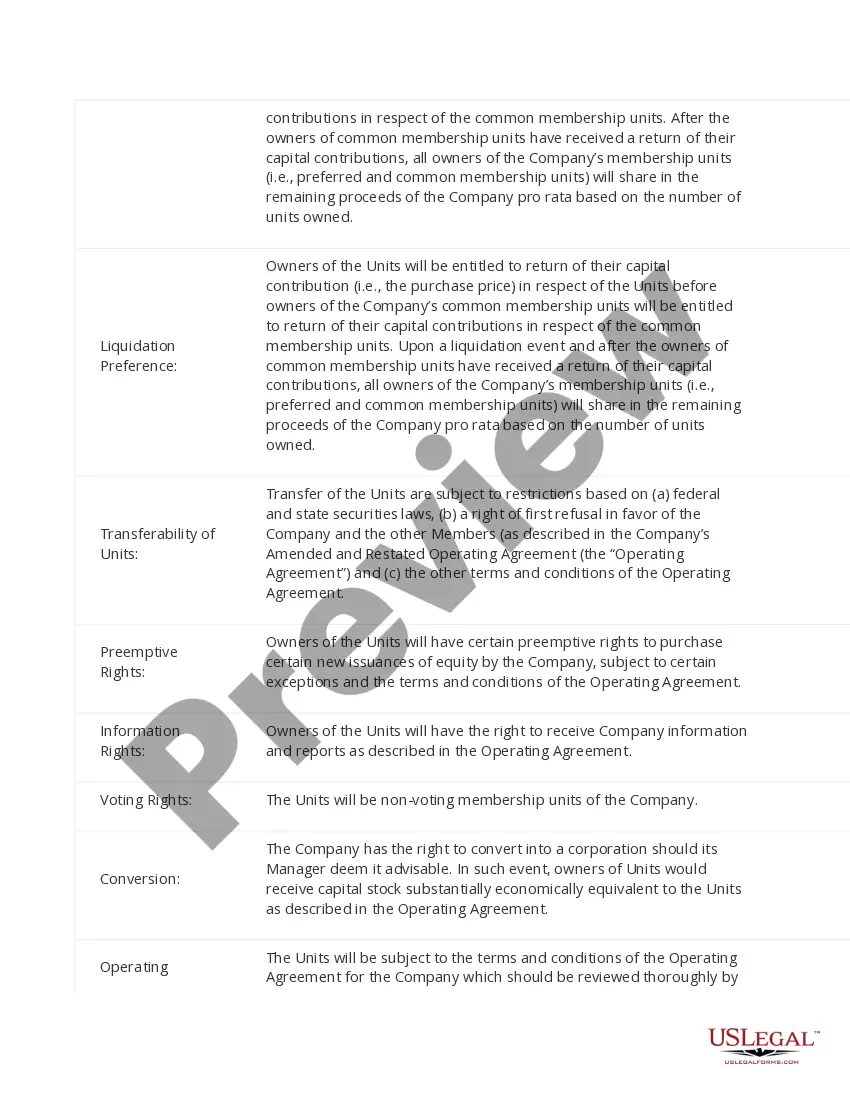

Title: Oklahoma Summary of Terms of Proposed Private Placement Offering: Understanding Different Types and Essential Details Introduction: In the following article, we delve into the detailed description of what an Oklahoma Summary of Terms of Proposed Private Placement Offering entails. We will explore the key components of such offerings, their purpose, and highlight important keywords to assist you in comprehending this financial concept better. 1. Definition and Purpose: The Oklahoma Summary of Terms of Proposed Private Placement Offering refers to a formal document that outlines the essential terms and conditions of a private placement investment opportunity. It serves as a critical reference for potential investors, providing them with comprehensive information regarding the securities offered, investment risks, return expectations, and legal obligations. 2. Keywords: — Oklahoma: The state of Oklahoma serves as the jurisdiction in which this private placement offering is governed. It adheres to specific state regulations and laws. — Summary of Terms: The document provides a concise summary of the crucial terms and conditions of the investment opportunity. — Proposed: The private placement offering is currently under consideration and subject to investor interest or approval. — Private Placement: This type of offering involves the sale of securities to a restricted group of accredited or sophisticated investors, excluding the public. — Offering: It refers to the investment opportunity presented to potential investors. — Terms: This encapsulates the contractual conditions, such as securities type, duration, pricing, payment terms, and more. 3. Types of Oklahoma Summary of Terms of Proposed Private Placement Offering: — Equity-Based Offering: In this type of offering, investors purchase equity securities (e.g., common stock, preferred stock) in a private company. Returns may come through dividends or capital appreciation. — Debt-Based Offering: This offering involves the issuance of debt securities, such as bonds or promissory notes, to investors. Interest payments and eventual principal repayment provide returns for investors. — Convertible Securities Offering: This type offers investors the opportunity to convert their securities into another form, such as equity shares, at a predetermined conversion ratio and price. — Real Estate Offering: Here, the investment opportunity involves the acquisition, development, or improvement of real estate properties. Investors may earn returns through rental income, capital appreciation, or profits from property sales. — Venture Capital Offering: In this context, the offering targets startup or early-stage companies seeking capital infusion. The investment aims for higher growth and substantial financial returns. Conclusion: An Oklahoma Summary of Terms of Proposed Private Placement Offering is a vital document that serves as a guiding reference for investors considering participation in a private placement offering. Different types of offerings, such as equity-based, debt-based, convertible securities, real estate, or venture capital offerings, cater to diverse investment preferences. By clearly understanding the keywords and components within this summary, potential investors can make informed decisions based on their financial goals, risk appetite, and investment capacity.

Oklahoma Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Oklahoma Summary Of Terms Of Proposed Private Placement Offering?

If you need to comprehensive, download, or produce legitimate papers themes, use US Legal Forms, the largest variety of legitimate kinds, which can be found on the web. Make use of the site`s simple and easy convenient lookup to get the files you require. A variety of themes for company and personal reasons are categorized by categories and suggests, or key phrases. Use US Legal Forms to get the Oklahoma Summary of Terms of Proposed Private Placement Offering in a few click throughs.

Should you be previously a US Legal Forms client, log in for your profile and click the Download button to find the Oklahoma Summary of Terms of Proposed Private Placement Offering. You may also accessibility kinds you previously saved inside the My Forms tab of the profile.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for the proper city/land.

- Step 2. Make use of the Review method to examine the form`s articles. Do not forget about to learn the outline.

- Step 3. Should you be unsatisfied using the form, use the Search discipline on top of the display to find other types of your legitimate form format.

- Step 4. After you have located the shape you require, click on the Buy now button. Opt for the prices plan you favor and add your credentials to sign up to have an profile.

- Step 5. Process the financial transaction. You should use your bank card or PayPal profile to finish the financial transaction.

- Step 6. Select the format of your legitimate form and download it on the gadget.

- Step 7. Comprehensive, modify and produce or signal the Oklahoma Summary of Terms of Proposed Private Placement Offering.

Every single legitimate papers format you get is your own property permanently. You may have acces to each form you saved within your acccount. Click the My Forms segment and select a form to produce or download once again.

Contend and download, and produce the Oklahoma Summary of Terms of Proposed Private Placement Offering with US Legal Forms. There are thousands of expert and state-distinct kinds you may use for your company or personal demands.