This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Oklahoma Surface Damage Payments

Description

How to fill out Surface Damage Payments?

If you want to complete, download, or produce legitimate record templates, use US Legal Forms, the greatest selection of legitimate kinds, that can be found online. Make use of the site`s basic and handy search to get the files you require. Numerous templates for company and person uses are categorized by groups and states, or keywords and phrases. Use US Legal Forms to get the Oklahoma Surface Damage Payments in a number of clicks.

If you are previously a US Legal Forms buyer, log in to the accounts and click on the Acquire key to find the Oklahoma Surface Damage Payments. You can even entry kinds you formerly acquired from the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the form to the right city/land.

- Step 2. Make use of the Preview option to examine the form`s articles. Do not neglect to read through the outline.

- Step 3. If you are not satisfied with all the type, use the Look for discipline near the top of the screen to locate other models from the legitimate type design.

- Step 4. Once you have identified the form you require, select the Get now key. Opt for the rates program you like and add your references to register to have an accounts.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Pick the structure from the legitimate type and download it on the device.

- Step 7. Total, change and produce or signal the Oklahoma Surface Damage Payments.

Each legitimate record design you buy is your own property forever. You may have acces to every type you acquired with your acccount. Click on the My Forms section and pick a type to produce or download again.

Compete and download, and produce the Oklahoma Surface Damage Payments with US Legal Forms. There are many specialist and status-distinct kinds you can utilize for your company or person needs.

Form popularity

FAQ

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

On average, a single acre's mineral rights can range from as low as $200 to over $10,000+ on the high end. As you might expect, the prices will vary depending on the mineral in question, the number of wells currently drilled, the current production rate, the existence of pipeline infrastructure, and much more.

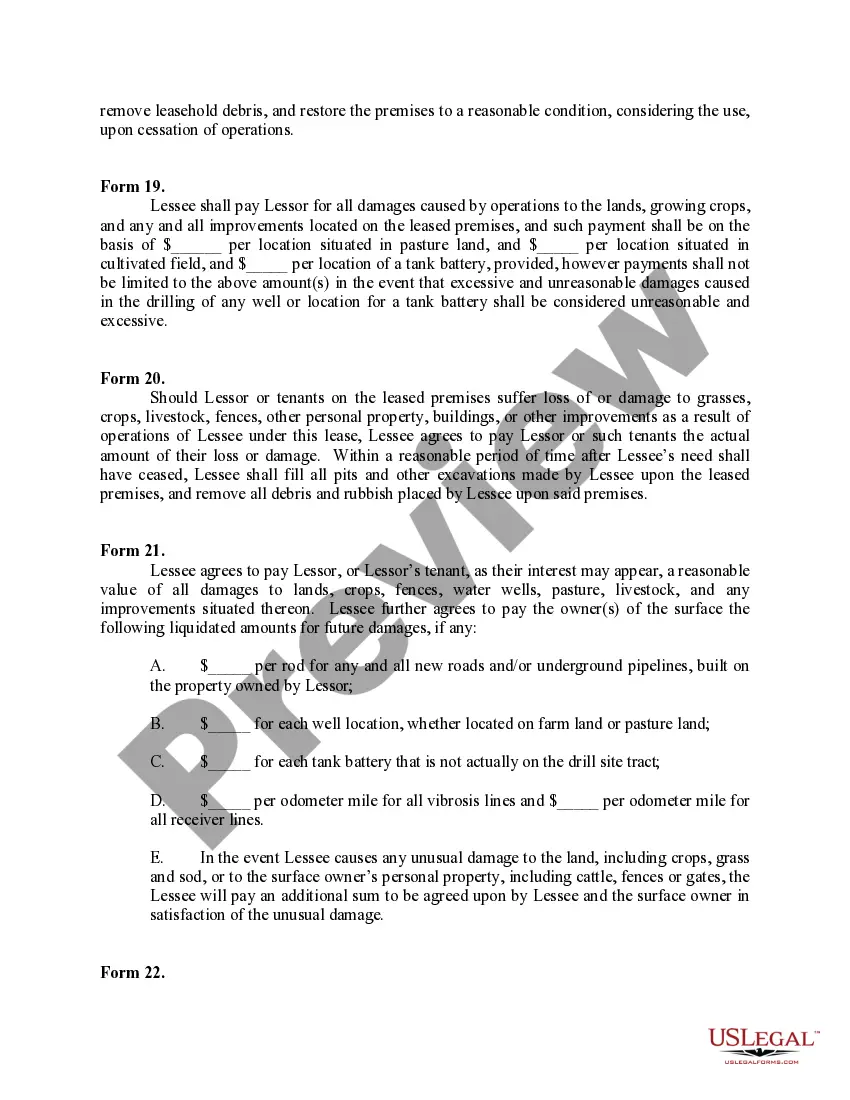

The Oklahoma Surface Damage Act guides interactions and negotiations between land surface owners and the oil companies and others who have the mineral rights. In the state, and elsewhere throughout the U.S., the owners of land parcels do not always also have ownership of what may lay below the surface.

A Pugh Clause terminates the lease as to the portions of the land that are not included in a unit if the lessee does not conduct independent operations. Therefore, the Pugh Clause requires the lessee to develop areas of the lease that are not included in a unit.

The value of mineral rights is based on what a buyer is willing to pay today for your property. Without any royalty income it comes down to what buyers think the future income might be.

In Oklahoma, there are two major categories of land rights: surface rights and mineral rights. Surface rights are rights attached to the surface of the land. With surface rights, you have access to and the ability to build or otherwise use the surface of the land. Mineral rights are sub-surface rights.

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.