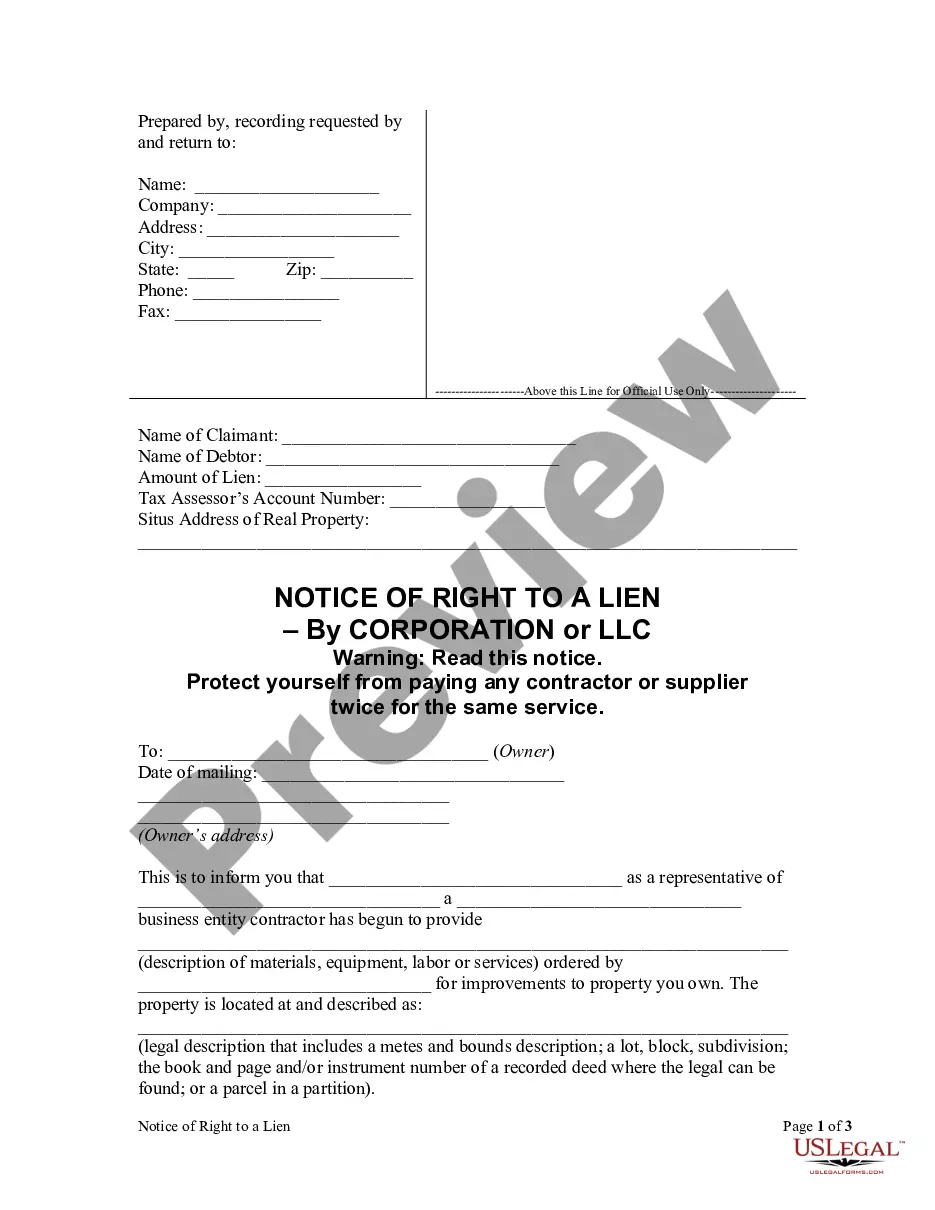

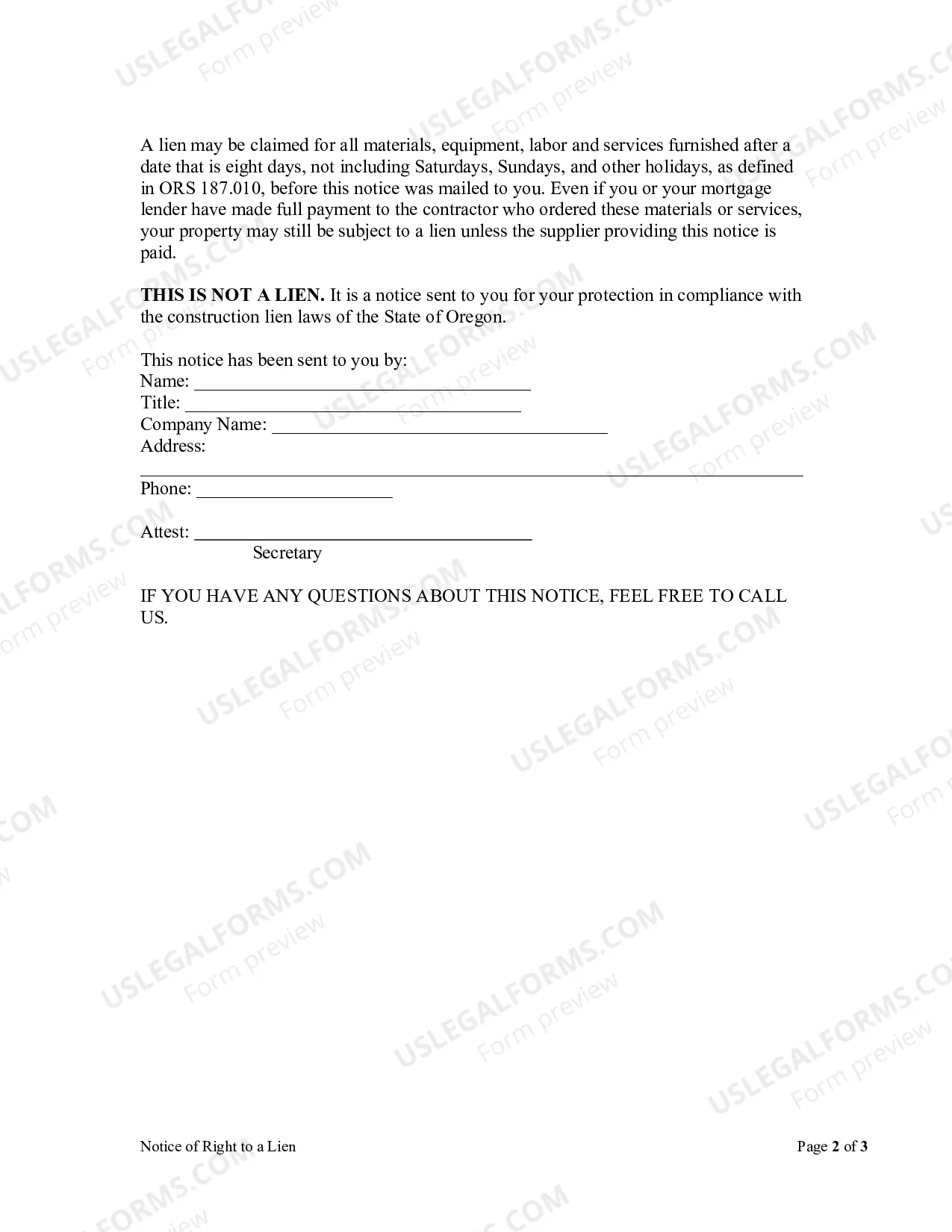

An entity furnishing any materials, equipment, services or labor described in ORS 87.010 (1) to (3), (5) and (6) for which a lien may be perfected under ORS 87.035 shall give a notice of right to a lien to the owner of the site. The notice of right to a lien may be given at any time during the progress of the improvement, but the notice only protects the right to perfect a lien for materials, equipment and labor or services provided after a date which is eight days, not including Saturdays, Sundays and other holidays as defined in ORS 187.010, before the notice is delivered or mailed.

Oregon Notice of Right to Lien Sect. 87.023 - Corporation

Description Notice Of Right To Lien Nevada

How to fill out Oregon Notice Of Right To Lien Sect. 87.023 - Corporation?

In terms of submitting Oregon Notice of Right to Lien Sect. 87.023 - Corporation or LLC, you probably imagine a long procedure that requires getting a perfect sample among numerous similar ones and then needing to pay legal counsel to fill it out for you. In general, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form in a matter of clicks.

For those who have a subscription, just log in and then click Download to have the Oregon Notice of Right to Lien Sect. 87.023 - Corporation or LLC template.

In the event you don’t have an account yet but need one, keep to the step-by-step guide below:

- Make sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do this by reading through the form’s description and by clicking the Preview option (if offered) to find out the form’s information.

- Click Buy Now.

- Select the suitable plan for your financial budget.

