Oklahoma Mineral Owner Consent Agreement (to Underground Storage Lease and Agreement) is a legally binding document outlining the agreement between the mineral owner and the party seeking permission to use the underground storage facilities on the mineral owner's property. This agreement is specific to the state of Oklahoma and governs the terms and conditions of the lease and storage activities. The Oklahoma Mineral Owner Consent Agreement is necessary when the mineral owner grants permission to an entity for the storage of substances such as natural gas, oil, or other minerals beneath their property. This agreement ensures that both parties involved are in compliance with the laws and regulations governing underground storage operations in Oklahoma. The agreement includes essential details pertaining to the lease and underground storage activities. It typically outlines the responsibilities and obligations of both the mineral owner and the entity seeking consent. Important elements covered in the agreement may include: 1. Identification of Parties: The agreement specifies the names and contact information of the mineral owner and the company obtaining consent for underground storage. 2. Description of Property: The agreement provides a detailed description of the property where the underground storage is to take place, including boundary lines and relevant parcel information. 3. Terms and Conditions: This section outlines the specific terms and conditions of the lease, including the duration of the agreement, the rights and limitations of the storage entity, and any specific requirements imposed by the mineral owner. 4. Compensation: The agreement addresses the compensation to be paid by the storage entity to the mineral owner for the use of their property. This can include one-time payments, annual fees, or royalties based on the volume of stored substances. 5. Environmental and Safety Provisions: An important aspect of the Oklahoma Mineral Owner Consent Agreement is the inclusion of provisions safeguarding the environment and the health and safety of individuals and property on and around the site. This may involve compliance with regulations related to underground storage operations, monitoring requirements, and liability insurance provisions. Different types of Oklahoma Mineral Owner Consent Agreements can exist based on the specific nature of the stored substances and the particular leasing and storage requirements. While the outline and key provisions may remain consistent, variations in terms and conditions may arise for agreements related to storing different minerals or different storage capacities. However, it is essential to consult legal counsel and review the specific terms of each agreement to ensure compliance and protection of the rights and interests of both parties involved.

Oklahoma Mineral Owner Consent Agreement (to Underground Storage Lease and Agreement)

