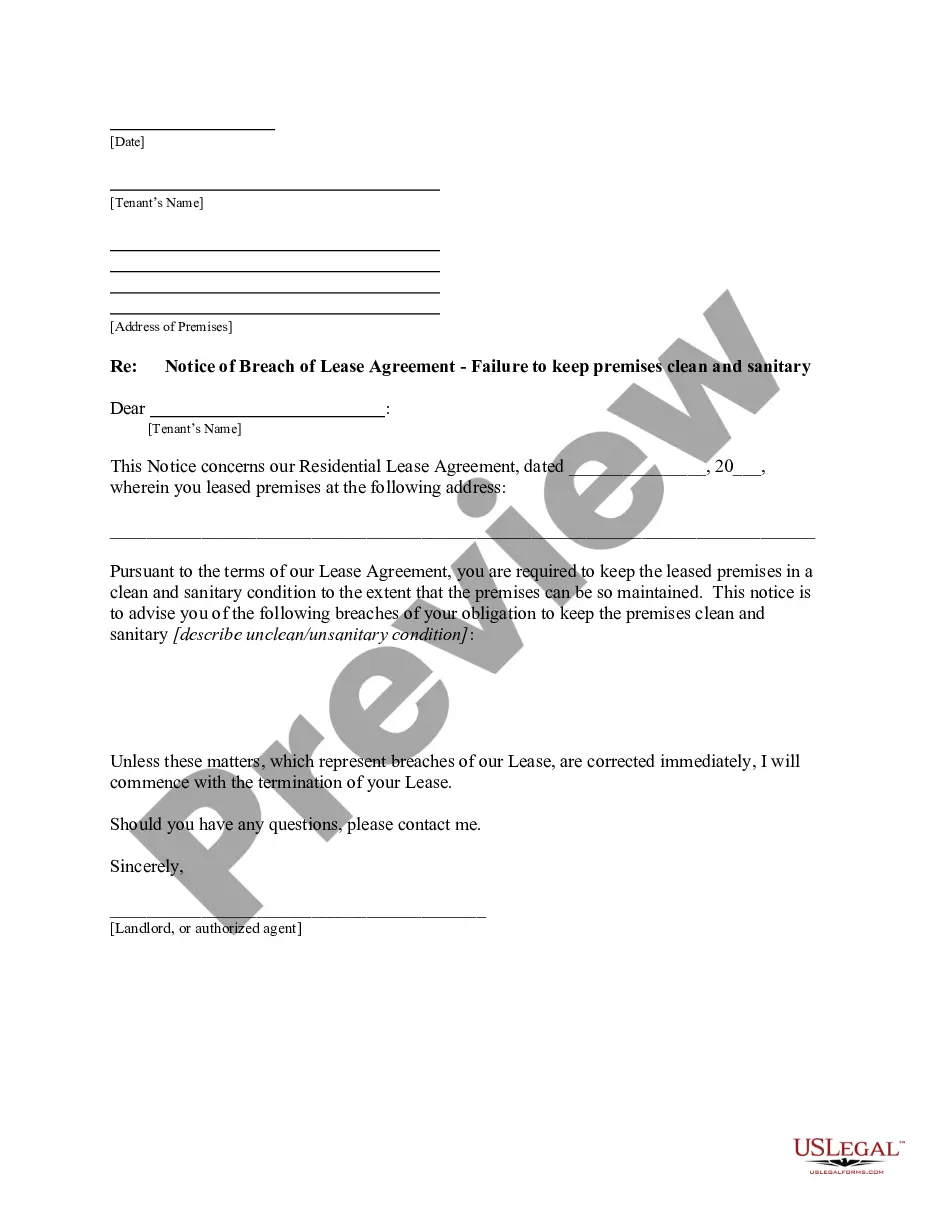

This office lease guaranty states that the guarantor unconditionally guarantees to the landlord the full and timely performance and observance of all of the terms, covenants, and conditions of the lease.

Oklahoma Full Guaranty is a legal term referring to a type of guaranty agreement that provides a comprehensive and unconditional guarantee for a specific obligation or debt. It is primarily used in the context of financial transactions and is often implemented in loan agreements, leases, or other contractual arrangements. In Oklahoma, the Full Guaranty offers enhanced protection to the creditor by ensuring that the guarantor takes on full liability for the entire debt, including principal, interest, and any associated fees or costs. Unlike limited guaranty agreements, which may only cover a portion of the obligation, the Oklahoma Full Guaranty guarantees the full amount owed. This type of guaranty provides significant benefits to both parties involved in the transaction. For the creditor, it minimizes the risk of loss, as the guarantor becomes a secondary source of repayment if the primary debtor defaults on the obligation. This gives the creditor additional assurance and increases the chances of recovering the debt in the event of non-payment. On the other hand, the guarantor should carefully evaluate the terms and conditions of the Oklahoma Full Guaranty before signing, as it entails a higher level of responsibility and exposes them to potential financial risks. By accepting this type of guaranty, the guarantor agrees to become personally liable for the entire debt, often without any requirement to pursue the primary debtor before seeking payment from them. It is important to note that there may be different types or variations of the Oklahoma Full Guaranty, customized to suit specific circumstances or industries. Some possible variations may include: 1. Oklahoma Full Guaranty for Real Estate Loans: This type of Full Guaranty is commonly utilized in real estate transactions, where a person or entity guarantees the repayment of a loan secured by a property. It guarantees the full amount of the mortgage or loan in case of default. 2. Oklahoma Full Guaranty for Commercial Leases: In commercial lease agreements, landlords often require a Full Guaranty to ensure the performance and payment obligations of the tenant. This guarantees that the guarantor will be responsible for fulfilling all the terms of the lease if the tenant fails to do so. 3. Oklahoma Full Guaranty for Business Loans: When companies or entrepreneurs borrow money for their business operations, lenders may request a Full Guaranty from the owners or key stakeholders to secure the loan. This provides an extra layer of protection for the lender, ensuring full repayment if the business defaults. In summary, the Oklahoma Full Guaranty is an extensive guarantee agreement frequently used in various financial transactions. It provides robust protection for creditors by obligating the guarantor to assume complete liability for the entire debt. Different variations of this guaranty may exist, tailored to specific contexts like real estate loans, commercial leases, or business loans.