The Oklahoma Form of Parent Guaranty is a legal document that serves as a guarantee provided by a parent company to secure the obligations and liabilities of its subsidiary company. This guarantee ensures that the subsidiary fulfills its financial and contractual obligations, offering additional security to third parties who conduct business or enter into agreements with the subsidiary. The Oklahoma Form of Parent Guaranty includes various terms and conditions that determine the extent of the parent company's guarantee. It outlines the rights and obligations of both the parent company and the subsidiary, ensuring transparency and clarity in their relationship. This document is crucial for businesses operating in the state of Oklahoma, as it protects the interests of all parties involved. There might be different types of Oklahoma Form of Parent Guaranty, depending on the specific requirements of a given situation. Some of these variations could include: 1. Unconditional Guarantee: This type of guaranty is the most common and straightforward form. The parent company unconditionally guarantees the subsidiary's obligations and liabilities without any specific conditions or limitations. 2. Limited Guarantee: In certain cases, the parent company may choose to provide a limited guarantee that covers only specific obligations or liabilities. This type of guaranty restricts the scope of the parent's liability and is often subject to negotiated terms. 3. Continuing Guarantee: A continuing guarantee ensures that the parent company's liability extends to all present and future obligations of the subsidiary. It offers ongoing protection even if the obligations or liabilities change over time. 4. Performance Guarantee: This form of guaranty is specifically related to the subsidiary's performance of contractual obligations. It guarantees that the subsidiary will fulfill its contractual duties as agreed upon, providing assurance to third parties involved in the contracts. 5. Financial Guarantee: A financial guaranty ensures that the parent company will guarantee the subsidiary's financial obligations, such as loans or other financial agreements. It offers lenders or creditors reassurance that the subsidiary's financial obligations will be fulfilled even if it faces financial difficulties. Overall, the Oklahoma Form of Parent Guaranty is a vital legal instrument that protects the interests of creditors, lenders, and other parties that engage with subsidiary companies. By signing this document, parent companies demonstrate their commitment to ensuring the subsidiary's obligations are met, providing financial security within the business relationship.

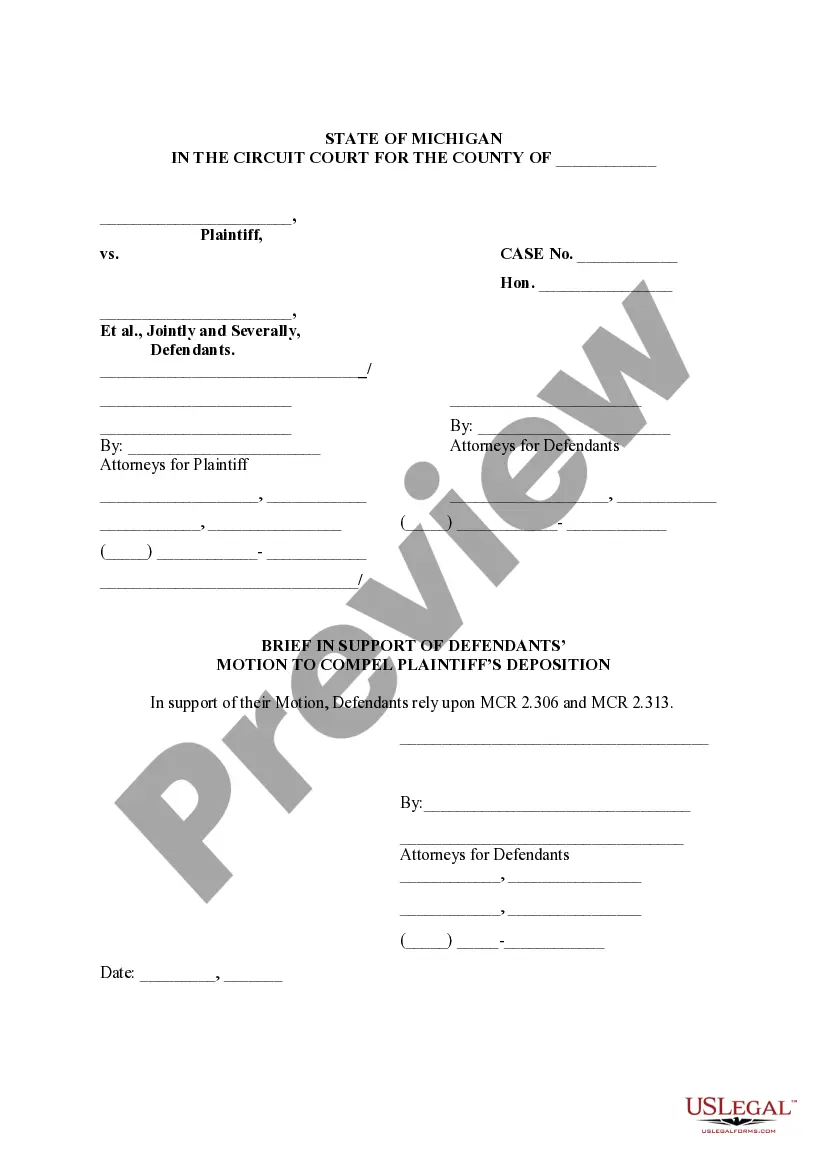

Oklahoma Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

US Legal Forms - one of many most significant libraries of lawful varieties in the United States - provides an array of lawful papers templates you may download or printing. Utilizing the site, you can find a large number of varieties for company and personal functions, sorted by classes, states, or keywords.You will find the latest variations of varieties much like the Oklahoma Form of Parent Guaranty within minutes.

If you currently have a subscription, log in and download Oklahoma Form of Parent Guaranty from your US Legal Forms collection. The Obtain option will appear on each develop you see. You have accessibility to all previously delivered electronically varieties in the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, listed below are straightforward directions to help you get started:

- Make sure you have picked the right develop to your metropolis/county. Click the Review option to examine the form`s articles. Read the develop explanation to actually have chosen the correct develop.

- In the event the develop does not suit your demands, make use of the Lookup field at the top of the monitor to find the the one that does.

- Should you be happy with the form, confirm your selection by simply clicking the Get now option. Then, choose the rates strategy you favor and give your references to register for an accounts.

- Method the transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the transaction.

- Choose the format and download the form on your own system.

- Make changes. Complete, edit and printing and sign the delivered electronically Oklahoma Form of Parent Guaranty.

Every format you added to your money does not have an expiration day and it is your own property for a long time. So, if you want to download or printing an additional copy, just check out the My Forms portion and click on around the develop you require.

Gain access to the Oklahoma Form of Parent Guaranty with US Legal Forms, by far the most extensive collection of lawful papers templates. Use a large number of professional and status-distinct templates that meet your organization or personal requires and demands.

Form popularity

FAQ

A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, other than an action by or in the right of the corporation, by reason of the ...

Indemnification is protection against loss or damage. When a contract is breached, the parties look to its indemnity clause to determine the compensation due to the aggrieved party by the nonperformer. The point is to restore the damaged party to where they would have been if not for the nonperformance.

Are indemnification clauses enforceable? Indemnification clauses are generally enforceable, but there are important qualifications. Some courts hold that broad form or ?no fault? indemnifications, which are blind to fault on the part of either party, violate public policy.

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, other than an action by or in the right of the corporation, by reason of the ...