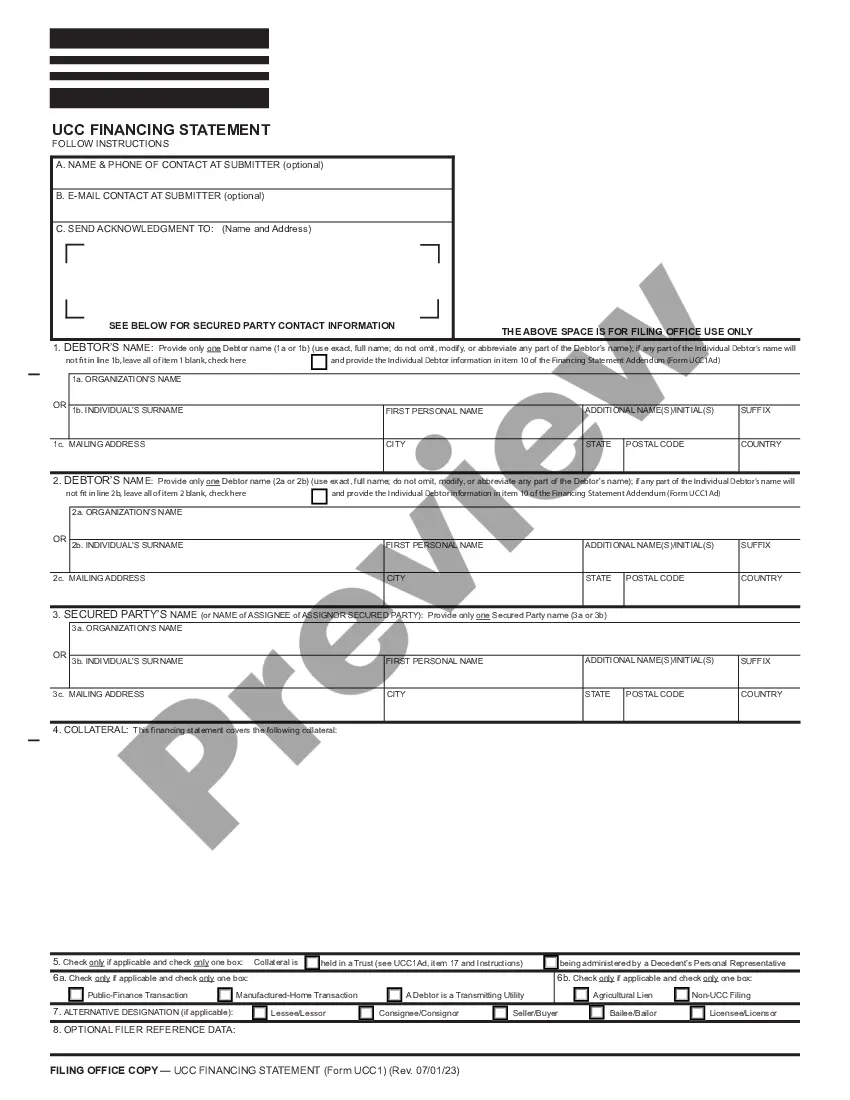

This is a financing agreement addendum to the software/services master agreement order form. It includes terms on interest and prepayments.

Oklahoma Financing refers to the various forms of financial assistance, loans, credit, and funding available within the state of Oklahoma. These financing options aim to support individuals, businesses, and organizations in meeting their financial needs and goals. Whether it's obtaining a mortgage for a home, securing startup capital for a new business, or acquiring funding for educational purposes, Oklahoma offers a range of financing solutions tailored to different requirements. Here are some types of Oklahoma Financing: 1. Mortgage Financing: Oklahoma provides numerous options for individuals looking to purchase or refinance a home. This includes traditional mortgages, FHA loans, VA loans, and various specialized programs, such as rural development loans. These financing options come with competitive interest rates and favorable terms. 2. Small Business Loans: Oklahoma understands the importance of supporting local entrepreneurship and offers various financing options specifically designed for small businesses. These may include small business loans, microloans, and business development programs providing entrepreneurs with the necessary capital to start, expand, or sustain their ventures. 3. Agricultural Financing: Given Oklahoma's significant agricultural industry, there are specific financing options available to support farmers, ranchers, and agricultural businesses. These include loans for purchasing equipment, livestock, or real estate, as well as loans for operational expenses and crop production. 4. Education Financing: Oklahoma recognizes the importance of education and provides several financing options to make it more accessible. These may include student loans, scholarships, grants, and tuition assistance programs for both undergraduate and graduate studies. 5. Renewable Energy Financing: Oklahoma embraces the growing demand for renewable energy sources and offers various financing programs to encourage the adoption of clean energy technologies. These programs may provide financial incentives, grants, tax credits, and loans for renewable energy installations like solar panels or wind turbines. 6. Infrastructure Financing: Oklahoma understands the importance of infrastructure development and offers financing options to facilitate the improvement and expansion of public infrastructure. This includes loans, bonds, and grants for transportation projects, water management systems, and public facilities. 7. Economic Development Financing: Oklahoma promotes economic growth and job creation by providing financing opportunities for businesses seeking to establish or expand their operations within the state. These may include loans, tax incentives, and grants aimed at attracting investments and fostering economic development. In summary, Oklahoma Financing encompasses a comprehensive range of financial options designed to meet the diverse needs of individuals, businesses, and industries. By leveraging these financing opportunities, individuals and organizations can obtain the necessary funds to achieve their goals and contribute to the state's economic development.