Oklahoma Assignment of Production Payment Measured by Quantity of Production

Description

How to fill out Assignment Of Production Payment Measured By Quantity Of Production?

Are you within a position the place you will need paperwork for both company or personal reasons virtually every working day? There are tons of legitimate file themes accessible on the Internet, but locating ones you can rely is not straightforward. US Legal Forms provides a large number of type themes, just like the Oklahoma Assignment of Production Payment Measured by Quantity of Production, that happen to be created to satisfy federal and state demands.

When you are presently knowledgeable about US Legal Forms site and also have a free account, simply log in. Following that, you are able to down load the Oklahoma Assignment of Production Payment Measured by Quantity of Production design.

Unless you offer an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for your proper metropolis/area.

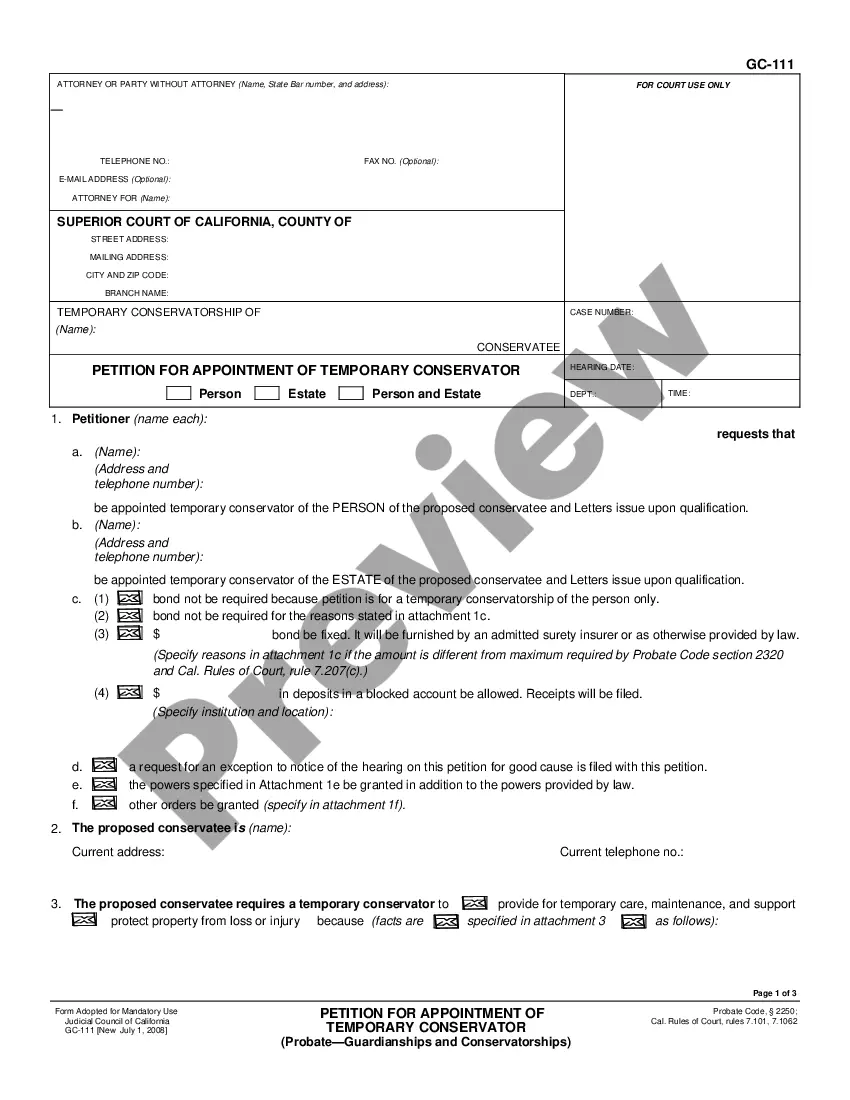

- Make use of the Review switch to examine the shape.

- Browse the description to ensure that you have selected the right type.

- If the type is not what you are trying to find, take advantage of the Lookup field to obtain the type that meets your requirements and demands.

- When you find the proper type, just click Buy now.

- Select the prices prepare you need, complete the desired information and facts to make your money, and pay money for the transaction making use of your PayPal or charge card.

- Select a convenient paper file format and down load your version.

Get each of the file themes you might have purchased in the My Forms food list. You may get a additional version of Oklahoma Assignment of Production Payment Measured by Quantity of Production at any time, if needed. Just go through the required type to down load or print the file design.

Use US Legal Forms, probably the most comprehensive collection of legitimate forms, to save efforts and prevent blunders. The assistance provides appropriately produced legitimate file themes which you can use for an array of reasons. Create a free account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

What Does 3 16 Royalty Mean? This simply means that the operator will pay oil royalties of 3/16 (18.75%) of revenue generated from the production on the land to the property owner.

A production payment is a type of agreement in the oil and gas industry where a person or company receives a share of the oil and gas produced from a property. This share is given without having to pay for the costs of production. The agreement ends once a certain amount of money has been paid to the person or company.

A Pugh Clause terminates the lease as to the portions of the land that are not included in a unit if the lessee does not conduct independent operations. Therefore, the Pugh Clause requires the lessee to develop areas of the lease that are not included in a unit.

Arithmetically, royalty (on sales) can be expressed as: Royalty = Payment-to-licensor/Product-sales-price. where: ROS = Royalty on Sales price.

Production payments: A contractual arrangement providing a mineral interest that gives the owner a right to receive a fraction of production, or of proceeds from the sale of production, until a specified quantity of minerals (or a definite sum of money, including interest) has been received.

26 U.S. Code § 636 - Income tax treatment of mineral production payments. A production payment carved out of mineral property shall be treated, for purposes of this subtitle, as if it were a mortgage loan on the property, and shall not qualify as an economic interest in the mineral property.

On average, a single acre's mineral rights can range from as low as $200 to over $10,000+ on the high end. As you might expect, the prices will vary depending on the mineral in question, the number of wells currently drilled, the current production rate, the existence of pipeline infrastructure, and much more.

A volumetric production payment (VPP) is a means of financing used predominantly in the oil and gas industry wherein the owner of an oil or gas property sells a percentage of the total production for an upfront cash payment. It allows the issuer to monetize his/her assets without diluting his control on them.

A quick definition of production payment: A production payment is a type of agreement in the oil and gas industry where a person or company receives a share of the oil and gas produced from a property. This share is given without having to pay for the costs of production.

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property.