Oklahoma Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Oklahoma Carpentry Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the biggest libraries of lawful varieties in the States - delivers a variety of lawful papers themes you can acquire or produce. Making use of the site, you will get thousands of varieties for enterprise and person purposes, categorized by groups, claims, or keywords and phrases.You can find the newest versions of varieties much like the Oklahoma Carpentry Services Contract - Self-Employed Independent Contractor in seconds.

If you have a registration, log in and acquire Oklahoma Carpentry Services Contract - Self-Employed Independent Contractor from the US Legal Forms library. The Download switch can look on every type you view. You get access to all formerly downloaded varieties inside the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed below are straightforward instructions to help you started off:

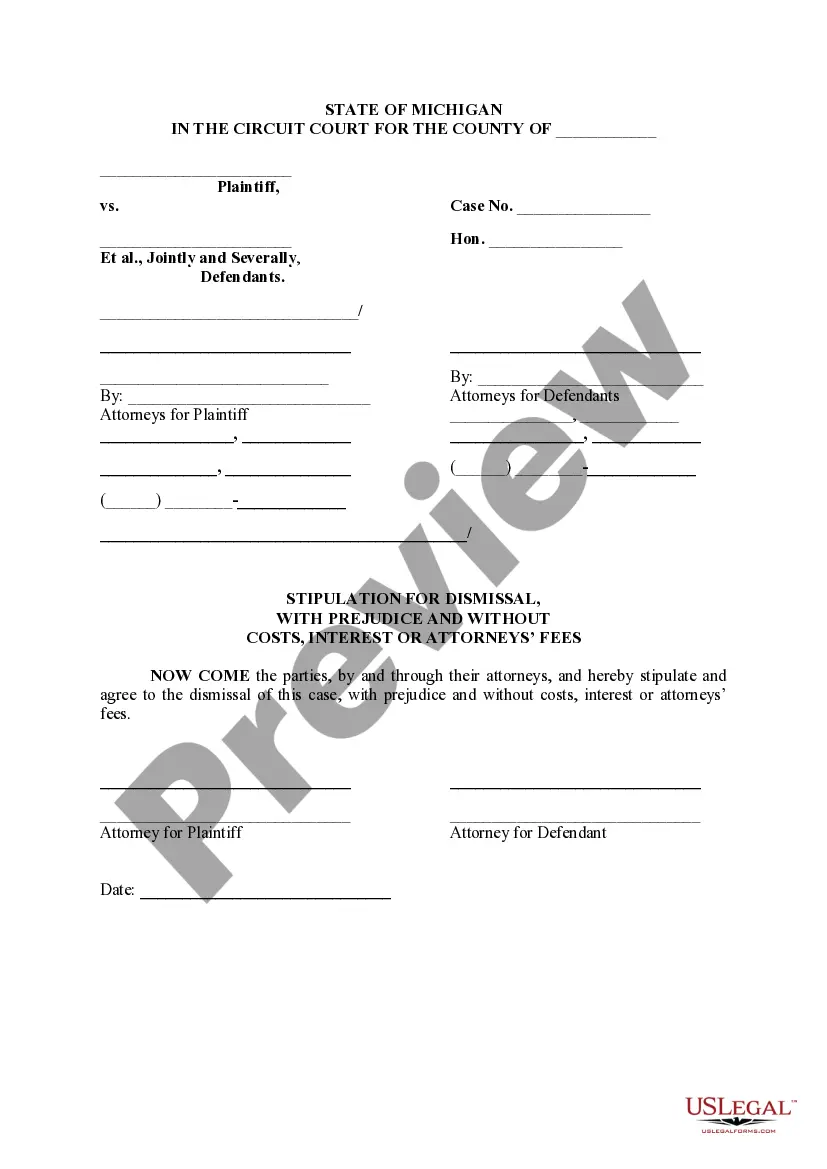

- Ensure you have selected the proper type to your city/area. Select the Preview switch to check the form`s information. See the type information to actually have selected the right type.

- If the type does not satisfy your needs, use the Look for discipline near the top of the display to discover the one which does.

- In case you are pleased with the shape, verify your choice by visiting the Buy now switch. Then, select the costs strategy you like and supply your credentials to register on an accounts.

- Procedure the financial transaction. Use your credit card or PayPal accounts to finish the financial transaction.

- Find the format and acquire the shape on your own product.

- Make adjustments. Complete, change and produce and signal the downloaded Oklahoma Carpentry Services Contract - Self-Employed Independent Contractor.

Each format you added to your account does not have an expiry particular date and is also your own forever. So, if you wish to acquire or produce an additional version, just check out the My Forms area and then click around the type you will need.

Obtain access to the Oklahoma Carpentry Services Contract - Self-Employed Independent Contractor with US Legal Forms, one of the most considerable library of lawful papers themes. Use thousands of professional and state-distinct themes that meet your business or person demands and needs.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.