Description

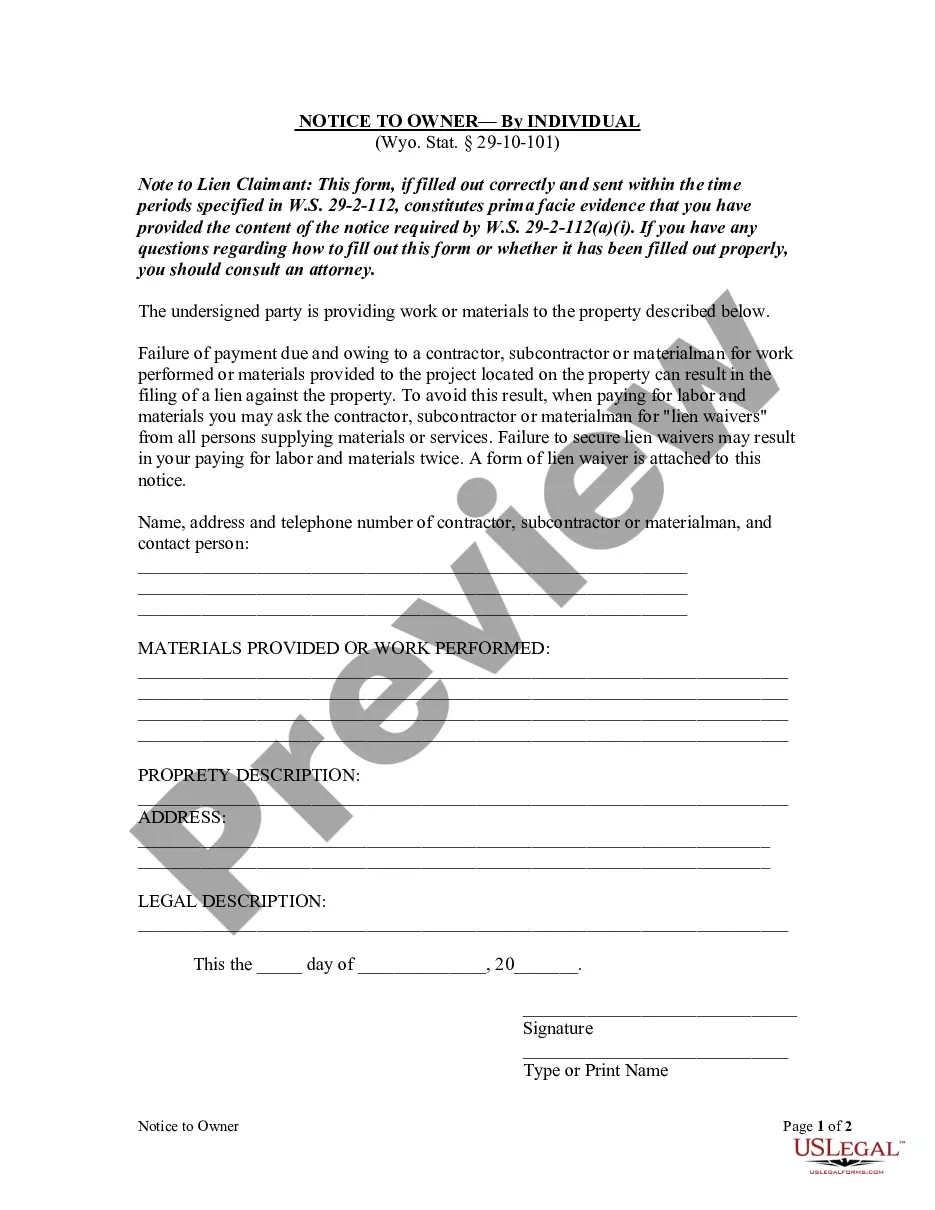

How to fill out Oklahoma Mineral Owner Consent Agreement (to Underground Storage Lease And Agreement)?

You are able to commit several hours on the Internet searching for the lawful papers template that meets the federal and state requirements you need. US Legal Forms offers a huge number of lawful types which are examined by professionals. It is simple to download or print the Oklahoma Mineral Owner Consent Agreement (to Underground Storage Lease and Agreement) from my services.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Download key. Next, it is possible to complete, modify, print, or signal the Oklahoma Mineral Owner Consent Agreement (to Underground Storage Lease and Agreement). Each and every lawful papers template you buy is yours forever. To have an additional copy of the purchased kind, proceed to the My Forms tab and click on the related key.

If you use the US Legal Forms internet site the first time, stick to the straightforward instructions listed below:

- Initial, make sure that you have selected the correct papers template to the region/city that you pick. Look at the kind description to ensure you have chosen the right kind. If readily available, make use of the Review key to check through the papers template also.

- If you want to get an additional edition of your kind, make use of the Search area to find the template that suits you and requirements.

- After you have discovered the template you would like, click on Buy now to carry on.

- Select the rates plan you would like, type your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You can utilize your charge card or PayPal accounts to fund the lawful kind.

- Select the structure of your papers and download it to the gadget.

- Make alterations to the papers if required. You are able to complete, modify and signal and print Oklahoma Mineral Owner Consent Agreement (to Underground Storage Lease and Agreement).

Download and print a huge number of papers templates using the US Legal Forms Internet site, that provides the greatest selection of lawful types. Use expert and status-distinct templates to deal with your company or individual needs.

Form popularity

FAQ

The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907. Mineral ownership information is not available online from any website.

If your well stops producing or the company decides to stop production on your land for any reason (market prices, oversupply, financial troubles, etc.), you will stop receiving royalties. Once the lease has expired on your mineral rights and you're no longer under contract, you will stop receiving royalties.

Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The price of mineral rights per acre ranges from under $500 to over $5,000.

The statutory minimum is 1/8th or 12.5%, but it may be as high as 1/4th, or 25%. Since the 1990s, Oklahoma royalties have typically been at least 18.75 percent, but 20 to 25 percent is not unheard of for Oklahoma mineral owners.