Oklahoma Term Sheet for Potential Investment in a Company

Description

How to fill out Term Sheet For Potential Investment In A Company?

If you need to full, obtain, or printing legitimate record layouts, use US Legal Forms, the most important assortment of legitimate kinds, that can be found on the Internet. Make use of the site`s simple and easy hassle-free lookup to get the papers you will need. A variety of layouts for company and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to get the Oklahoma Term Sheet for Potential Investment in a Company in just a number of mouse clicks.

If you are previously a US Legal Forms consumer, log in to the bank account and click the Acquire switch to obtain the Oklahoma Term Sheet for Potential Investment in a Company. Also you can access kinds you earlier acquired in the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the form to the proper metropolis/land.

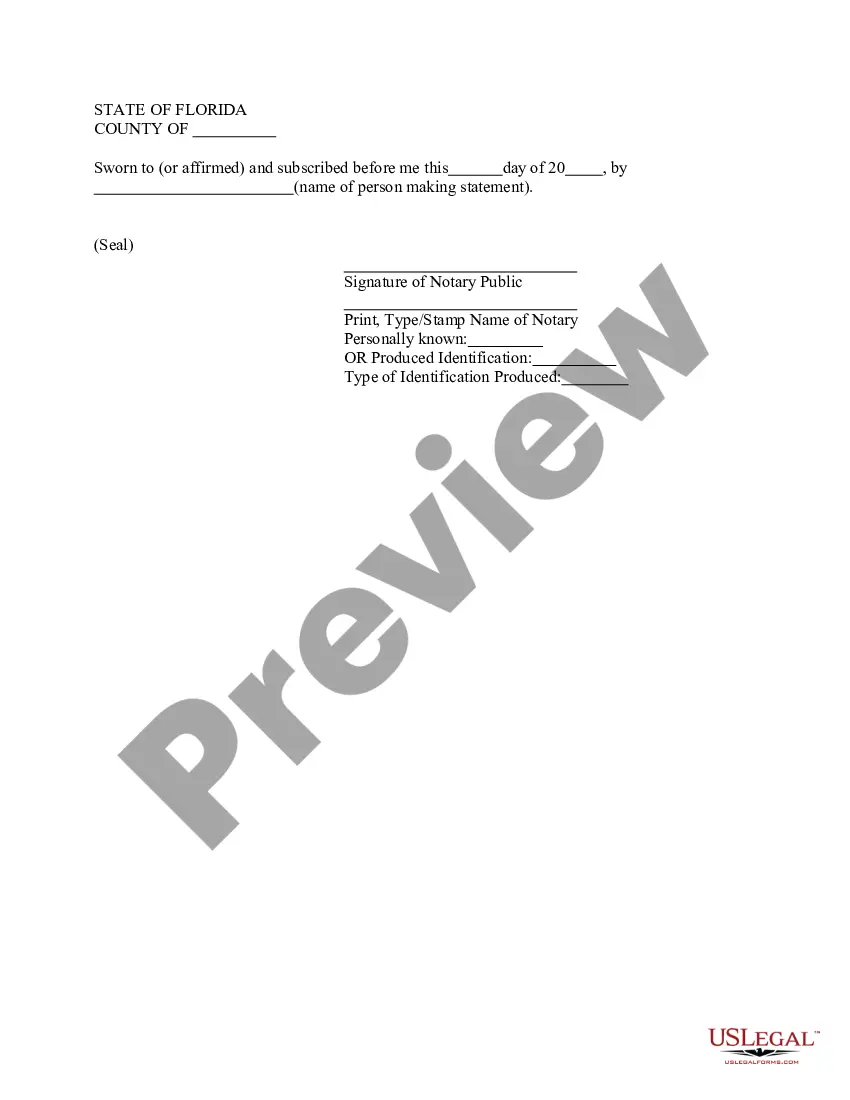

- Step 2. Utilize the Review option to examine the form`s information. Never forget about to see the explanation.

- Step 3. If you are unsatisfied together with the develop, take advantage of the Research field towards the top of the display screen to find other versions of the legitimate develop design.

- Step 4. When you have found the form you will need, go through the Purchase now switch. Pick the prices program you favor and add your credentials to sign up for the bank account.

- Step 5. Procedure the deal. You can utilize your bank card or PayPal bank account to perform the deal.

- Step 6. Find the structure of the legitimate develop and obtain it on your gadget.

- Step 7. Total, edit and printing or sign the Oklahoma Term Sheet for Potential Investment in a Company.

Every legitimate record design you purchase is yours forever. You have acces to every develop you acquired within your acccount. Click on the My Forms portion and choose a develop to printing or obtain yet again.

Compete and obtain, and printing the Oklahoma Term Sheet for Potential Investment in a Company with US Legal Forms. There are many skilled and status-particular kinds you can use for your personal company or personal needs.

Form popularity

FAQ

?The most important term in the term sheet is not a legal one ? it's really who you're working with,? Beebe says. ?Who's the firm, and who's the partner or lead on your deal?

3. Supporting Documentation Executive summary. Your executive summary is the first and most important document you will prepare for investors. ... Business plan. ... Financial projections. ... Pitch deck. ... Management team bios. ... Market research. ... Competitive analysis. ... Customer testimonials.

If you're looking to bring on investors, these are the key documents you will need. Certificate of Incorporation. ... Term Sheet. ... Investors' Rights Agreement. ... Stock Purchase Agreement. ... Raising Investment for Startups with JMR's Help.

Questions to Ask Before Investing in a Company What is the company s business model? ... What are the company s key competitive advantages? ... Who are the company s target customers? ... What is the company s pricing strategy? ... How does the company generate revenue? ... What are the company s costs of goods sold?

To help you evaluate whether to invest in a company, consider: The company's performance. How a company manages its money says a lot about how it will withstand stock market. ... Dividend. + read full definition history. ... Financial track record and operating costs. ... Leadership. ... Other risk factors.

Key Takeaways The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

The term sheet is the document that outlines the terms by which an investor (angel or venture capital investor) will make a financial investment in your company. Term sheets tend to consist of three sections: funding, corporate governance and liquidation.

A term sheet is not a legal promise to invest, but rather a nonbinding document that outlines the basic terms and conditions of a potential investment. Term sheets precede binding legal contracts in the venture capital process. Learn more > Agreements are legally binding.

This should include the company's income statement, balance sheet, cash flow statement and any other relevant financial documents. These documents will help you assess the company's financial performance and determine if the startup is a good investment opportunity.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.