The term "Oklahoma Simple Agreement for Future Equity" refers to a contract commonly used by startups and early-stage companies in Oklahoma to raise funds from investors in exchange for future equity. It is an investment vehicle that allows entrepreneurs to secure capital while delaying the establishment of the company's valuation until a later funding round or exit event. The Oklahoma Simple Agreement for Future Equity, also known as an Oklahoma SAFE, operates similarly to its national counterpart, the Simple Agreement for Future Equity (SAFE) developed by Y Combinator. However, the Oklahoma version is tailored to comply with the state's specific laws and regulations. Under an Oklahoma SAFE, an investor provides funds to a company with the expectation of receiving equity in the event of a qualifying future financing or liquidity event. This agreement allows startups to avoid setting an immediate valuation, which can often be complex and challenging for early-stage companies with limited operating history. There are different types of Oklahoma SAFE agreements, such as: 1. pre-Roman SAFE: In this type of agreement, the investment is made prior to the company receiving any subsequent external funding. The equity allocation is determined after the next financing round, and the investor typically benefits from a lower share price due to the earlier investment. 2. Post-Money SAFE: This variant involves investing in the company after it has secured external funding. The equity allocation is determined based on the total value of the company after the latest funding round. Investors in a post-money SAFE generally receive a higher share price, reflecting the dilution caused by the external investment. 3. Valuation Cap SAFE: This type of SAFE sets a maximum predetermined valuation for the company upon conversion into equity. It provides investors with the potential of acquiring equity at a capped valuation, thus protecting their percentage ownership in the event of a significant increase in the company's valuation. 4. Discount SAFE: A Discount SAFE offers investors the opportunity to purchase equity at a discounted price compared to the price offered to subsequent investors in a future funding round. This feature allows early investors to acquire a larger share of the company. Investors and startups in Oklahoma can leverage these different types of SAFE agreements to structure funding rounds that align with their unique fundraising needs and strategies. By utilizing an Oklahoma SAFE, entrepreneurs can attract capital from investors interested in supporting the growth and success of early-stage companies without immediately establishing a valuation.

Oklahoma Simple Agreement for Future Equity

Description

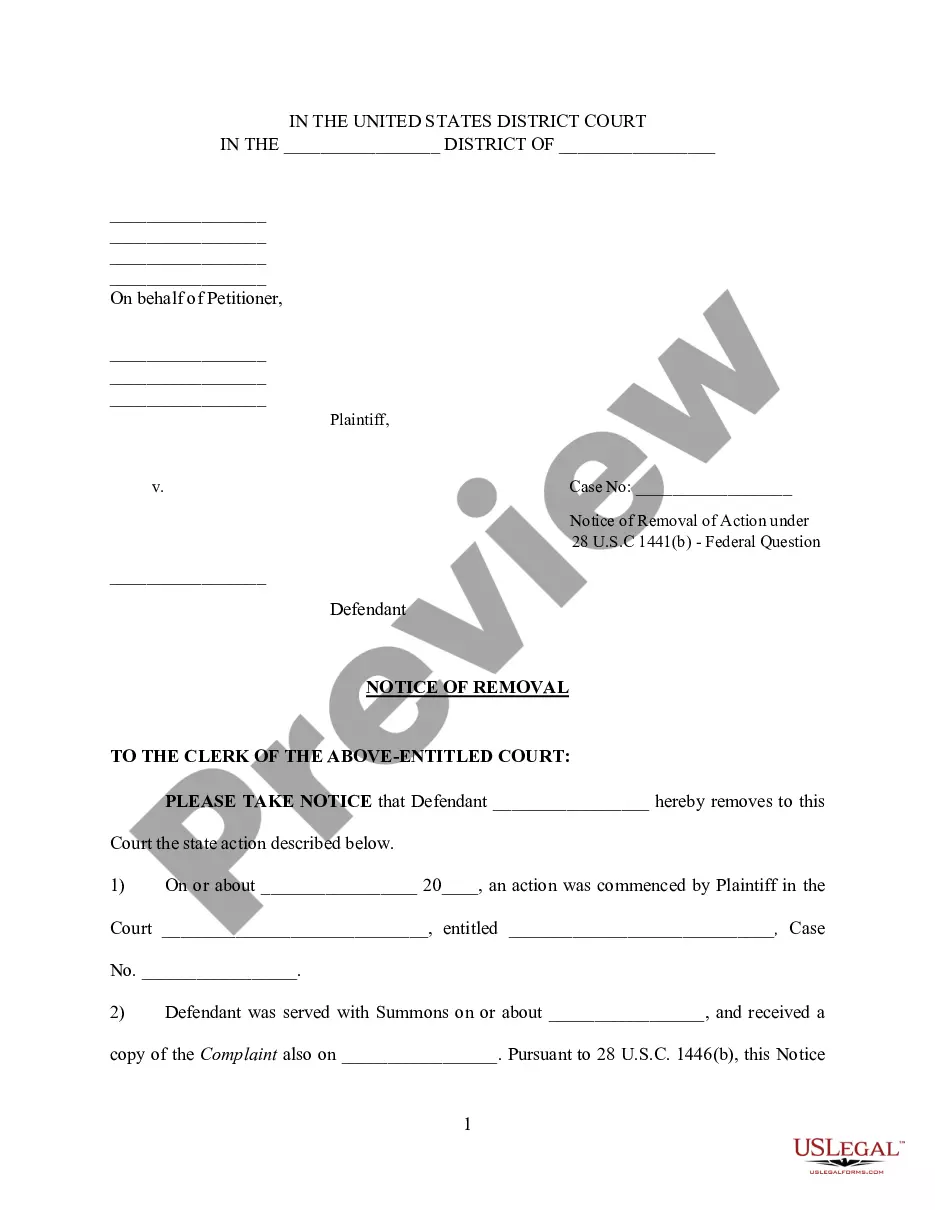

How to fill out Oklahoma Simple Agreement For Future Equity?

US Legal Forms - one of many greatest libraries of legal varieties in America - provides a wide array of legal document layouts you may obtain or produce. Utilizing the website, you can get 1000s of varieties for business and individual reasons, categorized by groups, suggests, or search phrases.You can find the newest variations of varieties much like the Oklahoma Simple Agreement for Future Equity in seconds.

If you have a subscription, log in and obtain Oklahoma Simple Agreement for Future Equity through the US Legal Forms collection. The Acquire key will appear on every develop you perspective. You gain access to all previously acquired varieties within the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, listed here are easy guidelines to help you started out:

- Ensure you have chosen the correct develop to your city/region. Go through the Review key to review the form`s articles. See the develop information to ensure that you have selected the proper develop.

- When the develop does not match your needs, make use of the Lookup discipline on top of the monitor to get the one who does.

- If you are pleased with the form, validate your selection by clicking on the Buy now key. Then, pick the prices plan you like and provide your references to register to have an accounts.

- Method the purchase. Make use of Visa or Mastercard or PayPal accounts to accomplish the purchase.

- Find the file format and obtain the form on the device.

- Make alterations. Fill up, edit and produce and sign the acquired Oklahoma Simple Agreement for Future Equity.

Every format you added to your bank account lacks an expiration day and is your own property for a long time. So, if you want to obtain or produce yet another backup, just visit the My Forms segment and click about the develop you require.

Get access to the Oklahoma Simple Agreement for Future Equity with US Legal Forms, one of the most substantial collection of legal document layouts. Use 1000s of professional and express-distinct layouts that satisfy your organization or individual requires and needs.