Title: Understanding the Oklahoma Accounting Agreement — Self-Employed Independent Contractor Introduction: The Oklahoma Accounting Agreement — Self-Employed Independent Contractor is a legal document that outlines the rights, responsibilities, and financial obligations between a self-employed individual and their clients or customers. In this article, we will delve into the specifics of this agreement, exploring its purpose, key components, and the different types of accounting agreements that fall under this category. 1. Purpose of the Oklahoma Accounting Agreement — Self-Employed Independent Contractor: The primary purpose of this agreement is to establish a formal relationship between a self-employed independent contractor and their clients or customers for accounting or financial services. It defines the terms of engagement, clarifies the scope of work, sets the payment arrangements, and safeguards the interests of both parties involved. 2. Key Components of the Oklahoma Accounting Agreement — Self-Employed Independent Contractor: a) Identification of the Parties: This section outlines the legal names and contact details of the self-employed independent contractor (the service provider) and their client or customer (the recipient of services). b) Engagement Details: Here, the agreement specifies the specific accounting services to be provided, including detailed descriptions, timelines, and any additional obligations or deliverables expected from the independent contractor. c) Payment Terms: This section details the payment arrangements, such as the compensation structure, billing frequency, due dates, accepted payment methods, and any penalties for late payments or non-payment. d) Confidentiality and Non-Disclosure: It is common for accounting agreements to contain clauses ensuring the protection of sensitive business or financial information shared during the engagement. e) Intellectual Property: If any intellectual property is created or utilized during the provision of accounting services, this section clarifies the ownership and rights associated with such materials. f) Termination and Dispute Resolution: The agreement should address the circumstances and procedures for termination by either party, as well as the protocol for resolving disputes, such as mediation or arbitration. 3. Types of Oklahoma Accounting Agreement — Self-Employed Independent Contractor: a) General Accounting Agreement: This refers to the standard accounting agreement that covers a broad range of accounting services, including bookkeeping, financial statement preparation, tax planning, and compliance. b) Payroll Accounting Agreement: This type of agreement specifically focuses on payroll-related services, such as processing payrolls, calculating taxes, and generating employee reports. c) Tax Consulting Agreement: This agreement centers around providing specialized tax consulting services, including assistance with tax planning, tax preparation, and IRS compliance. d) Forensic Accounting Agreement: In cases involving financial investigations or suspected fraud, a forensic accounting agreement is necessary. It outlines the procedures for analyzing financial records, identifying irregularities, and generating reports for legal purposes. Conclusion: The Oklahoma Accounting Agreement — Self-Employed Independent Contractor is a vital legal document that governs the professional relationship between self-employed individuals and their clients or customers. By understanding the purpose, key components, and different types of accounting agreements falling under this category, both parties can ensure transparency, protect their interests, and maintain a strong working relationship.

