This form is used by Claimant as notice of ownership and claim of title to additional interest of the mineral estate in lands, by having engaged in, conducted, and exercised the acts of ownership, which entitle Claimant to ownership of the additional mineral interest by limitations, under the laws of the state in which the Lands are located.

Oklahoma Notice of Claimed Ownership of Mineral Interest, by Limitations

Description

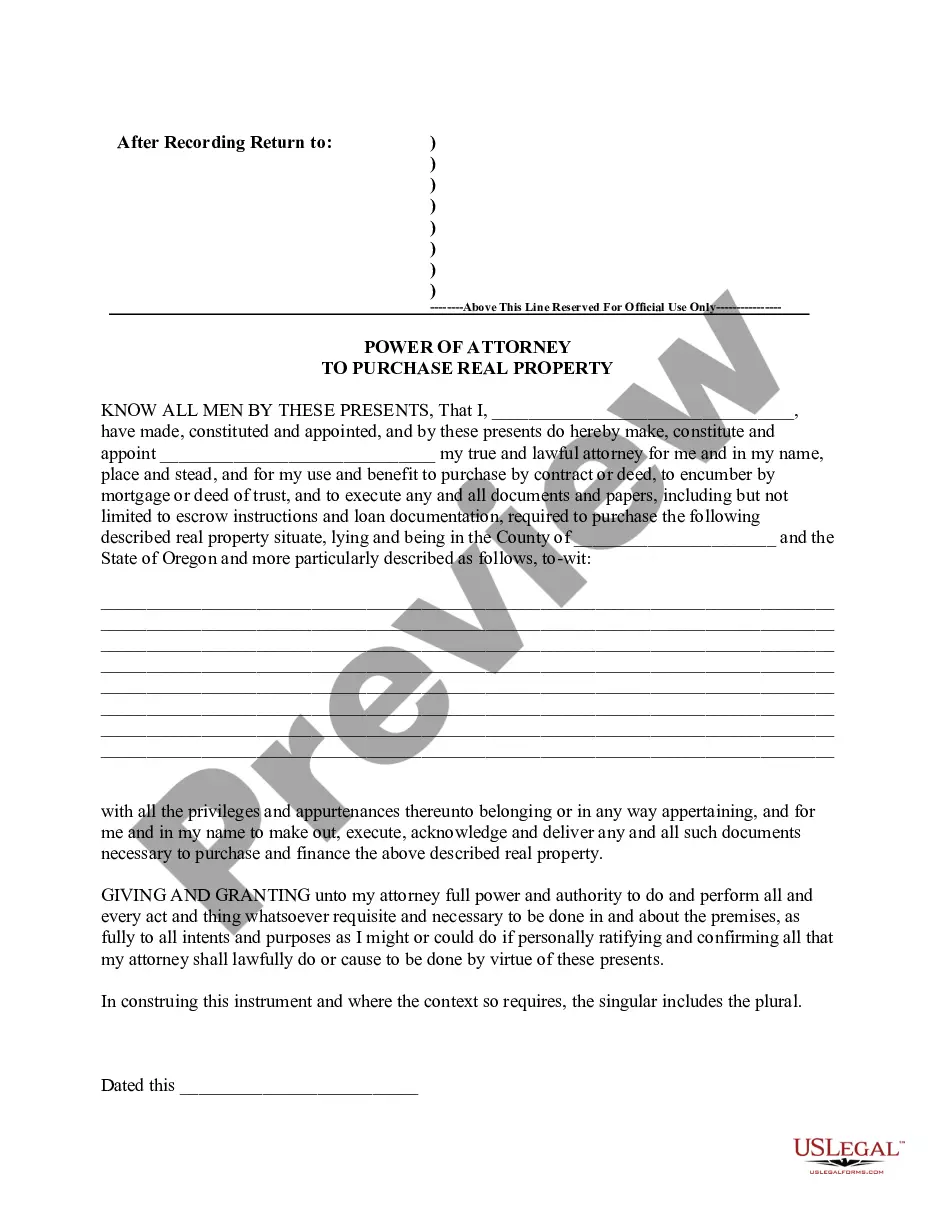

How to fill out Notice Of Claimed Ownership Of Mineral Interest, By Limitations?

US Legal Forms - one of several greatest libraries of lawful kinds in the United States - delivers an array of lawful file templates you can down load or printing. Utilizing the internet site, you may get a large number of kinds for enterprise and specific functions, categorized by groups, states, or search phrases.You will discover the latest types of kinds like the Oklahoma Notice of Claimed Ownership of Mineral Interest, by Limitations within minutes.

If you currently have a membership, log in and down load Oklahoma Notice of Claimed Ownership of Mineral Interest, by Limitations from your US Legal Forms local library. The Obtain option will show up on each and every form you look at. You have accessibility to all formerly acquired kinds within the My Forms tab of your own bank account.

If you wish to use US Legal Forms for the first time, listed below are basic guidelines to obtain started:

- Be sure to have picked out the best form for the area/state. Go through the Preview option to review the form`s information. Look at the form explanation to actually have selected the right form.

- If the form doesn`t suit your specifications, make use of the Research discipline at the top of the monitor to find the one who does.

- When you are content with the form, confirm your decision by clicking on the Buy now option. Then, opt for the rates program you want and supply your qualifications to register on an bank account.

- Approach the transaction. Make use of your charge card or PayPal bank account to complete the transaction.

- Choose the format and down load the form on your own gadget.

- Make changes. Fill out, modify and printing and sign the acquired Oklahoma Notice of Claimed Ownership of Mineral Interest, by Limitations.

Every format you included in your money lacks an expiry date which is the one you have for a long time. So, if you want to down load or printing an additional duplicate, just go to the My Forms portion and click on in the form you will need.

Gain access to the Oklahoma Notice of Claimed Ownership of Mineral Interest, by Limitations with US Legal Forms, the most extensive local library of lawful file templates. Use a large number of professional and state-distinct templates that fulfill your organization or specific needs and specifications.

Form popularity

FAQ

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.

Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

Mineral ownership constitutes the right to explore for and produce oil and gas. The mineral owner has the right to: Enter onto the property to explore for oil & gas. Authorize another entity to enter the property and explore production opportunities by granting an oil & gas lease.

Are Mineral Rights and Royalties Taxable? Any income you earn from the sale or lease of your land's mineral rights is taxable. Income, severance and ad valorem taxes are some of the taxes you might need to pay. Each type comes from a different entity.

Transfer By Will The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

Without any royalty income it comes down to what buyers think the future income might be. For non-producing properties, the Mineral Rights Value in Oklahoma could be anywhere from a few hundred dollars per acre to $5,000+/acre. It really depends on which county your property is located in.

Determining Mineral Ownership: The Corporation Commission does not determine the ownership of minerals. This should be a matter of record in the courthouse of the county where the land is located. Tax Commission records may also help. You may need an attorney to research this for you.