The Oklahoma Waiver of Call on Production is a legal document commonly used in the oil and gas industry. This waiver grants the producer the right to deduct expenses associated with the placement, operation, and maintenance of equipment necessary for the production of minerals from the revenues derived from the sale of such minerals. Keywords: Oklahoma, Waiver of Call on Production, oil and gas industry, legal document, expenses, revenues, minerals There are different types of Oklahoma Waiver of Call on Production that can be applied based on specific circumstances. 1. Standard Waiver of Call on Production: This is the most common type of waiver used in the oil and gas industry in Oklahoma. It allows the producer to deduct reasonable expenses directly related to the production and sale of minerals before distributing the revenue to the lessor. 2. Enhanced Waiver of Call on Production: In some cases, an enhanced waiver may be utilized. This type of waiver may include additional provisions that allow for more extensive expense deductions, such as repairs, improvements, and upgrades to the production equipment. 3. Specific Expense Waiver of Call on Production: This type of waiver may be employed when the producer seeks to deduct specific costs, such as equipment replacement, maintenance, transportation, or marketing expenses, from the mineral revenue. 4. Temporary Waiver of Call on Production: In certain situations, a temporary waiver may be granted for a specific period of time. This type of waiver allows the producer to deduct expenses during that timeframe and is often used when there is a need for significant repairs or upgrades to the production equipment. Overall, the Oklahoma Waiver of Call on Production provides a legal framework for the producer to deduct necessary and reasonable expenses from the revenue generated from the sale of minerals. It is crucial for both the producer and the lessor to understand the specific terms and conditions outlined in the waiver to ensure a fair and mutually beneficial agreement.