- Subscribe to an account and choose how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Professional legal professionals work on drawing up our templates to ensure after downloading, you don't need to worry about modifying content material outside of your personal details or your business’s information. Be a part of US Legal Forms and get your Oregon Notice of Right to Lien Sect. 87.023 - Corporation or LLC example now.

Notice Of Right To Lien Form popularity

FAQ

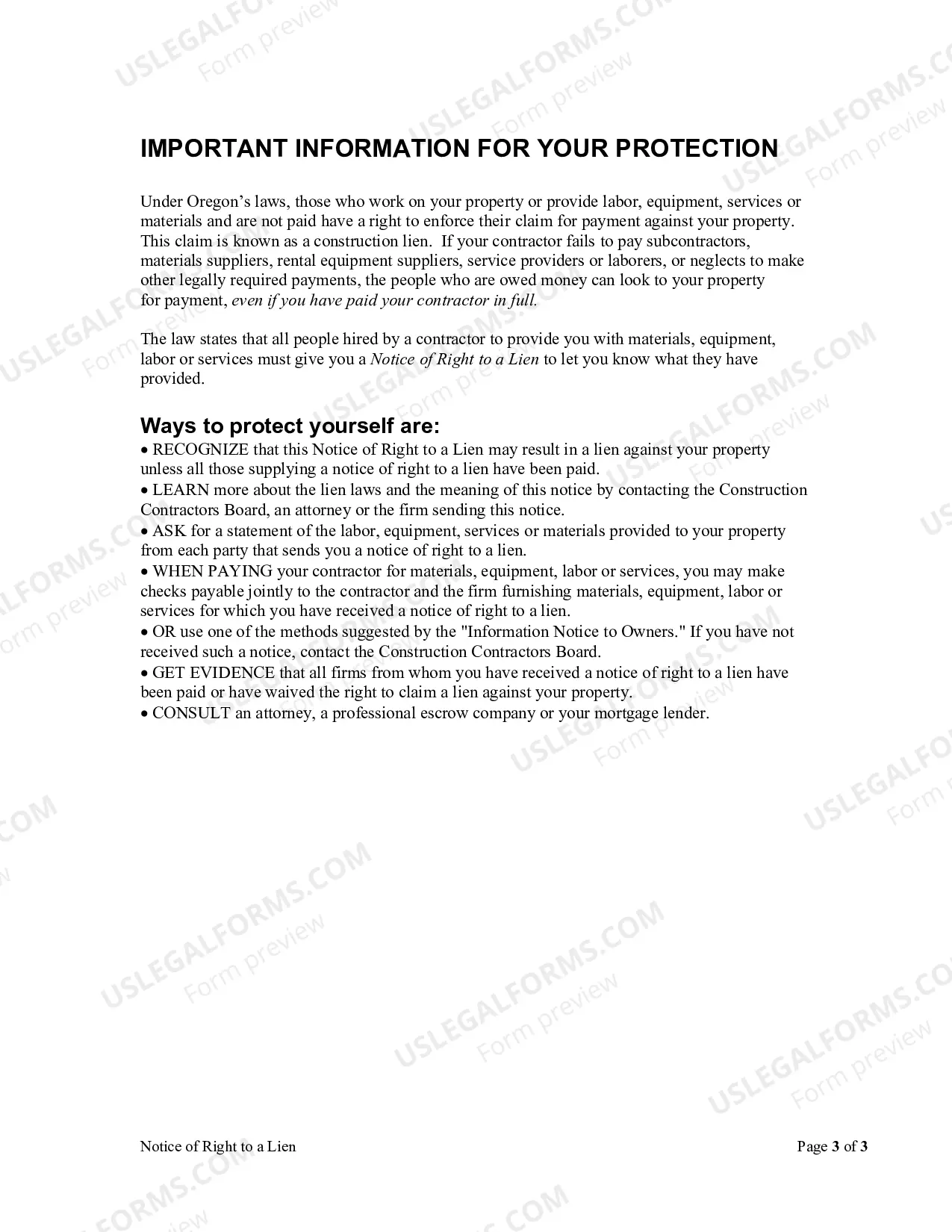

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.

If you want to place a lien on a commercial rental property and you are not the landlord, you may need to put a lien on the property by filing with the court of record in the jurisdiction where the property is actually located.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

In the state of Oregon, a lien must be filed within 75 days after the last day of performing labor or providing materials or within 75 days after the completion of construction.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

In Alberta, for example, your lien is valid for 180 days from the date the lien was placed. In Ontario, liens are only valid for 90 days from the date of last on site working.