oklahoma.

Oklahoma Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Oklahoma Term Sheet - Series A Preferred Stock Financing Of A Company?

Choosing the best legal papers template can be a battle. Of course, there are tons of templates accessible on the Internet, but how do you get the legal develop you need? Use the US Legal Forms site. The service delivers a huge number of templates, for example the Oklahoma Term Sheet - Series A Preferred Stock Financing of a Company, that you can use for company and personal requirements. Every one of the varieties are examined by experts and fulfill federal and state specifications.

If you are already signed up, log in in your profile and click on the Acquire switch to obtain the Oklahoma Term Sheet - Series A Preferred Stock Financing of a Company. Use your profile to appear with the legal varieties you may have acquired in the past. Proceed to the My Forms tab of your respective profile and acquire one more backup in the papers you need.

If you are a whole new end user of US Legal Forms, here are straightforward recommendations that you can stick to:

- Very first, ensure you have selected the right develop for your metropolis/state. You are able to look through the shape using the Review switch and look at the shape outline to make certain this is basically the right one for you.

- When the develop will not fulfill your needs, make use of the Seach discipline to obtain the proper develop.

- Once you are positive that the shape is proper, click on the Buy now switch to obtain the develop.

- Select the pricing plan you desire and enter in the essential information and facts. Design your profile and pay money for an order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the file structure and obtain the legal papers template in your system.

- Full, edit and print out and sign the attained Oklahoma Term Sheet - Series A Preferred Stock Financing of a Company.

US Legal Forms is the greatest collection of legal varieties that you can discover numerous papers templates. Use the service to obtain expertly-created paperwork that stick to condition specifications.