Oklahoma Chef Services Contract - Self-Employed

Description

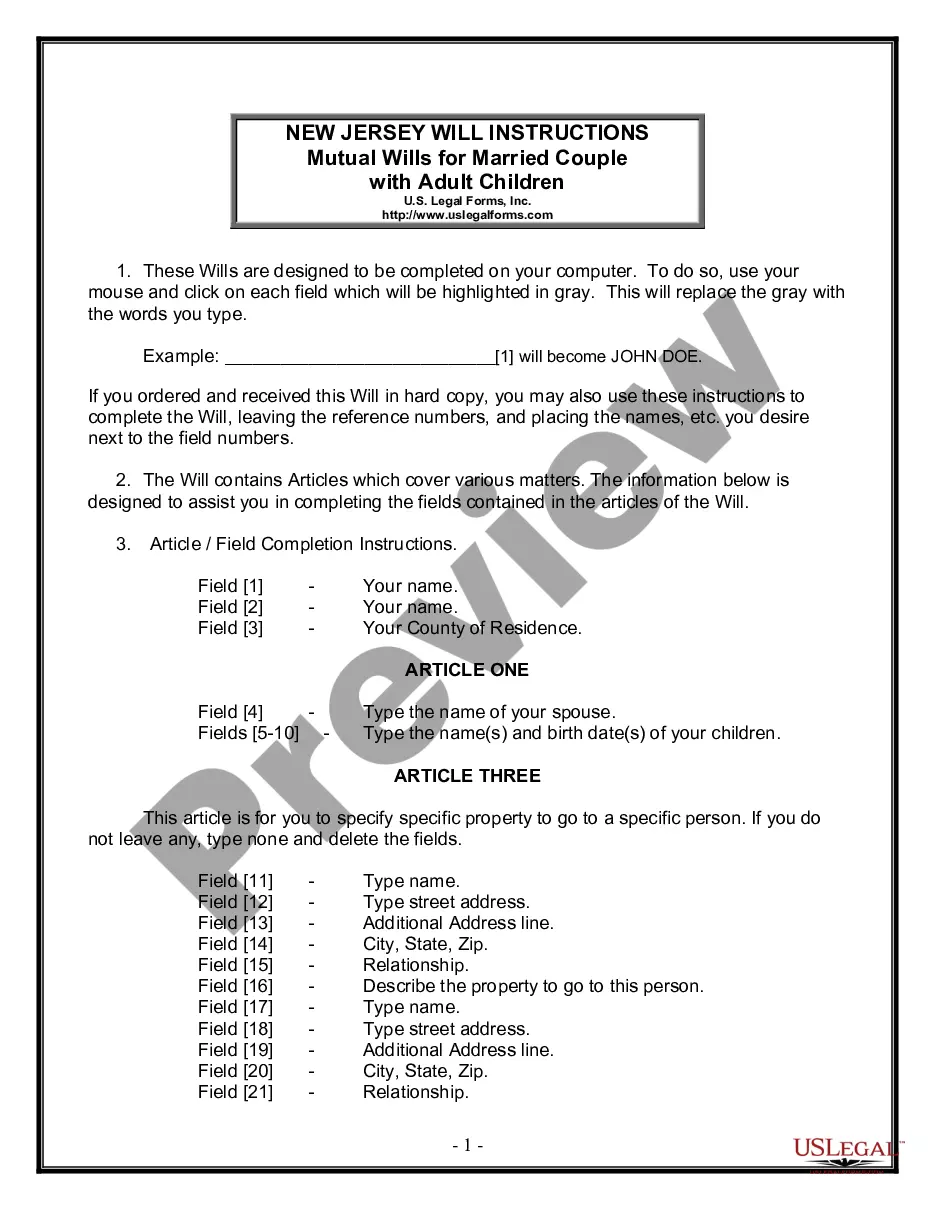

How to fill out Oklahoma Chef Services Contract - Self-Employed?

US Legal Forms - one of several most significant libraries of lawful kinds in the United States - provides an array of lawful file templates it is possible to down load or print. Utilizing the web site, you can get 1000s of kinds for business and specific purposes, categorized by classes, says, or key phrases.You will discover the most recent variations of kinds just like the Oklahoma Chef Services Contract - Self-Employed within minutes.

If you already possess a membership, log in and down load Oklahoma Chef Services Contract - Self-Employed from the US Legal Forms catalogue. The Download button can look on each develop you perspective. You have accessibility to all formerly saved kinds from the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, allow me to share basic directions to help you get started out:

- Be sure to have selected the best develop for your personal metropolis/area. Click the Review button to examine the form`s content. Look at the develop explanation to actually have selected the appropriate develop.

- If the develop doesn`t satisfy your specifications, take advantage of the Lookup area towards the top of the display screen to get the the one that does.

- In case you are content with the shape, affirm your selection by simply clicking the Acquire now button. Then, choose the rates prepare you want and offer your qualifications to register on an accounts.

- Process the purchase. Make use of charge card or PayPal accounts to finish the purchase.

- Pick the structure and down load the shape in your product.

- Make changes. Load, modify and print and indicator the saved Oklahoma Chef Services Contract - Self-Employed.

Every single template you included with your money does not have an expiry day and it is your own eternally. So, if you wish to down load or print yet another duplicate, just proceed to the My Forms section and click on the develop you need.

Obtain access to the Oklahoma Chef Services Contract - Self-Employed with US Legal Forms, the most substantial catalogue of lawful file templates. Use 1000s of skilled and state-certain templates that meet up with your business or specific demands and specifications.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

The majority of personal chefs are self-employed, operating their own businesses in the culinary field. In their homes, they prepare their own meals and pre-prepared meals for their clients on a weekly or monthly basis, leaving them ready to be consumed on the day, while others are refrigerated and reheated.

A chef is integral to the business of preparing food and would not be considered an independent contractor. A specialist chef, who prepares food for a one-time event for the restaurant, could be considered an independent contractor.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

If the worker is paid a salary or guaranteed a regular company wage, they're probably classified as an employee. If the worker is paid a flat fee per job or project, they're more likely to be classified as an independent contractor.

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

A Private Chef is employed by a single household on a full time basis, cooking every meal, every day. Private chefs are part of the household staff; they may live on or off the premises. A Personal Chef prepares meal for multiple clients, either in a client's kitchen or out of a commercial kitchen.

Personal Chefs are self-employed, as are Private Cooks who work on a contract basis.