Oklahoma Investors Rights Agreement

Description

1. Information Rights

2. Restrictions on Transfer

3. Participation Right

4. Board of Directors

5. Covenants

6. General Provisions"

How to fill out Investors Rights Agreement?

If you have to complete, down load, or print authorized record templates, use US Legal Forms, the biggest selection of authorized varieties, that can be found on-line. Take advantage of the site`s basic and convenient lookup to discover the paperwork you need. Various templates for enterprise and specific purposes are sorted by types and suggests, or search phrases. Use US Legal Forms to discover the Oklahoma Investors Rights Agreement within a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in for your account and click the Obtain option to get the Oklahoma Investors Rights Agreement. You can even entry varieties you previously acquired from the My Forms tab of your account.

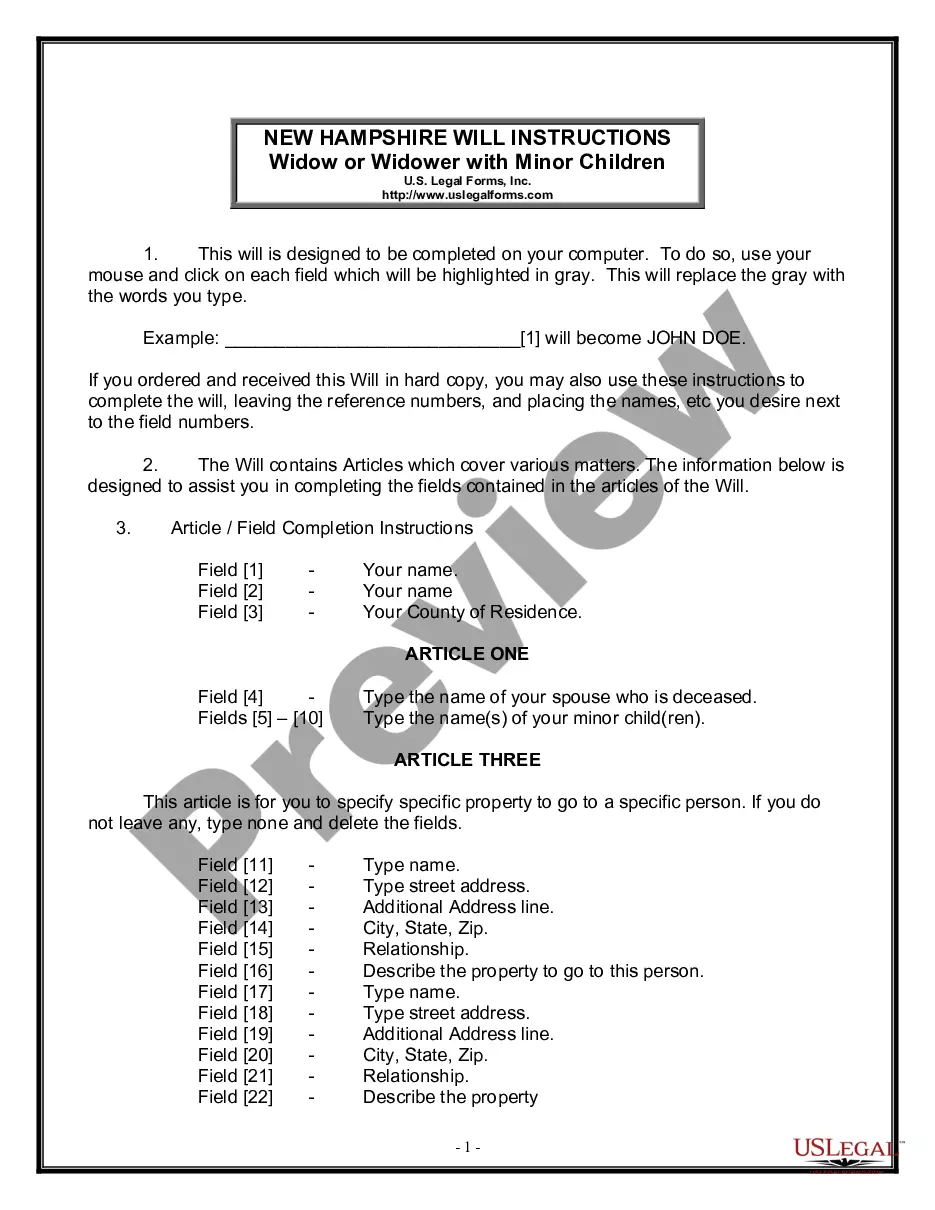

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape to the appropriate metropolis/land.

- Step 2. Make use of the Review option to look through the form`s content. Never forget to see the outline.

- Step 3. Should you be unhappy with the kind, make use of the Research discipline on top of the monitor to get other types of your authorized kind web template.

- Step 4. After you have identified the shape you need, click on the Purchase now option. Opt for the pricing plan you choose and add your credentials to register to have an account.

- Step 5. Procedure the deal. You should use your bank card or PayPal account to complete the deal.

- Step 6. Select the format of your authorized kind and down load it in your system.

- Step 7. Comprehensive, edit and print or sign the Oklahoma Investors Rights Agreement.

Each and every authorized record web template you buy is the one you have permanently. You may have acces to each kind you acquired within your acccount. Click the My Forms portion and select a kind to print or down load once again.

Contend and down load, and print the Oklahoma Investors Rights Agreement with US Legal Forms. There are many specialist and condition-certain varieties you can utilize for your enterprise or specific demands.

Form popularity

FAQ

An example would be if Dexter gives $100,000 to ABC (company) in exchange for a convertible debt note that will either be repaid in 1 year with 50% gain or converted into 100,000 shares of the company's stock.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

An investment agreement is a legally binding contract between two or more parties that outlines the terms and conditions of an investment arrangement.

If the seller complies with Rule 144, the sale will not violate the registration requirements of the Securities Act. Rule 144 imposes certain holding period, informational, volume, manner of sale and notice obligations in certain situations and for certain stockholders.

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.

A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.

How to draft a contract agreement Check out the parties. Come to an agreement on the terms. Specify the length of the contract. Spell out the consequences. Determine how you would resolve any disputes. Think about confidentiality. Check the contract's legality. Open it up to negotiation.

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company.

3 registration gives investors the right to demand that a company registers their shares using Form 3. Form 3 is a shorter registration form than Form 1, which is used in an initial stock launch or IPO. Form 3 can be used by a company one year after an IPO.

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.