Oklahoma Waiver of Call on Production

Description

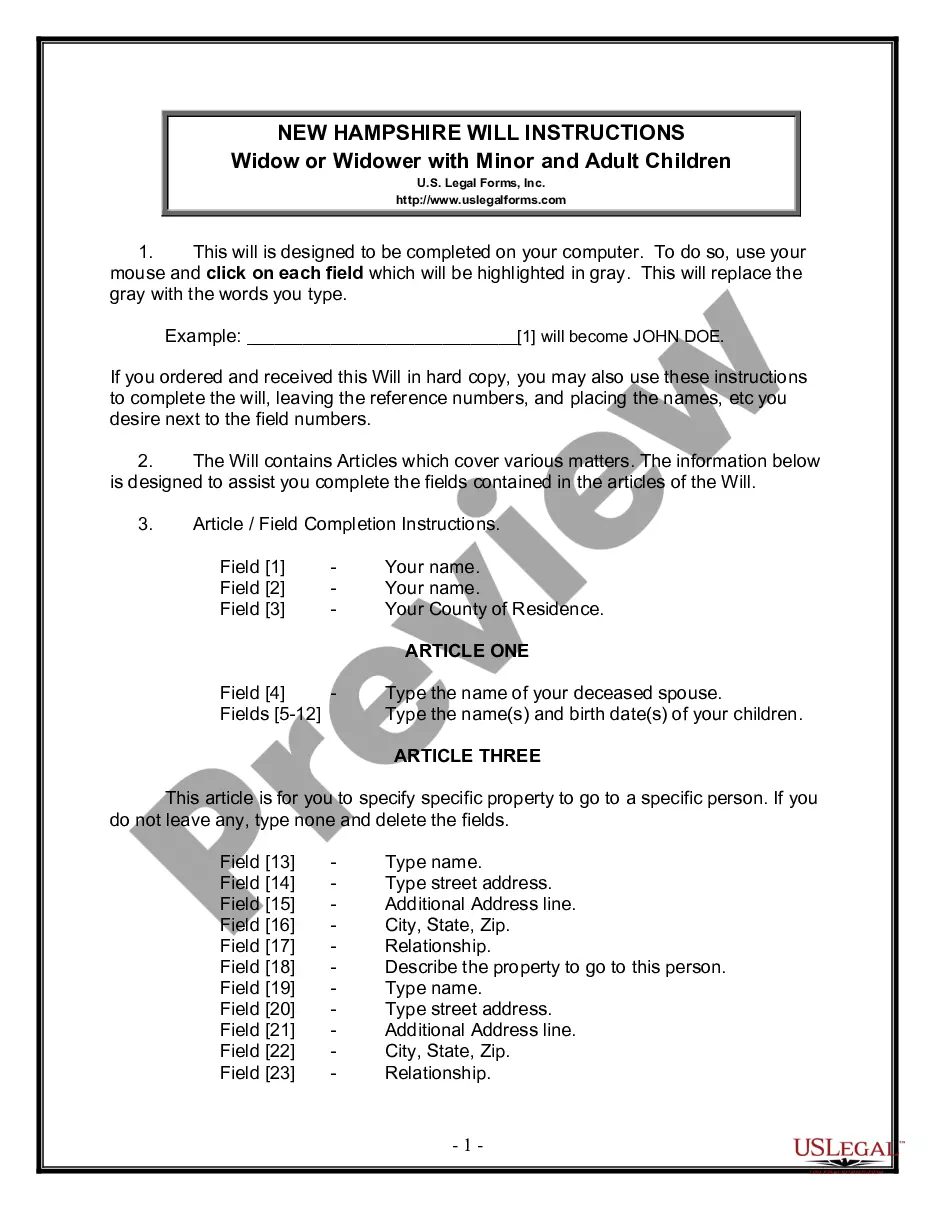

How to fill out Oklahoma Waiver Of Call On Production?

If you have to comprehensive, acquire, or produce legal file themes, use US Legal Forms, the greatest collection of legal varieties, that can be found online. Utilize the site`s easy and convenient look for to discover the papers you will need. Numerous themes for enterprise and specific uses are categorized by categories and states, or keywords and phrases. Use US Legal Forms to discover the Oklahoma Waiver of Call on Production within a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in for your accounts and then click the Acquire key to have the Oklahoma Waiver of Call on Production. You can even entry varieties you previously acquired inside the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for the right city/country.

- Step 2. Take advantage of the Review method to check out the form`s information. Don`t neglect to read through the outline.

- Step 3. If you are unhappy with the develop, make use of the Research field near the top of the display screen to get other variations in the legal develop design.

- Step 4. When you have found the shape you will need, click on the Buy now key. Choose the costs program you choose and include your credentials to sign up for an accounts.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to perform the financial transaction.

- Step 6. Pick the file format in the legal develop and acquire it on the device.

- Step 7. Complete, edit and produce or indication the Oklahoma Waiver of Call on Production.

Every single legal file design you buy is your own forever. You have acces to every develop you acquired in your acccount. Click the My Forms section and decide on a develop to produce or acquire yet again.

Contend and acquire, and produce the Oklahoma Waiver of Call on Production with US Legal Forms. There are thousands of specialist and condition-particular varieties you can utilize for the enterprise or specific demands.

Form popularity

FAQ

Title 18, Section 2049 The following activities of a foreign limited liability company, among others, do not constitute transacting business within the meaning of this act: 1. Maintaining, defending, or settling any proceeding; 2.

You may have heard of a ?239 sale,? which is a reference to Oklahoma Statutes, title 58, section 239; this section is often used to sell real estate owned by a decedent while the probate case is still ongoing and not yet complete.

PLEASE NOTE: Title 18, O.S., Section 552.4 pertains to persons and organizations that are exempt from the requirement to register with the Secretary of State. Be advised that this office CANNOT make the determination as to whether a person or organization conforms to one of the exemptions listed.

Oklahoma Statutes Title 18, Chapter 22 The Act also outlines the rights, duties, and liabilities of homeowners associations, as well as the powers and authority of the board of directors, members, and officers.

Corporations. §18-1140.2. Transfer of trade name. In the event a corporation or other business entity elects to transfer ownership of a trade name to another corporation or business entity, it shall file a report, in duplicate, with the Secretary of State, specifying such transfer.

Title 18, Section 2049 The following activities of a foreign limited liability company, among others, do not constitute transacting business within the meaning of this act: 1. Maintaining, defending, or settling any proceeding; 2.

The conversion of any entity into a domestic limited liability company shall not be deemed to affect any obligations or liabilities of the entity incurred before its conversion to a domestic limited liability company or the personal liability of any person incurred before the conversion. F.

A domestic limited liability company that has ceased to be in good standing or a foreign limited liability company that has ceased to be registered in this state may not maintain any action, suit or proceeding in any court of this state until the domestic limited liability company has been reinstated as a domestic ...