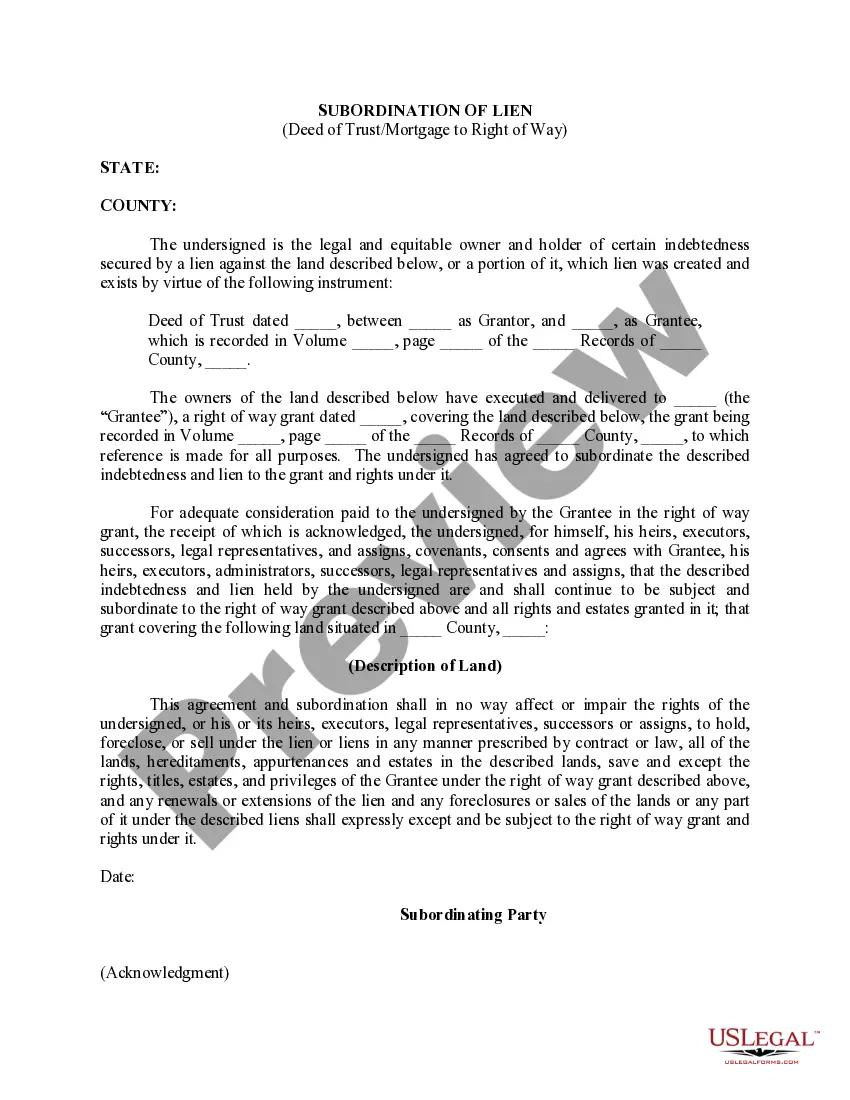

Oklahoma Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage)?

Are you presently in a place where you require documents for either organization or individual reasons virtually every time? There are a variety of legal file themes available online, but discovering ones you can rely on isn`t easy. US Legal Forms delivers a large number of develop themes, much like the Oklahoma Subordination of Lien (Deed of Trust/Mortgage), which can be written in order to meet federal and state specifications.

When you are presently informed about US Legal Forms website and get an account, just log in. Following that, it is possible to down load the Oklahoma Subordination of Lien (Deed of Trust/Mortgage) design.

If you do not have an accounts and need to start using US Legal Forms, adopt these measures:

- Obtain the develop you will need and make sure it is for that right area/state.

- Make use of the Review key to review the form.

- See the information to ensure that you have selected the right develop.

- In case the develop isn`t what you are trying to find, take advantage of the Lookup area to obtain the develop that meets your needs and specifications.

- If you get the right develop, click on Buy now.

- Choose the pricing program you would like, complete the desired information and facts to produce your money, and purchase the order utilizing your PayPal or credit card.

- Select a practical document formatting and down load your backup.

Locate all the file themes you might have bought in the My Forms food list. You can obtain a extra backup of Oklahoma Subordination of Lien (Deed of Trust/Mortgage) anytime, if possible. Just go through the needed develop to down load or produce the file design.

Use US Legal Forms, the most substantial selection of legal forms, to save lots of time as well as prevent blunders. The services delivers professionally produced legal file themes that can be used for a range of reasons. Make an account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans. What Is Mortgage Subordination? | Quicken Loans quickenloans.com ? learn ? understanding-... quickenloans.com ? learn ? understanding-...

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future. Subordination Clause: What it is, How it Works - Investopedia Investopedia ? ... ? Loans Investopedia ? ... ? Loans

Subordination. This Security Instrument is and shall be automatically subordinate to a loan made to Borrower evidenced by a purchase money promissory note and secured by a first deed of trust (the ?First Deed of Trust?) recorded concurrently herewith on the Property. CalHFA Subordinate Deed of Trust ca.gov ? homeownership ? forms ? d... ca.gov ? homeownership ? forms ? d...

This Security Instrument secures to Lender (i) the. repayment of the Loan, and all renewals, extensions, and modifications of the Note, and (ii) the performance. of Borrower's covenants and agreements under this Security Instrument and the Note.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process. What To Know About A Subordinate Mortgage Rocket Mortgage ? learn ? mortgage-s... Rocket Mortgage ? learn ? mortgage-s...