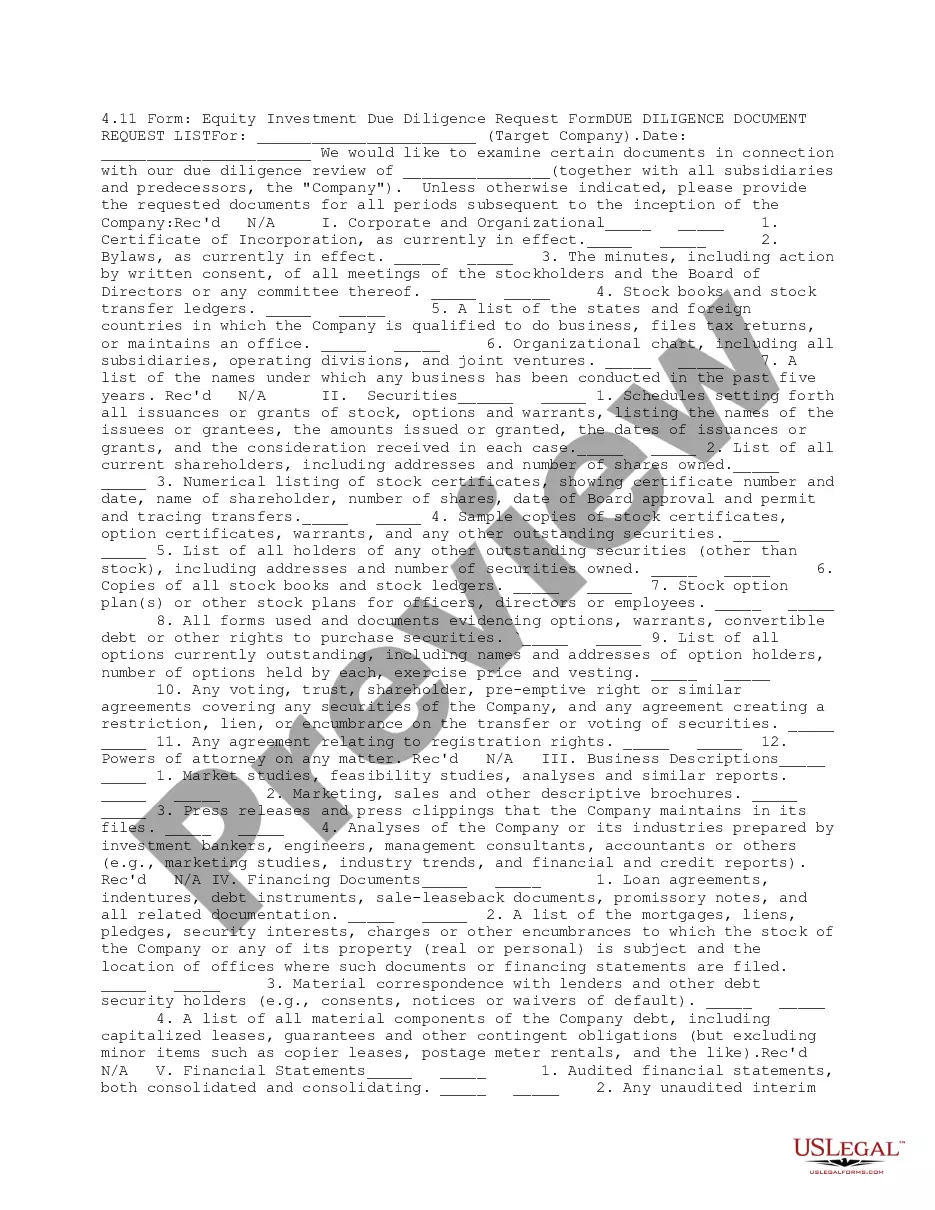

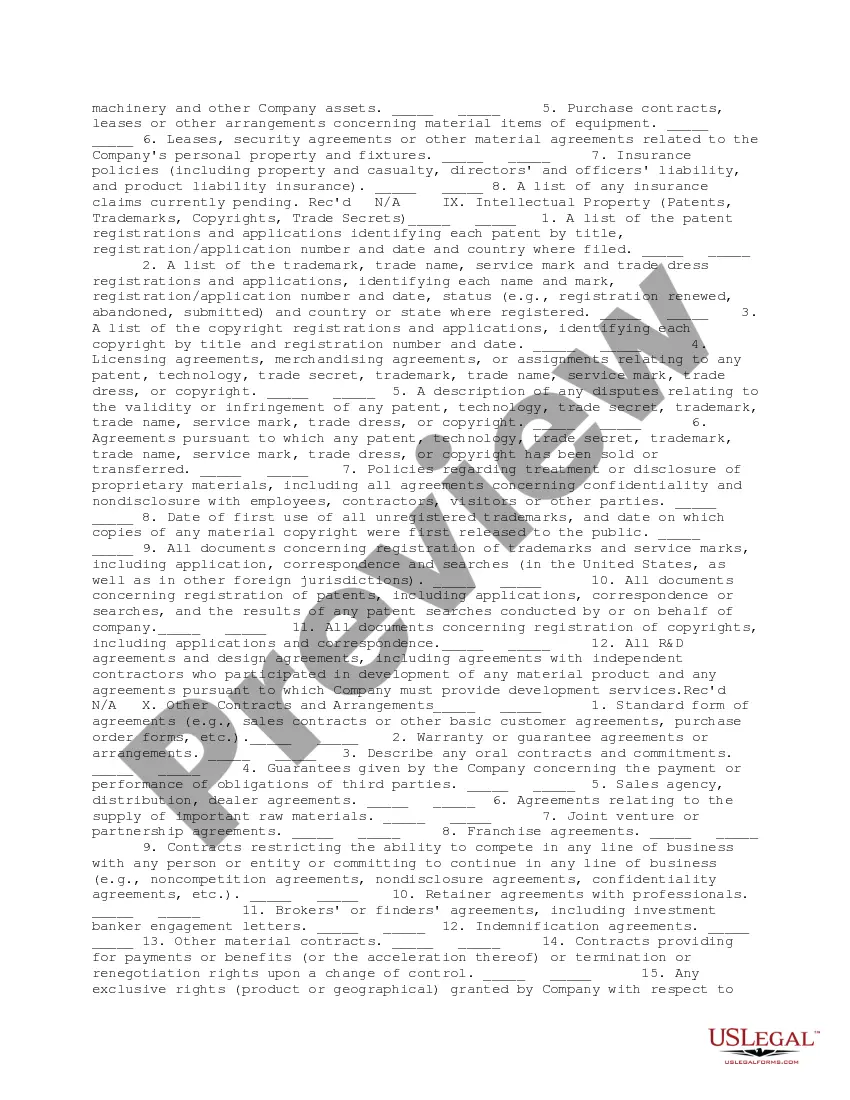

This is a due diligence document request list requesting certain documents to be used in the due diligence review. It asks for corporate and organizational documents, securities documents, business descriptions, financing documents, and other documents necessary for the due diligence review.

The Oklahoma Equity Investment Due Diligence Request Form is an essential document used in the process of equity investment in the state of Oklahoma. This form is crucial for investors who are interested in participating in equity investments and need to gather all the necessary information about the investment opportunity they are considering. This due diligence request form is designed to facilitate the investor in obtaining comprehensive information about the investment and to ensure that all relevant aspects are thoroughly assessed before making a decision. The Oklahoma Equity Investment Due Diligence Request Form gathers pertinent details about the investment opportunity, such as the name and contact information of the investment project or company. It also includes the purpose of the investment, the industry it operates in, and the anticipated return on investment. Additionally, the form requests information on the potential risks associated with the investment, such as market risks, competition, and regulatory factors. This comprehensive evaluation helps investors make informed decisions and consider various investment alternatives. Different types of Oklahoma Equity Investment Due Diligence Request Forms may exist, depending on the nature of the investment opportunity or the organization requesting the form. For instance, specific forms may be created for startup companies, real estate projects, or established businesses seeking additional equity funding. These tailored forms may include additional sections specific to the respective industry or investment category. Some keywords relevant to the Oklahoma Equity Investment Due Diligence Request Form could include: investment due diligence, equity investment, Oklahoma investment, investment opportunity, investor information, investment risk assessment, investment evaluation, investment form, investment request, Oklahoma business investment, investment project assessment. Overall, the Oklahoma Equity Investment Due Diligence Request Form serves as an invaluable tool for investors, enabling them to thoroughly evaluate potential investment opportunities in the state and make informed decisions regarding equity investments.