Oklahoma Specialty Services Contact - Self-Employed

Description

How to fill out Oklahoma Specialty Services Contact - Self-Employed?

US Legal Forms - one of several largest libraries of legitimate types in the United States - offers a wide array of legitimate record web templates it is possible to obtain or print. Making use of the internet site, you can get a huge number of types for enterprise and individual reasons, categorized by classes, states, or search phrases.You can find the most recent versions of types such as the Oklahoma Specialty Services Contact - Self-Employed within minutes.

If you already possess a membership, log in and obtain Oklahoma Specialty Services Contact - Self-Employed from the US Legal Forms library. The Obtain key will appear on every form you see. You have accessibility to all in the past delivered electronically types within the My Forms tab of the accounts.

If you want to use US Legal Forms for the first time, listed here are simple recommendations to obtain started off:

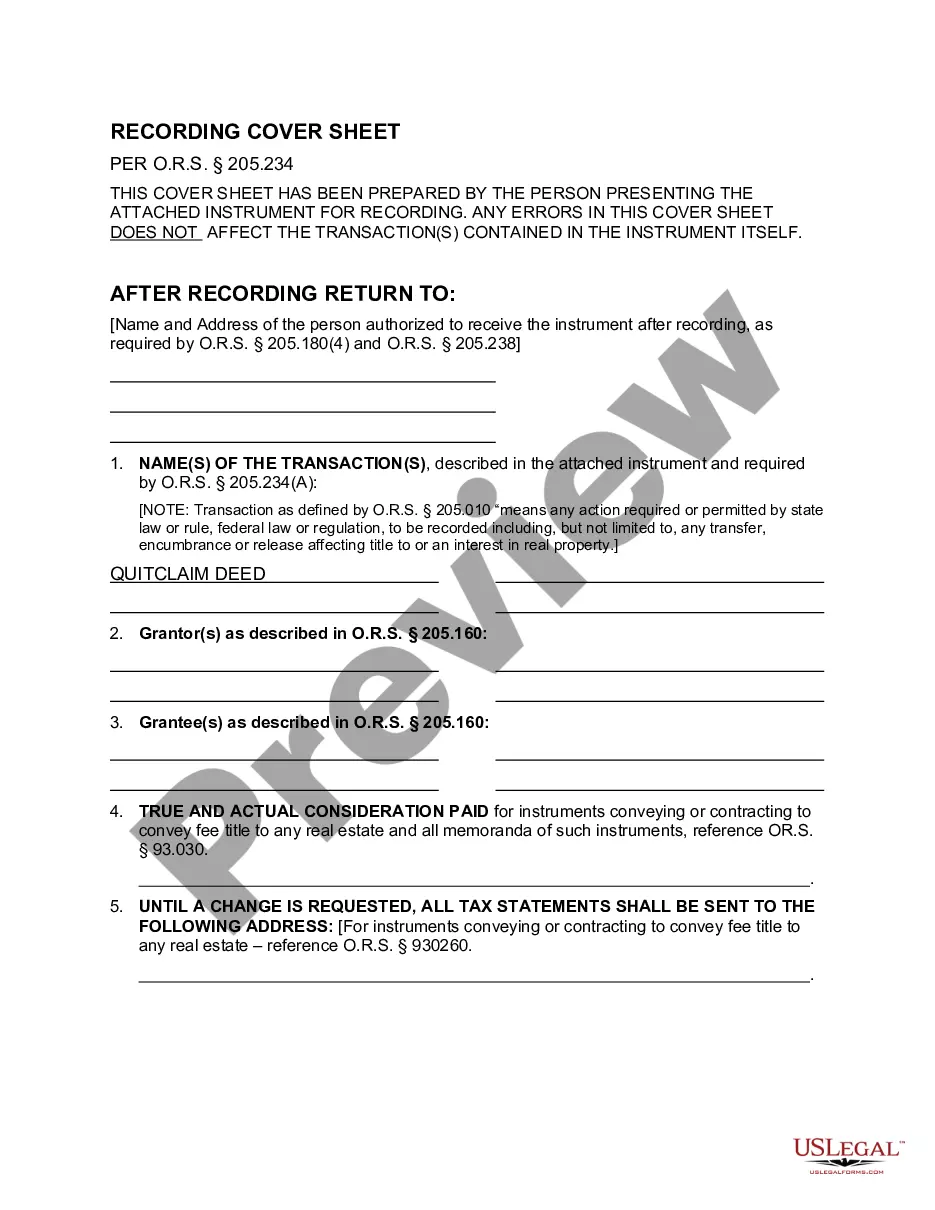

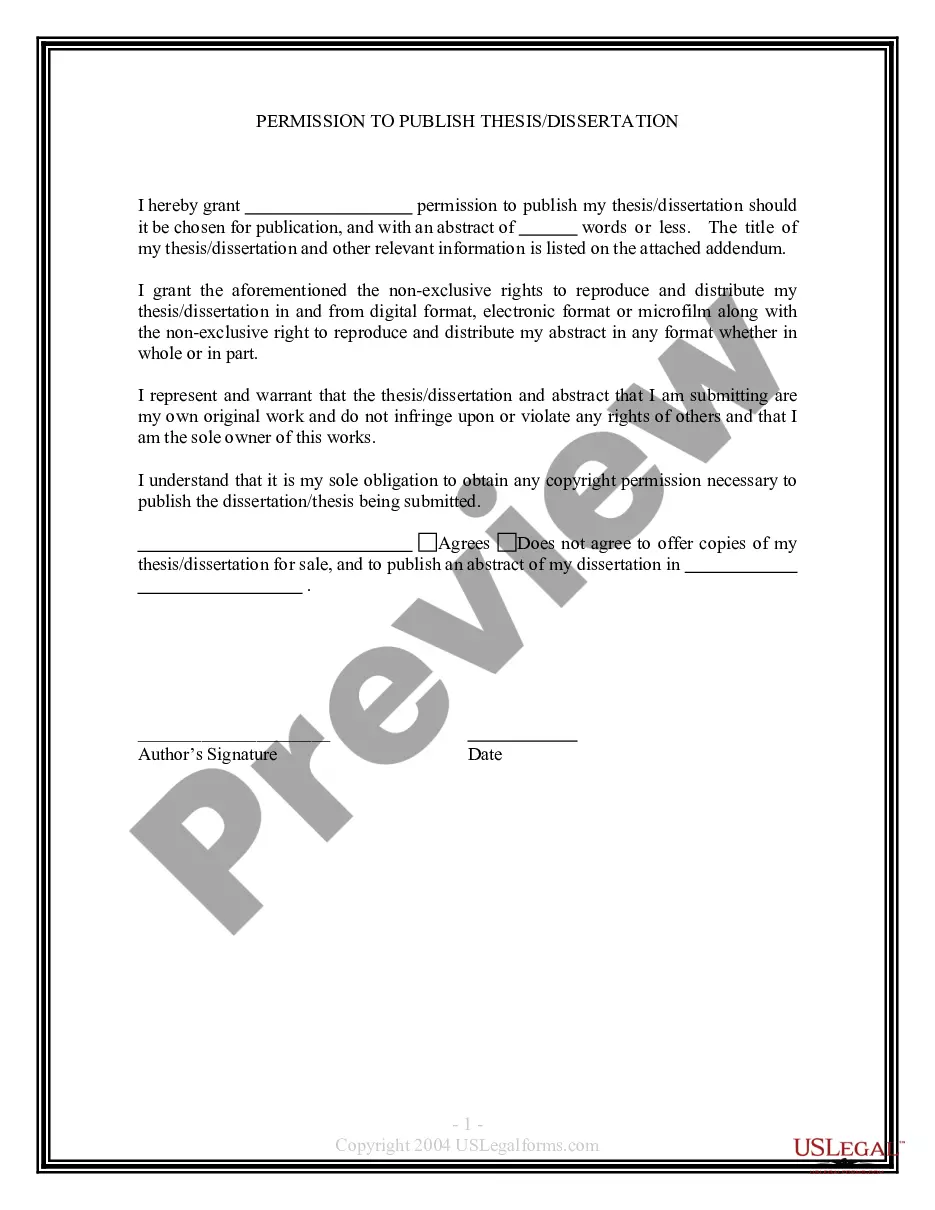

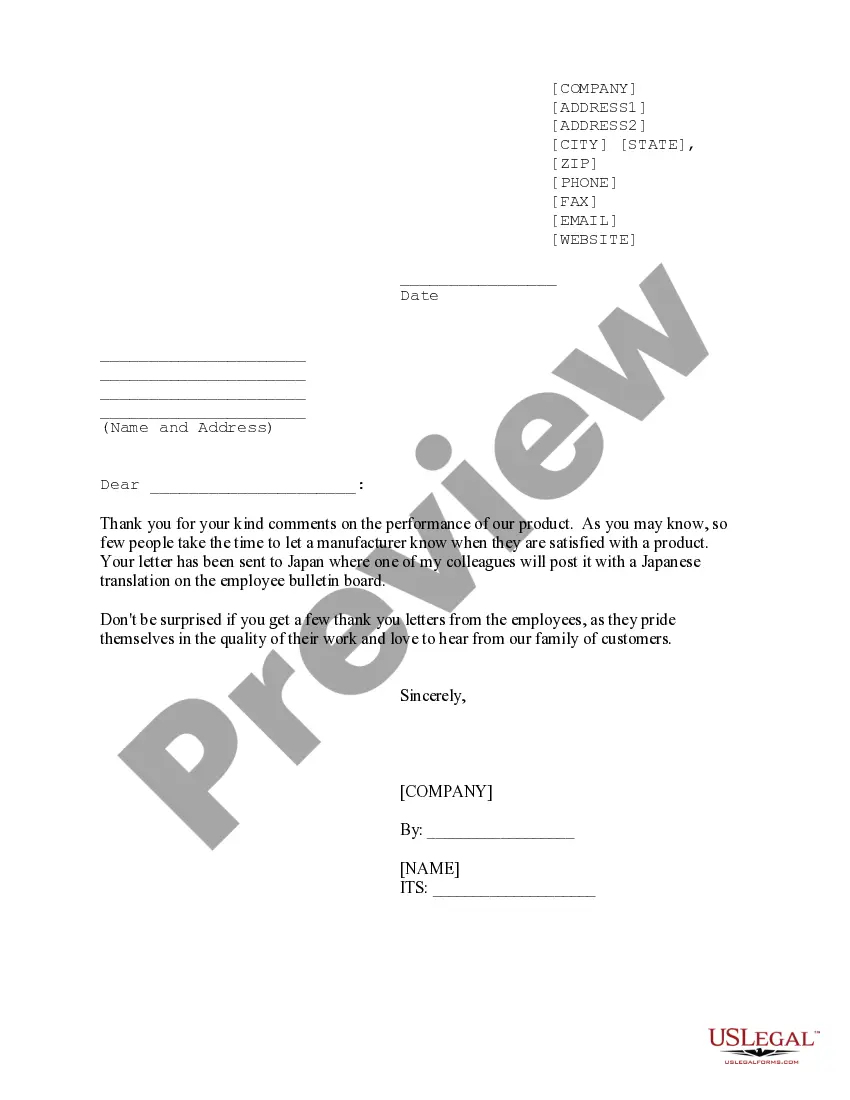

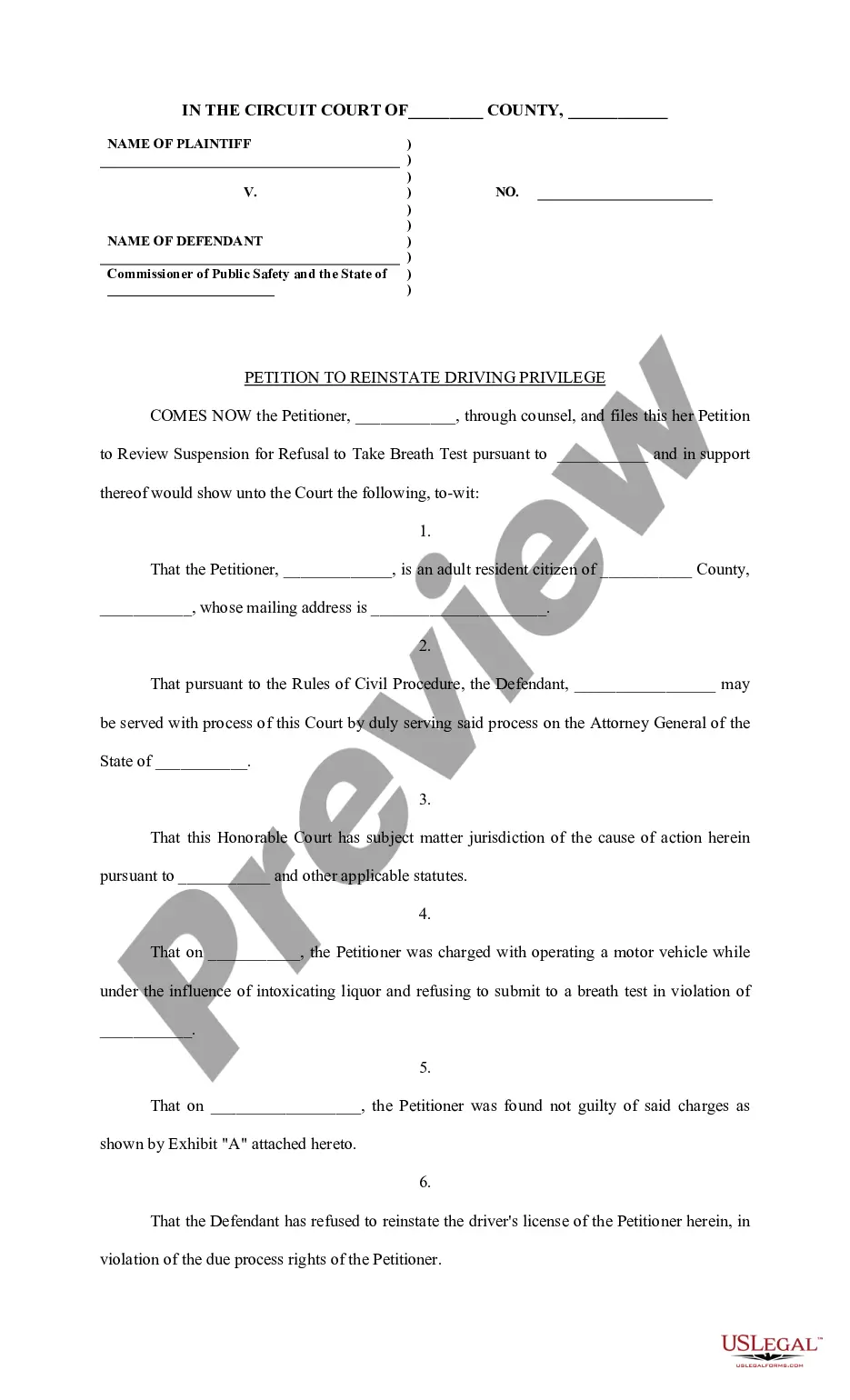

- Make sure you have picked out the proper form for your personal area/county. Go through the Review key to examine the form`s content material. Browse the form information to actually have chosen the appropriate form.

- When the form does not fit your requirements, utilize the Lookup discipline on top of the display screen to obtain the one that does.

- Should you be happy with the form, confirm your decision by visiting the Acquire now key. Then, choose the rates program you want and supply your credentials to register for an accounts.

- Approach the deal. Make use of your charge card or PayPal accounts to accomplish the deal.

- Pick the format and obtain the form on the gadget.

- Make modifications. Complete, edit and print and indicator the delivered electronically Oklahoma Specialty Services Contact - Self-Employed.

