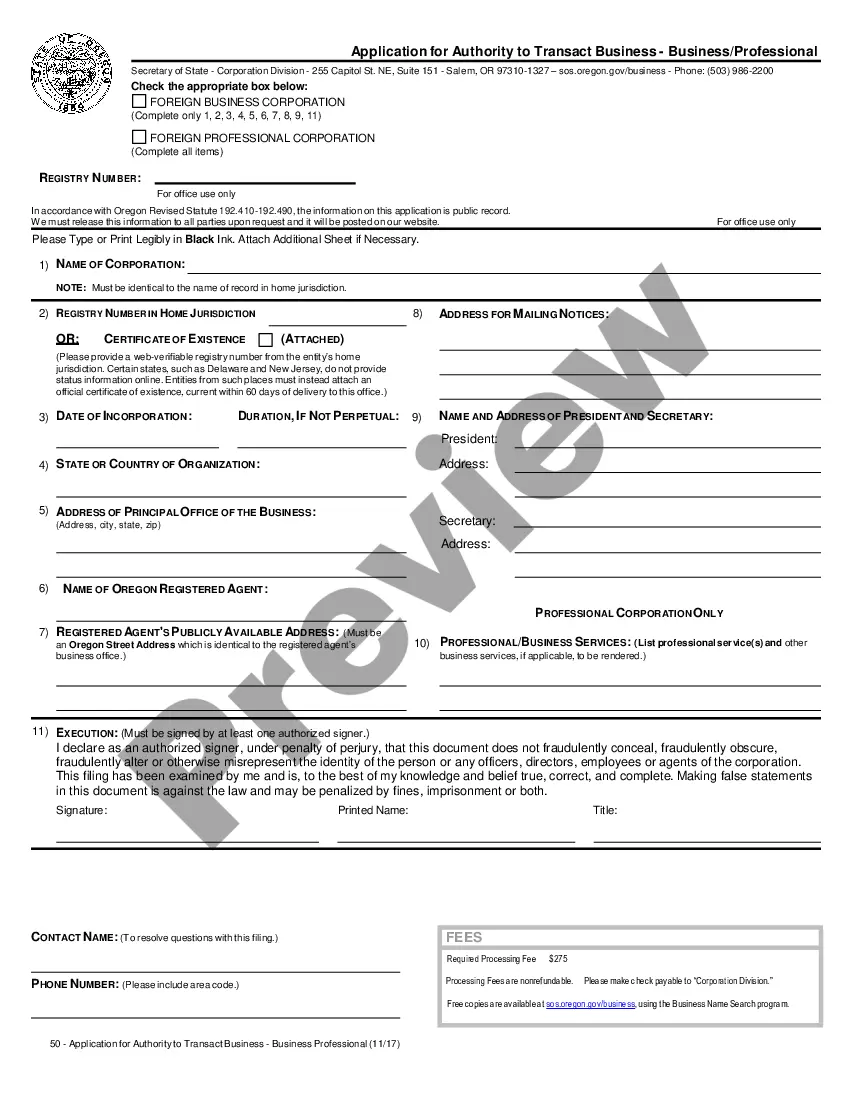

This form allows you to register a corporation for doing business in Oregon.

Oregon Registration of Foreign Corporation

Description

How to fill out Oregon Registration Of Foreign Corporation?

In terms of filling out Oregon Registration of Foreign Corporation, you almost certainly imagine a long process that involves choosing a perfect form among countless similar ones after which having to pay out a lawyer to fill it out to suit your needs. Generally, that’s a slow and expensive option. Use US Legal Forms and select the state-specific form in a matter of clicks.

In case you have a subscription, just log in and click on Download button to have the Oregon Registration of Foreign Corporation form.

If you don’t have an account yet but want one, follow the step-by-step guide below:

- Be sure the file you’re getting applies in your state (or the state it’s required in).

- Do so by reading the form’s description and by clicking on the Preview function (if available) to find out the form’s content.

- Click Buy Now.

- Find the appropriate plan for your budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure that after downloading, you don't need to worry about enhancing content material outside of your individual information or your business’s details. Be a part of US Legal Forms and receive your Oregon Registration of Foreign Corporation sample now.

Form popularity

FAQ

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

Yes, all businesses in Oregon must be registered, including those businesses operating as DBAs, assumed names, sole proprietorship, LLC, corporation, or limited partnership. The form can be filed on the Oregon Secretary of State website or mailed to the State's Corporation Division.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines. The process of setting up a company in a foreign state is called foreign qualification.

To form an Oregon LLC, the Articles of Organization needs to be filed with the Oregon Secretary of State, Corporation Division, along with the state filing fee of $100.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.