Oklahoma Accounting Agreement - Self-Employed Independent Contractor

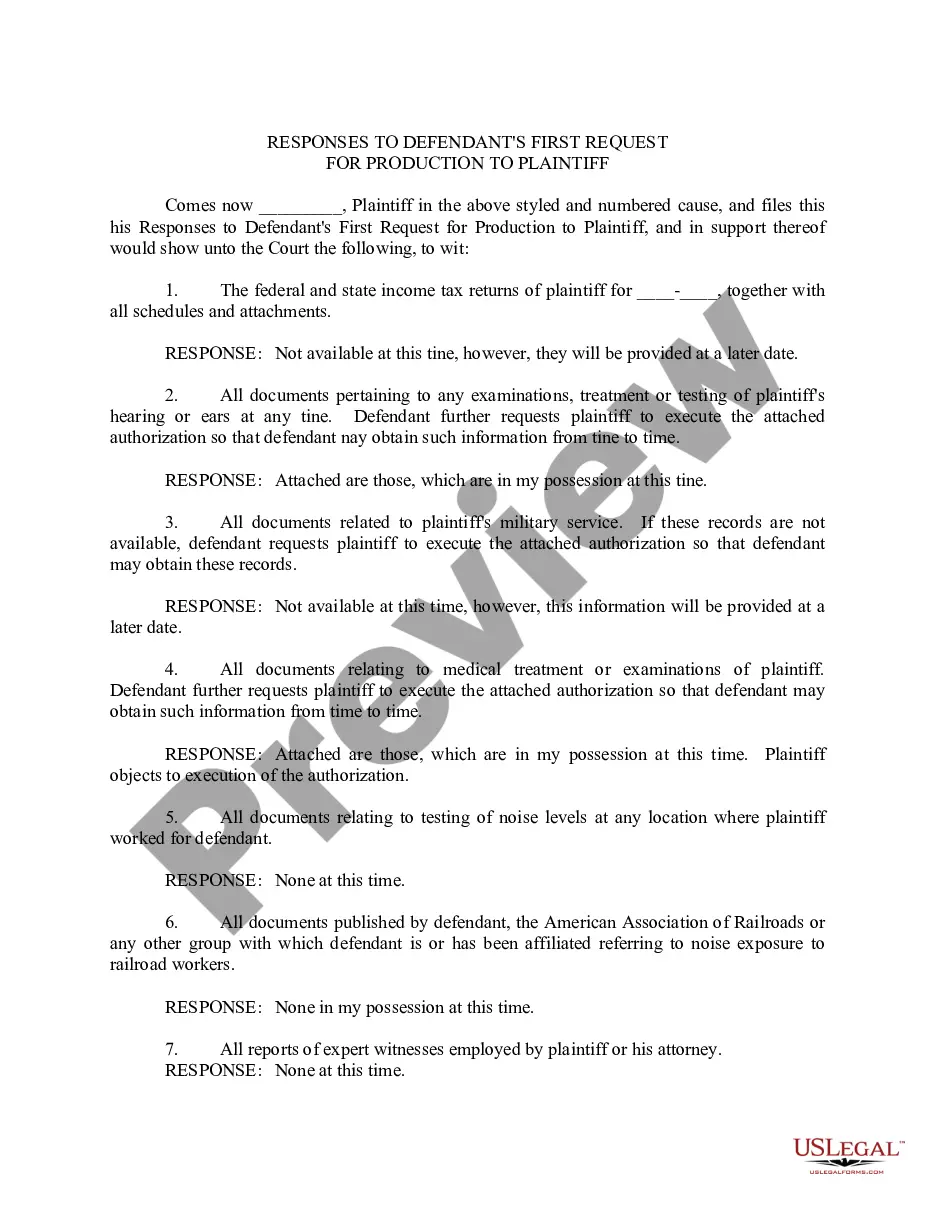

Description

How to fill out Oklahoma Accounting Agreement - Self-Employed Independent Contractor?

Are you within a situation in which you need papers for sometimes company or individual functions virtually every day? There are a variety of lawful file web templates available online, but getting ones you can depend on isn`t straightforward. US Legal Forms delivers a large number of form web templates, just like the Oklahoma Accounting Agreement - Self-Employed Independent Contractor, which can be composed to satisfy federal and state needs.

In case you are already familiar with US Legal Forms site and have your account, merely log in. Next, you can acquire the Oklahoma Accounting Agreement - Self-Employed Independent Contractor design.

If you do not come with an accounts and want to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for your right town/state.

- Take advantage of the Review key to check the form.

- Read the description to actually have selected the proper form.

- In case the form isn`t what you are seeking, use the Look for area to obtain the form that meets your needs and needs.

- Once you get the right form, just click Buy now.

- Pick the costs strategy you would like, fill in the desired info to generate your money, and pay for an order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free paper formatting and acquire your version.

Discover all the file web templates you have purchased in the My Forms food list. You can get a additional version of Oklahoma Accounting Agreement - Self-Employed Independent Contractor anytime, if required. Just go through the required form to acquire or print out the file design.

Use US Legal Forms, by far the most extensive selection of lawful varieties, to save lots of time as well as stay away from faults. The assistance delivers expertly produced lawful file web templates that you can use for a selection of functions. Create your account on US Legal Forms and commence generating your life a little easier.