Oklahoma Amended Equity Fund Partnership Agreement

Description

How to fill out Amended Equity Fund Partnership Agreement?

If you wish to full, acquire, or print legitimate record themes, use US Legal Forms, the largest selection of legitimate varieties, that can be found on the Internet. Make use of the site`s basic and convenient lookup to discover the documents you require. A variety of themes for enterprise and individual purposes are sorted by types and says, or key phrases. Use US Legal Forms to discover the Oklahoma Amended Equity Fund Partnership Agreement within a couple of clicks.

In case you are previously a US Legal Forms consumer, log in to the account and click on the Down load key to have the Oklahoma Amended Equity Fund Partnership Agreement. You can also entry varieties you formerly saved in the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for that appropriate town/nation.

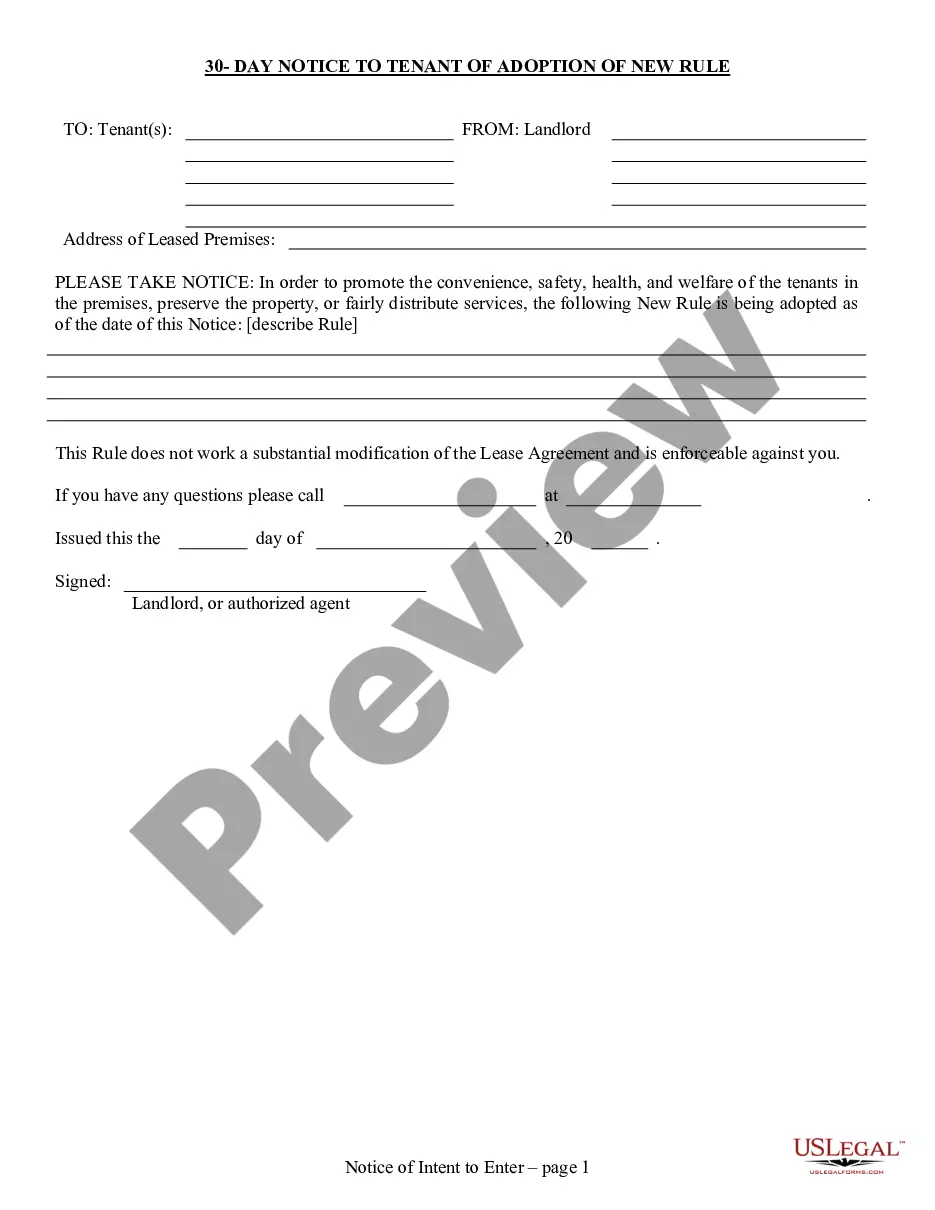

- Step 2. Utilize the Review solution to look through the form`s information. Don`t neglect to learn the explanation.

- Step 3. In case you are unsatisfied using the kind, make use of the Search industry near the top of the screen to discover other versions in the legitimate kind template.

- Step 4. When you have identified the shape you require, go through the Get now key. Opt for the pricing plan you choose and include your references to sign up on an account.

- Step 5. Procedure the transaction. You should use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Choose the file format in the legitimate kind and acquire it on your product.

- Step 7. Full, modify and print or indicator the Oklahoma Amended Equity Fund Partnership Agreement.

Each legitimate record template you get is the one you have forever. You have acces to each kind you saved with your acccount. Go through the My Forms area and decide on a kind to print or acquire yet again.

Remain competitive and acquire, and print the Oklahoma Amended Equity Fund Partnership Agreement with US Legal Forms. There are many expert and state-particular varieties you may use for your enterprise or individual demands.

Form popularity

FAQ

General partnerships are business entities that allow two or more partners to share revenue and responsibilities. GPs do not offer any protection to the partners from the GP's debts. Thus, the partners are jointly and severally liable for the entirety of the businesses liabilities.

Without this provision, the default rule is that each partner shares equally in the profits and losses of the partnership. These provisions often include any credit for capital contributions partners may receive in the event of dissolution.

A partnership for which no period or duration is fixed, under the Indian partnership act 1932 is known as partnership at will.

General Partnership (GP) A general partnership is a partnership when all partners share in the profits, managerial responsibilities, and liability for debts equally. If the partners plan to share profits or losses unequally, they should document this in a legal partnership agreement to avoid future disputes.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

Each partner has the authority to make legally binding decisions on behalf of the general partnership. Partners share all profits and losses equally by default unless otherwise agreed upon. Liabilities against partners in a general partnership remain ?joint and several?, regardless of agreement.

General Partnership Shares are assumed to be equal unless a written agreement states differently.

Limited partnerships. The main difference between these partnerships is that general partners have full operational control of a business and unlimited liability, in the business sense. Limited partners have less liability and do not take part in day-to-day business operations.