Oklahoma Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

How to fill out Oklahoma Journalist - Reporter Agreement - Self-Employed Independent Contractor?

You are able to spend several hours on the web attempting to find the legitimate file design that meets the state and federal requirements you require. US Legal Forms gives a large number of legitimate types that are examined by experts. It is possible to down load or produce the Oklahoma Journalist - Reporter Agreement - Self-Employed Independent Contractor from your support.

If you have a US Legal Forms bank account, you can log in and click the Acquire button. After that, you can full, revise, produce, or sign the Oklahoma Journalist - Reporter Agreement - Self-Employed Independent Contractor. Every single legitimate file design you buy is your own property permanently. To have one more backup for any purchased form, check out the My Forms tab and click the corresponding button.

Should you use the US Legal Forms internet site the very first time, follow the basic directions below:

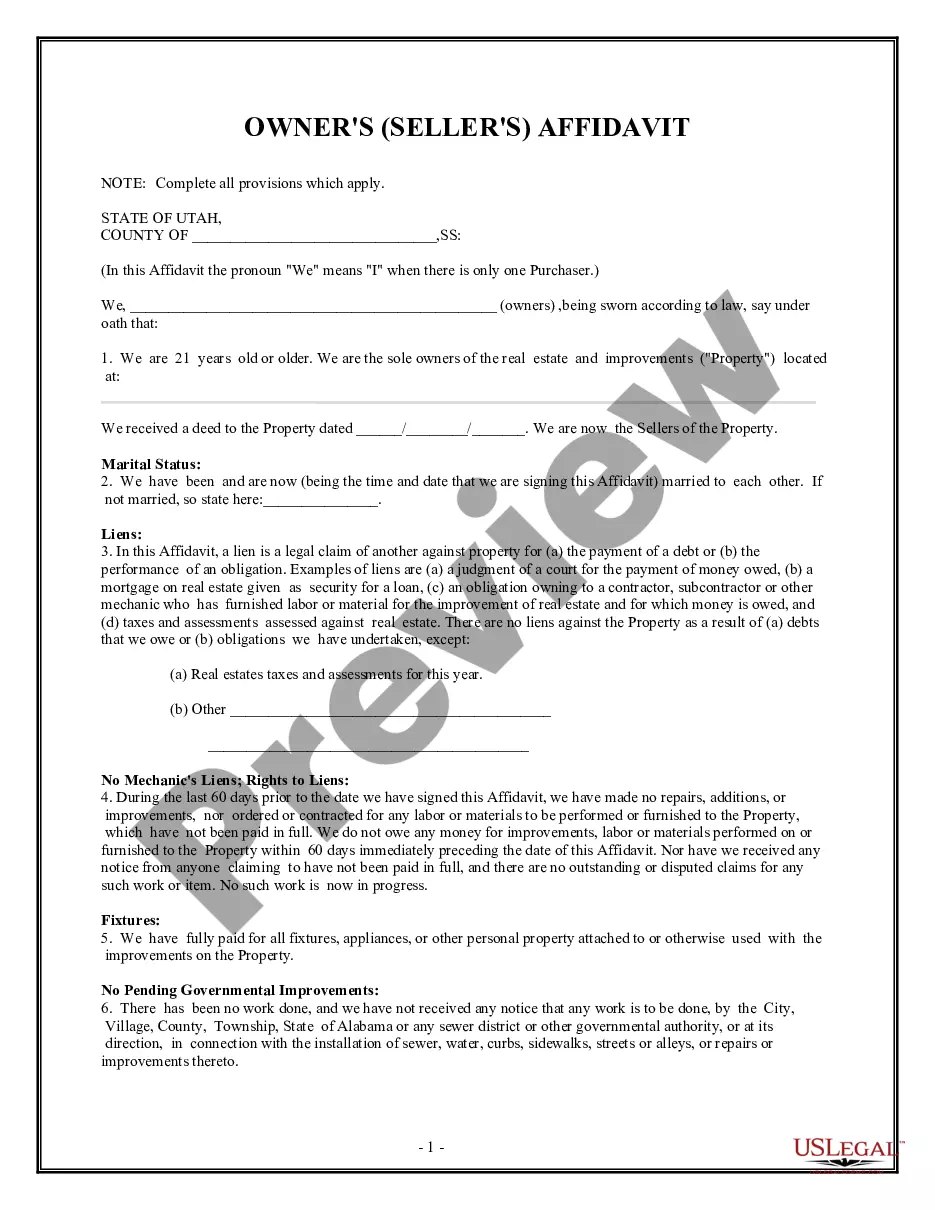

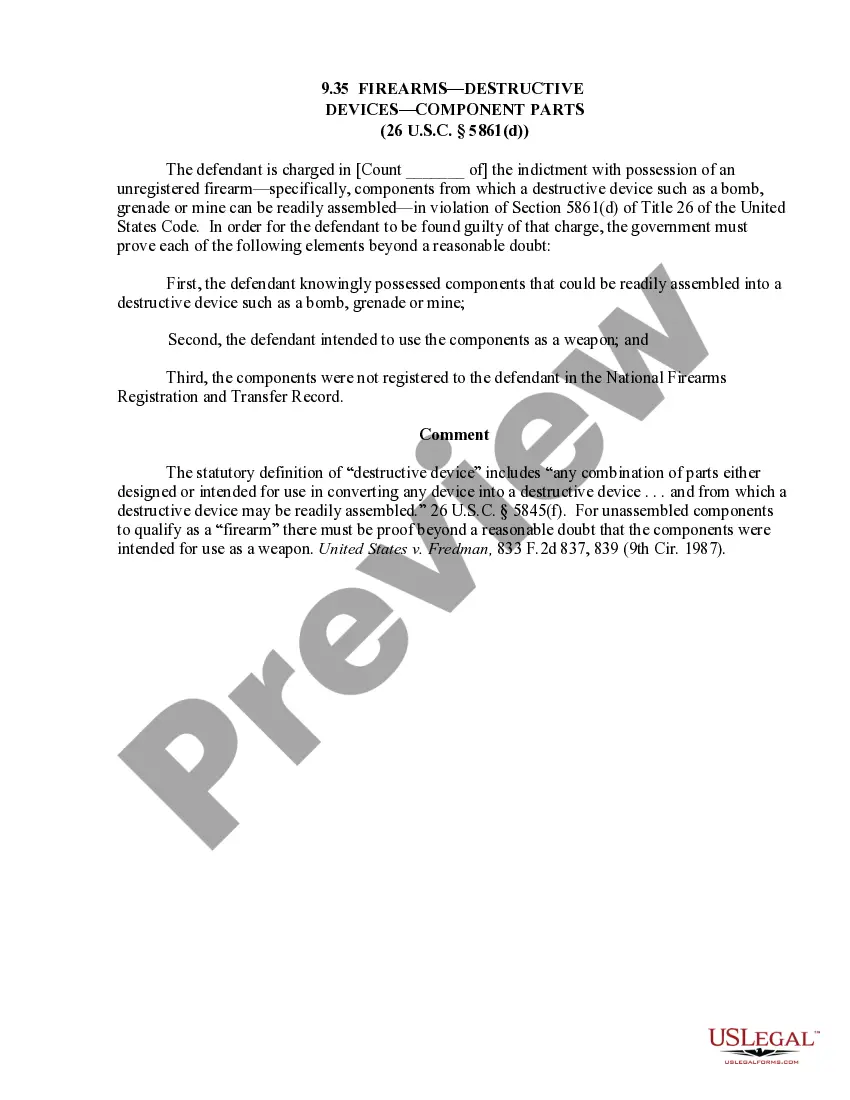

- Very first, be sure that you have selected the correct file design to the area/area that you pick. Read the form explanation to ensure you have chosen the correct form. If readily available, take advantage of the Preview button to look with the file design at the same time.

- In order to get one more variation in the form, take advantage of the Research area to discover the design that fits your needs and requirements.

- Upon having identified the design you want, just click Get now to carry on.

- Find the prices strategy you want, type your credentials, and sign up for your account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal bank account to cover the legitimate form.

- Find the file format in the file and down load it to your product.

- Make modifications to your file if necessary. You are able to full, revise and sign and produce Oklahoma Journalist - Reporter Agreement - Self-Employed Independent Contractor.

Acquire and produce a large number of file layouts making use of the US Legal Forms Internet site, which provides the largest assortment of legitimate types. Use skilled and condition-distinct layouts to tackle your small business or person requirements.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

An independent contractor is not employed by a businessinstead, they work with a business as a third party....Here are some examples of professions that frequently work as independent contractors:Electricians.Plumbers.Carpenters.Painters.Auto mechanics.Florists.Dentists.Veterinarians.More items...?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

As an independent contractor, a freelance social media manager is also responsible for all of their own taxes and benefits.

Under no circumstances should an employer use its employee performance review process to evaluate the work done by an independent contractor. It is also advisable to require independent contrac-tors to provide periodic progress reports and to submit regular invoices as defined tar-gets are met.

An independent contractor often functions as a freelancer, but typically will work with one client for a longer time frame. In many cases, independent contractors work for an hourly rate. Furthermore, they might work through a third party or agency but can also work on their own.