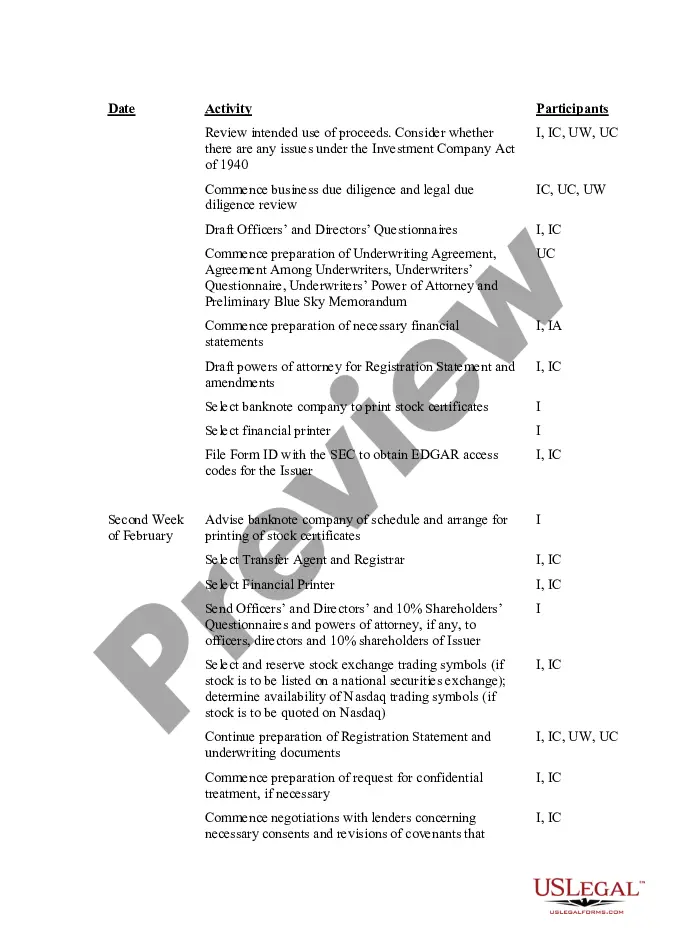

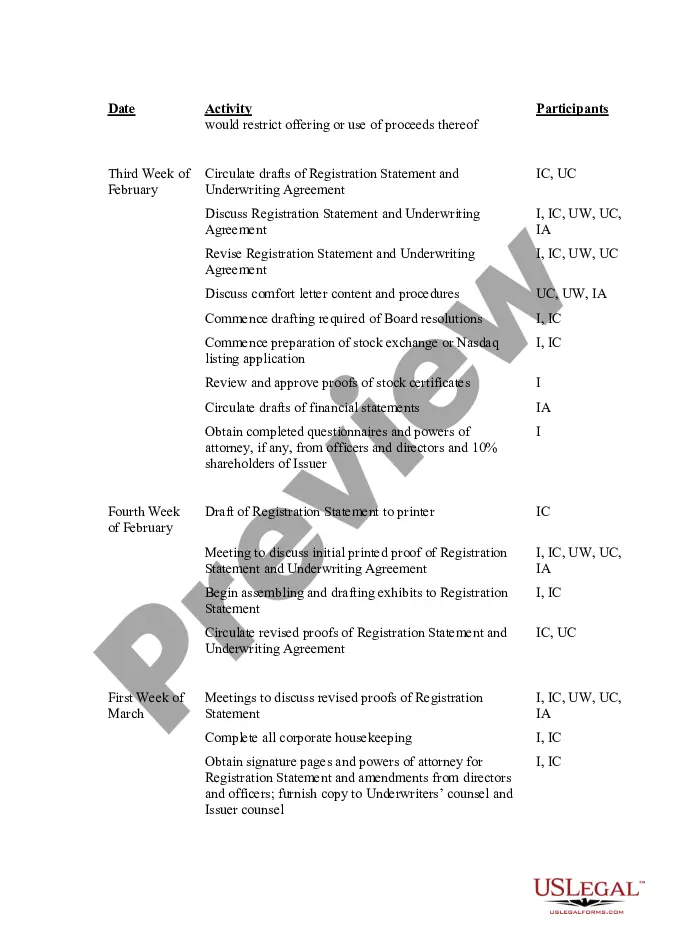

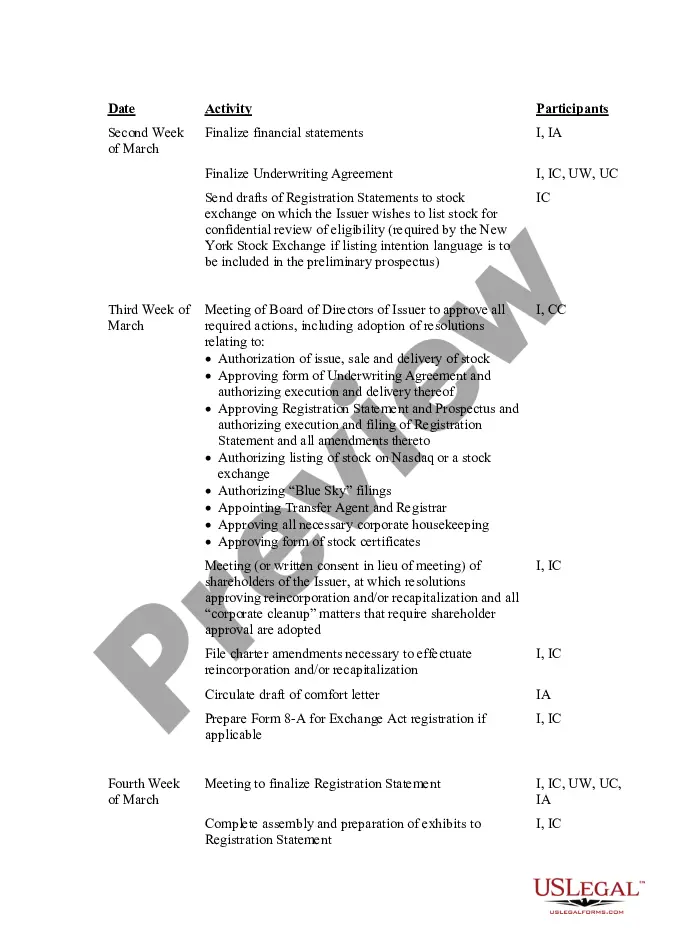

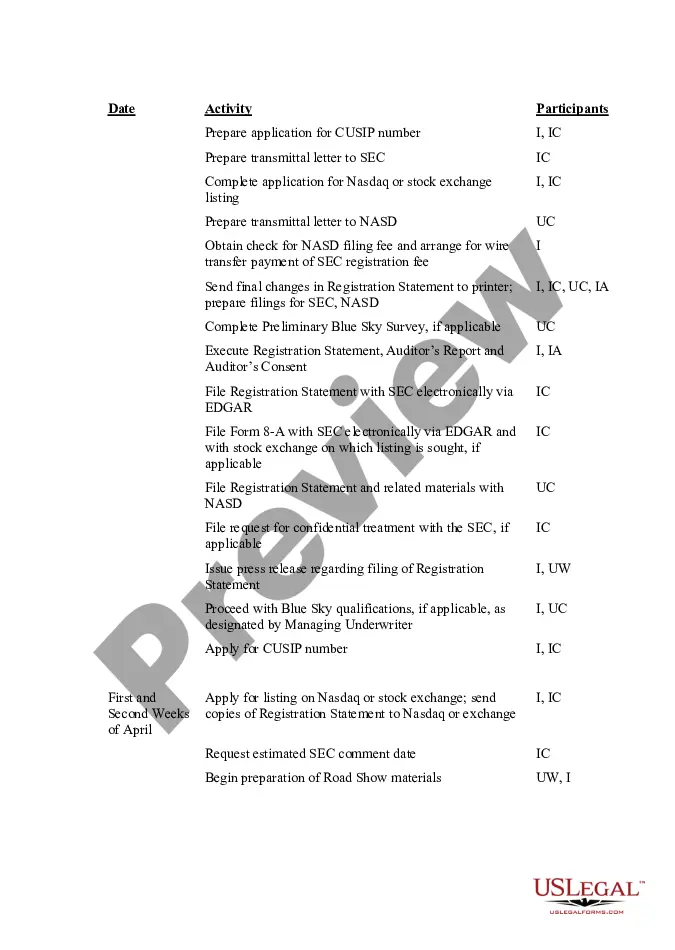

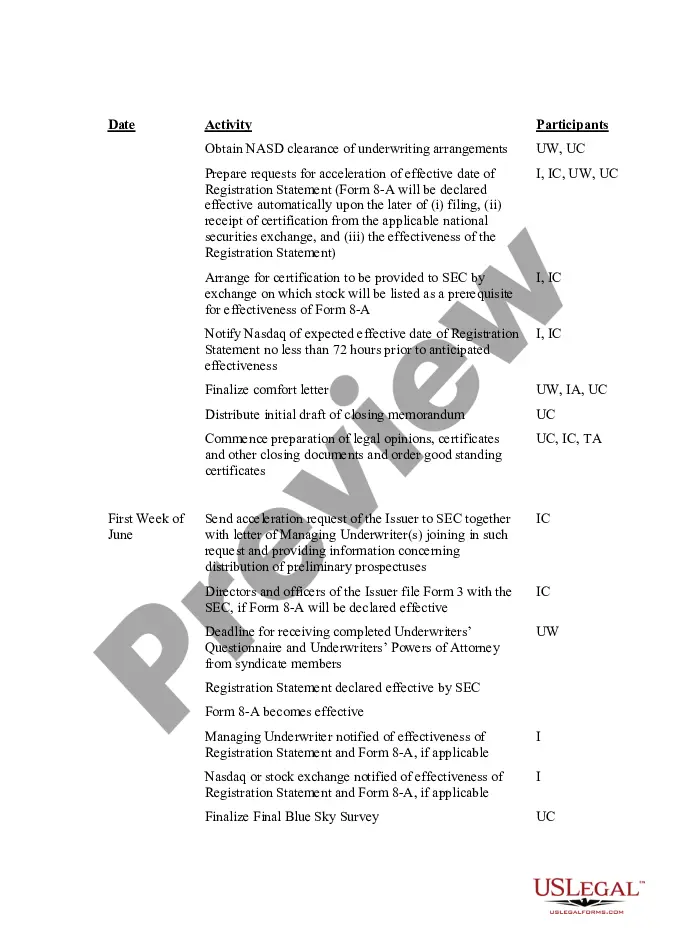

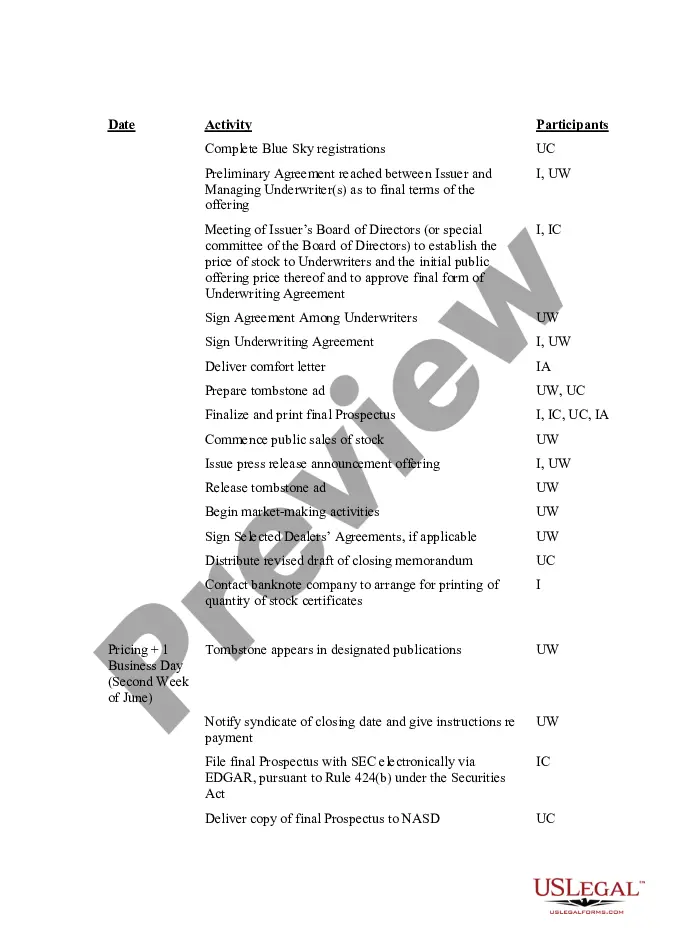

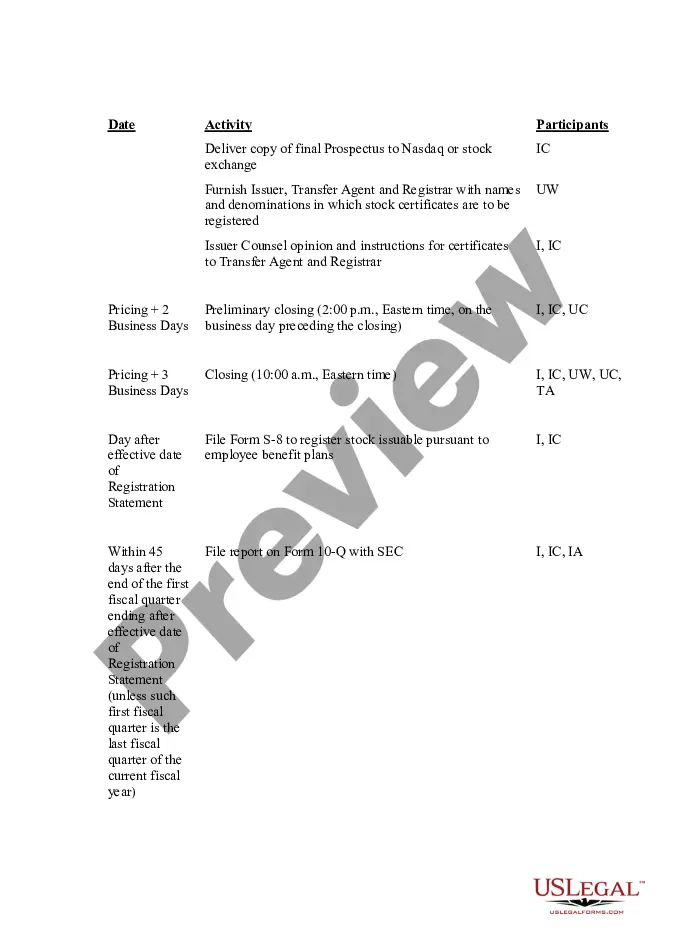

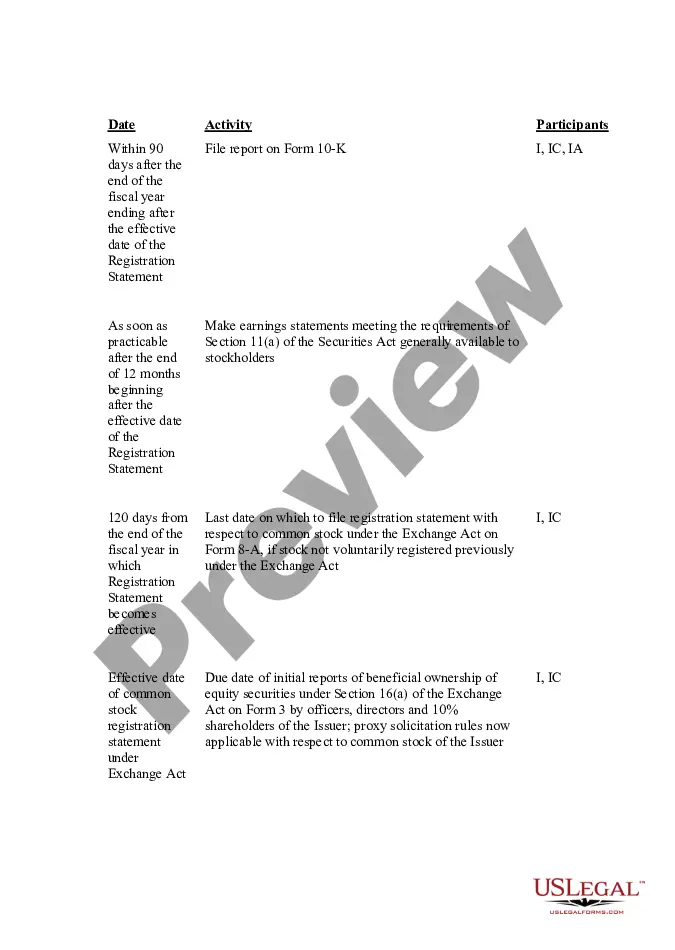

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

The Oklahoma IPO Time and Responsibility Schedule is a comprehensive outline that details the various tasks, deadlines, and responsibilities associated with an Initial Public Offering (IPO) in the state of Oklahoma. This schedule is designed to ensure a smooth and efficient IPO process, providing transparency and guidance to all parties involved. The Oklahoma IPO Time and Responsibility Schedule encompasses several key stages, beginning with the initial IPO preparation and culminating in the successful listing of a company's shares on the stock market. It outlines the necessary steps for both the company seeking to go public and the regulatory bodies involved in overseeing the IPO. Some primary tasks mentioned in the Oklahoma IPO Time and Responsibility Schedule include: 1. pre-IPO Planning: This phase involves preparing the company for an IPO, which includes conducting due diligence, forming an IPO team, selecting underwriters, and organizing financial statements. 