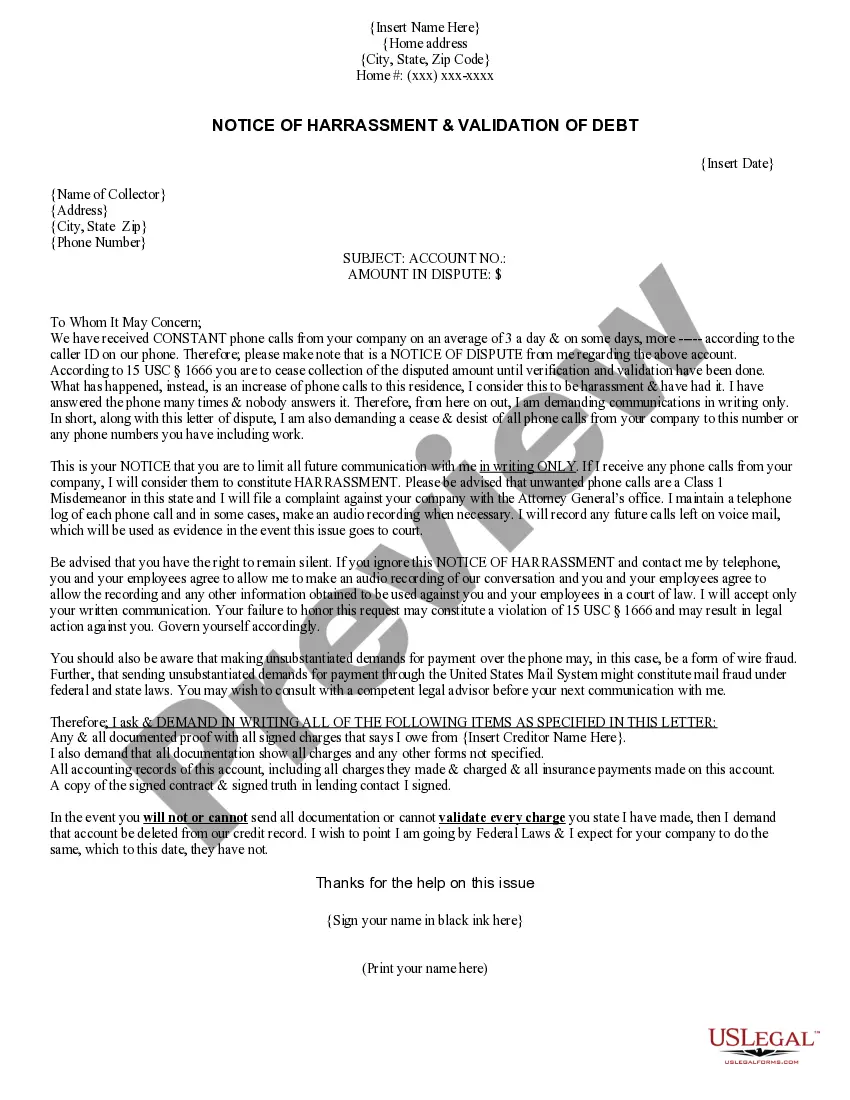

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Oklahoma Notice of Harassment and Validation of Debt

Description

How to fill out Oklahoma Notice Of Harassment And Validation Of Debt?

Are you presently in the position where you require documents for possibly organization or person purposes almost every time? There are a lot of authorized file web templates available online, but locating kinds you can rely on is not effortless. US Legal Forms offers a large number of develop web templates, such as the Oklahoma Notice of Harassment and Validation of Debt, which can be written to meet federal and state demands.

When you are already knowledgeable about US Legal Forms site and get a merchant account, basically log in. Afterward, you are able to down load the Oklahoma Notice of Harassment and Validation of Debt design.

Unless you offer an profile and wish to start using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for that correct area/region.

- Take advantage of the Review button to check the shape.

- Browse the description to actually have chosen the appropriate develop.

- If the develop is not what you are seeking, make use of the Lookup area to find the develop that meets your needs and demands.

- Whenever you get the correct develop, click Get now.

- Select the costs strategy you want, fill in the required information and facts to produce your money, and pay for the order using your PayPal or credit card.

- Decide on a hassle-free document structure and down load your backup.

Find every one of the file web templates you possess bought in the My Forms food selection. You can obtain a further backup of Oklahoma Notice of Harassment and Validation of Debt at any time, if necessary. Just go through the required develop to down load or print out the file design.

Use US Legal Forms, by far the most extensive selection of authorized kinds, to save lots of efforts and prevent mistakes. The service offers expertly produced authorized file web templates which can be used for a variety of purposes. Generate a merchant account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

In Oklahoma, for most debts, a creditor is afforded five years to take legal action on a debt. After the statute of limitations has expired, a creditor or debt collector can no longer sue you for the debt.

The Statute of Limitations in Oklahoma Can Protect You In Oklahoma, a judgment creditor can attempt execution of a judgment for five years from the date of the judgment. This is known as the statute of limitations. After the statute of limitations has expired, it becomes unenforceable by the operation of law.

The statute of limitations on open-account debt, like credit cards, for Oklahoma is five (5) years.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

In most instances, Oklahoma plaintiffs have a two-year limit from the date of the incident in which to file a lawsuit. Exceptions include defamation (libel or slander) at one year, five years for rent and debt collection or written contracts, and three years for judgments and oral contracts.