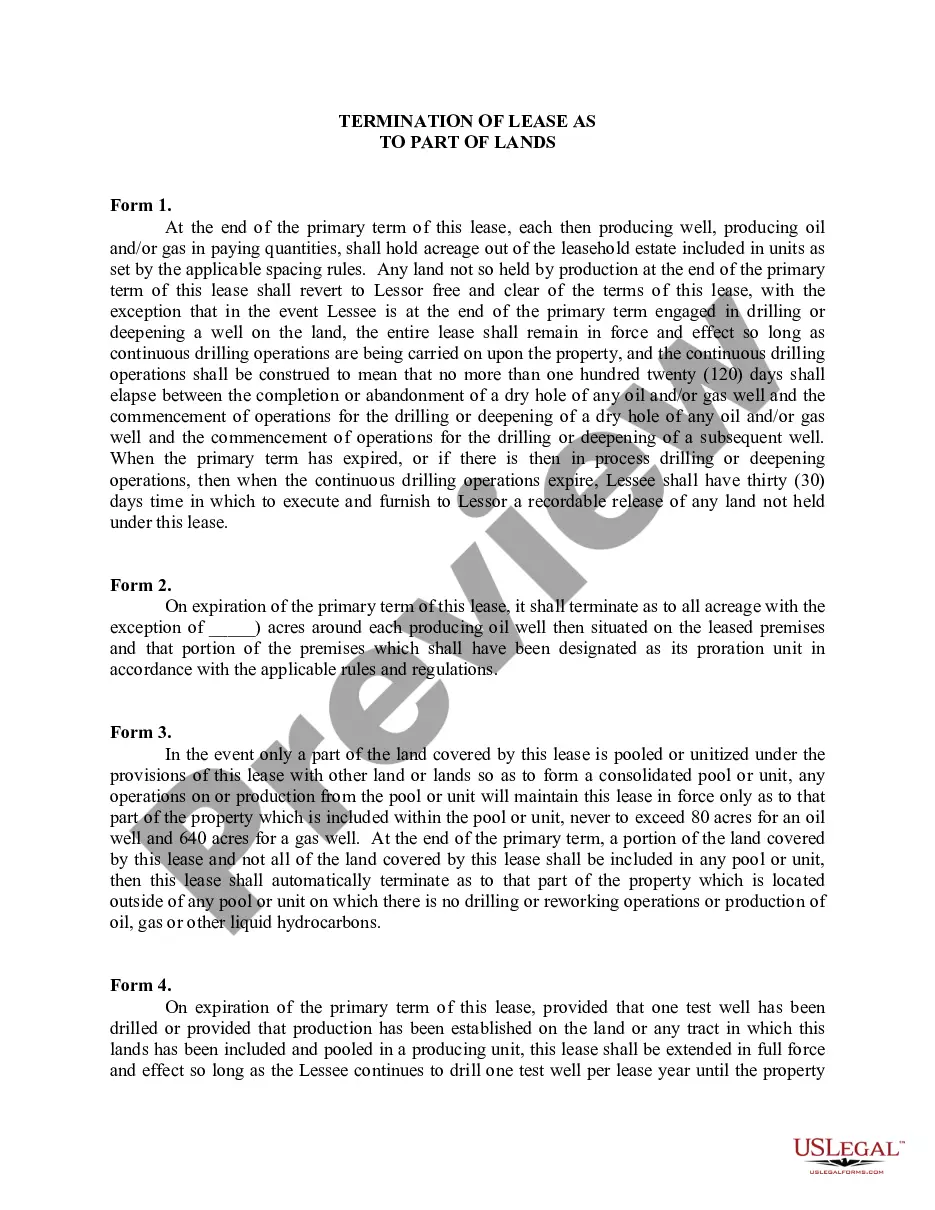

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

The Oklahoma Audit of Lessee's Books and Records is a process conducted by the state's authorities to examine and verify the financial records of a lessee. This audit aims to ensure compliance with state regulations and determine the accuracy and completeness of financial statements. The audit focuses on thoroughly reviewing the lessee's books and records, including financial statements, ledgers, receipts, invoices, and any other relevant documents. The audit process involves analyzing financial transactions, identifying any discrepancies, and investigating potential fraudulent activities. There are various types of Oklahoma Audit of Lessee's Books and Records, including: 1. Compliance Audit: This type of audit assesses the lessee's adherence to Oklahoma's laws, regulations, and agreements related to financial reporting. It ensures that the lessee follows proper accounting principles and accurately reports income, expenses, and other financial activities. 2. Internal Control Audit: This audit evaluates the lessee's internal control systems, procedures, and practices. It aims to determine the effectiveness of internal controls in safeguarding assets, preventing fraud, and ensuring accurate financial reporting. It may involve reviewing segregation of duties, access controls, and risk assessment processes. 3. Sales and Use Tax Audit: This specific type of audit focuses on verifying if the lessee complies with Oklahoma's sales and use tax laws. It examines sales records, tax returns, and supporting documentation to ensure accurate reporting and payment of sales and use taxes. 4. Royalty Audit: In cases where the lessee has leased property for the extraction of natural resources, a royalty audit may be performed. This audit ensures that the lessee accurately calculates and pays royalties to the property owner based on the terms outlined in the lease agreement. It involves verifying production volumes, sales records, royalty calculations, and payments. During the Oklahoma Audit of Lessee's Books and Records, auditors may request additional information, interview personnel, and conduct on-site inspections. The process aims to provide assurance to the state and stakeholders that the lessee's financial records are reliable, transparent, and compliant with relevant laws and regulations. In conclusion, the Oklahoma Audit of Lessee's Books and Records is a comprehensive examination of a lessee's financial records. It encompasses various types of audits, such as compliance audits, internal control audits, sales and use tax audits, and royalty audits. Through this audit, the state ensures the accuracy of financial reporting and compliance with applicable rules and regulations.