2. Drafting the Prospectus: Companies are required to disclose detailed information about their operations, financials, risks, and future prospects in a prospectus. The schedule establishes a timeframe for preparing this legal document, ensuring all necessary information is included and reviewed by legal and financial experts. 3. SEC Registration and Filing: The Schedule specifies the deadline for filing the registration statement with the U.S. Securities and Exchange Commission (SEC). This step is crucial, as it provides public information about the company and affirms compliance with relevant regulations. 4. Pricing and Marketing: Determining the offer price and marketing strategy for the IPO is a critical step. The schedule details the timeline for finalizing the offer price, coordinating roadshows, and promoting the IPO to potential investors. 5. Underwriting and Due Diligence: The IPO underwriting process involves selecting investment banks, negotiating terms, conducting due diligence, and finalizing the underwriting agreement. This schedule outlines the necessary steps and sets deadlines to ensure a smooth underwriting process. 6. SEC Review and Approval: The SEC reviews the registration statement and may request additional information or amendments. The schedule allows time for this review process and subsequent revisions required by the SEC. It is important to note that there may be variations in the Oklahoma IPO Time and Responsibility Schedule based on factors such as the size of the company, industry, market conditions, and specific regulatory requirements. However, the core elements mentioned above generally apply to most IPOs in Oklahoma. By following the Oklahoma IPO Time and Responsibility Schedule, companies can effectively navigate the complex IPO process, adhere to legal and regulatory obligations, and increase the chances of a successful public offering.The Oklahoma IPO Time and Responsibility Schedule is a comprehensive outline that details the various tasks, deadlines, and responsibilities associated with an Initial Public Offering (IPO) in the state of Oklahoma. This schedule is designed to ensure a smooth and efficient IPO process, providing transparency and guidance to all parties involved. The Oklahoma IPO Time and Responsibility Schedule encompasses several