Every web template you put into your money does not have an expiry time which is your own property permanently. So, in order to obtain or print one more backup, just go to the My Forms section and click on about the form you require.

Get access to the Oklahoma Specialty Services Contact - Self-Employed with US Legal Forms, one of the most extensive library of legitimate record web templates. Use a huge number of expert and state-certain web templates that fulfill your small business or individual requirements and requirements.

Form popularity

FAQ

Five Self-Employed IRS Tax Forms for 2017Form 1040, U.S. Individual Tax Return.Schedule C to Form 1040, Profit or Loss From Business (Sole Proprietorship)Form 1099-MISC, Miscellaneous Income.Form 8829, Expenses for Business Use of Your Home.Schedule SE (Form 1040), Self-Employment Tax.

At its most basic, here is how to file self-employment taxes step-by-step.Calculate your income and expenses. That is a list of the money you've made, less the amount you've spent.Determine if you have a net profit or loss.Fill out an information return.Fill out a 1040 and other self-employment tax forms.

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The net income you earn from your own trade or business. For example, any net income (profit) you earn from goods you sell or services you provide to others counts as self-employment income.

The IRS says that someone is self-employed if they meet one of these conditions: Someone who carries on a trade or business as a sole proprietor or independent contractor, A member of a partnership that carries on a trade or business, or. Someone who is otherwise in business for themselves, including part-time business

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Self-employment income is earned from carrying on a "trade or business" as a sole proprietor, an independent contractor, or some form of partnership. To be considered a trade or business, an activity does not necessarily have to be profitable, and you do not have to work at it full time, but profit must be your motive.

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.