key stages, beginning with the initial IPO preparation and culminating in the successful listing of a company's shares on the stock market. It outlines the necessary steps for both the company seeking to go public and the regulatory bodies involved in overseeing the IPO. Some primary tasks mentioned in the Oklahoma IPO Time and Responsibility Schedule include: 1. pre-IPO Planning: This phase involves preparing the company for an IPO, which includes conducting due diligence, forming an IPO team, selecting underwriters, and organizing financial statements. 2. Drafting the Prospectus: Companies are required to disclose detailed information about their operations, financials, risks, and future prospects in a prospectus. The schedule establishes a timeframe for preparing this legal document, ensuring all necessary information is included and reviewed by legal and financial experts. 3. SEC Registration and Filing: The Schedule specifies the deadline for filing the registration statement with the U.S. Securities and Exchange Commission (SEC). This step is crucial, as it provides public information about the company and affirms compliance with relevant regulations. 4. Pricing and Marketing: Determining the offer price and marketing strategy for the IPO is a critical step. The schedule details the timeline for finalizing the offer price, coordinating roadshows, and promoting the IPO to potential investors. 5. Underwriting and Due Diligence: The IPO underwriting process involves selecting investment banks, negotiating terms, conducting due diligence, and finalizing the underwriting agreement. This schedule outlines the necessary steps and sets deadlines to ensure a smooth underwriting process. 6. SEC Review and Approval: The SEC reviews the registration statement and may request additional information or amendments. The schedule allows time for this review process and subsequent revisions required by the SEC. It is important to note that there may be variations in the Oklahoma IPO Time and Responsibility Schedule based on factors such as the size of the company, industry, market conditions, and specific regulatory requirements. However, the core elements mentioned above generally apply to most IPOs in Oklahoma. By following the Oklahoma IPO Time and Responsibility Schedule, companies can effectively navigate the complex IPO process, adhere to legal and regulatory obligations, and increase the chances of a successful public offering.