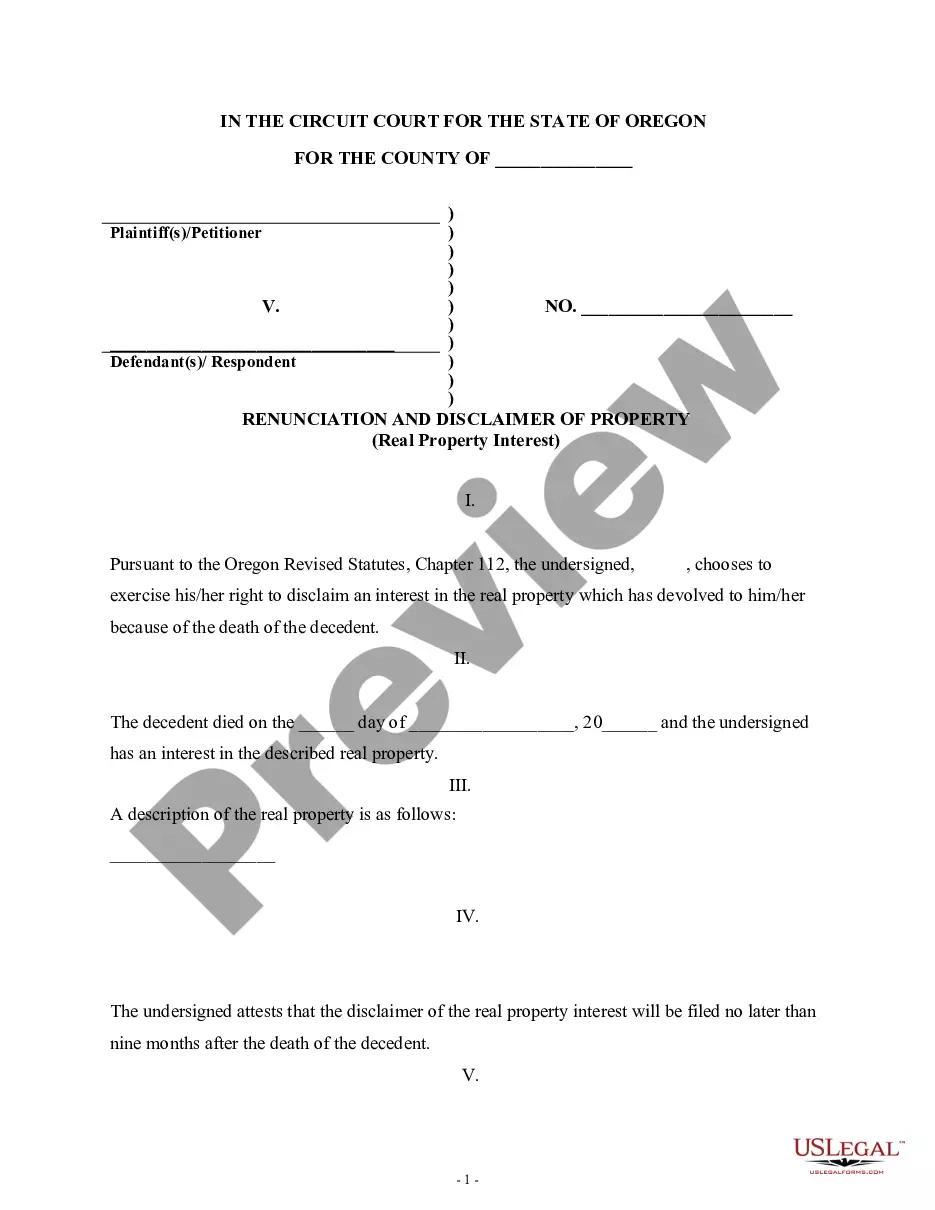

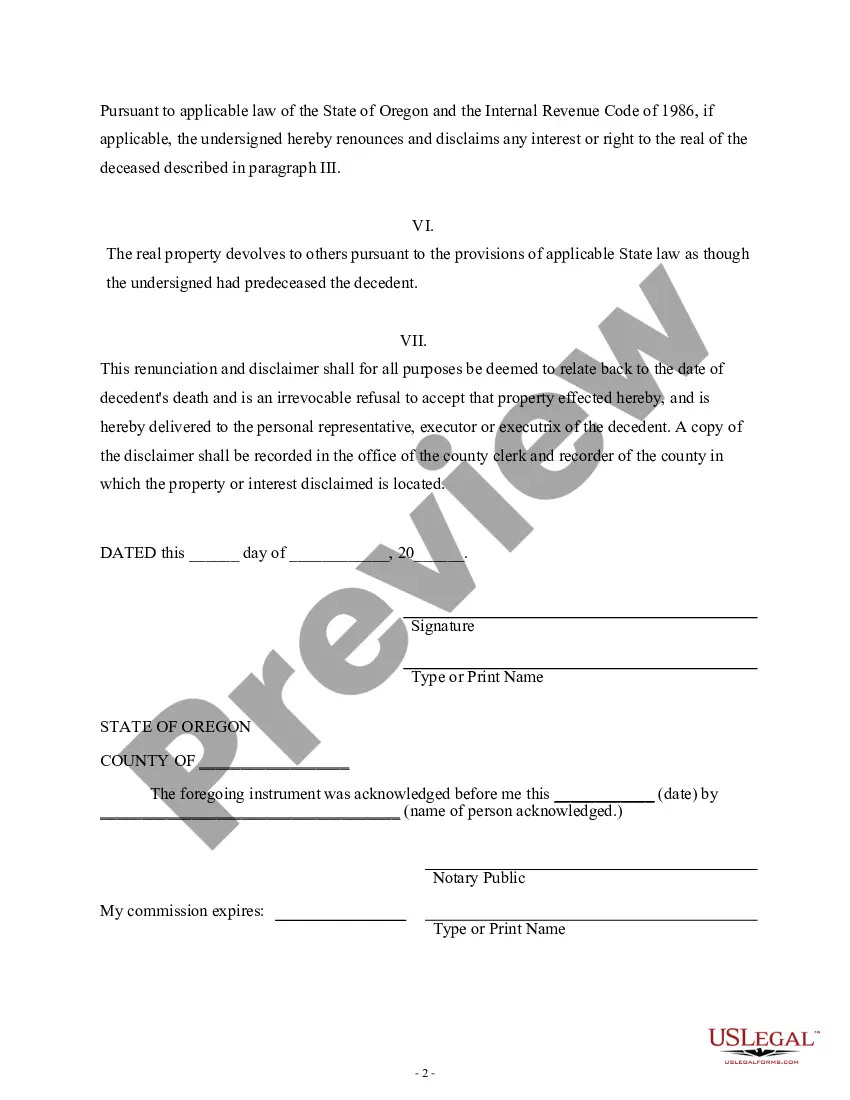

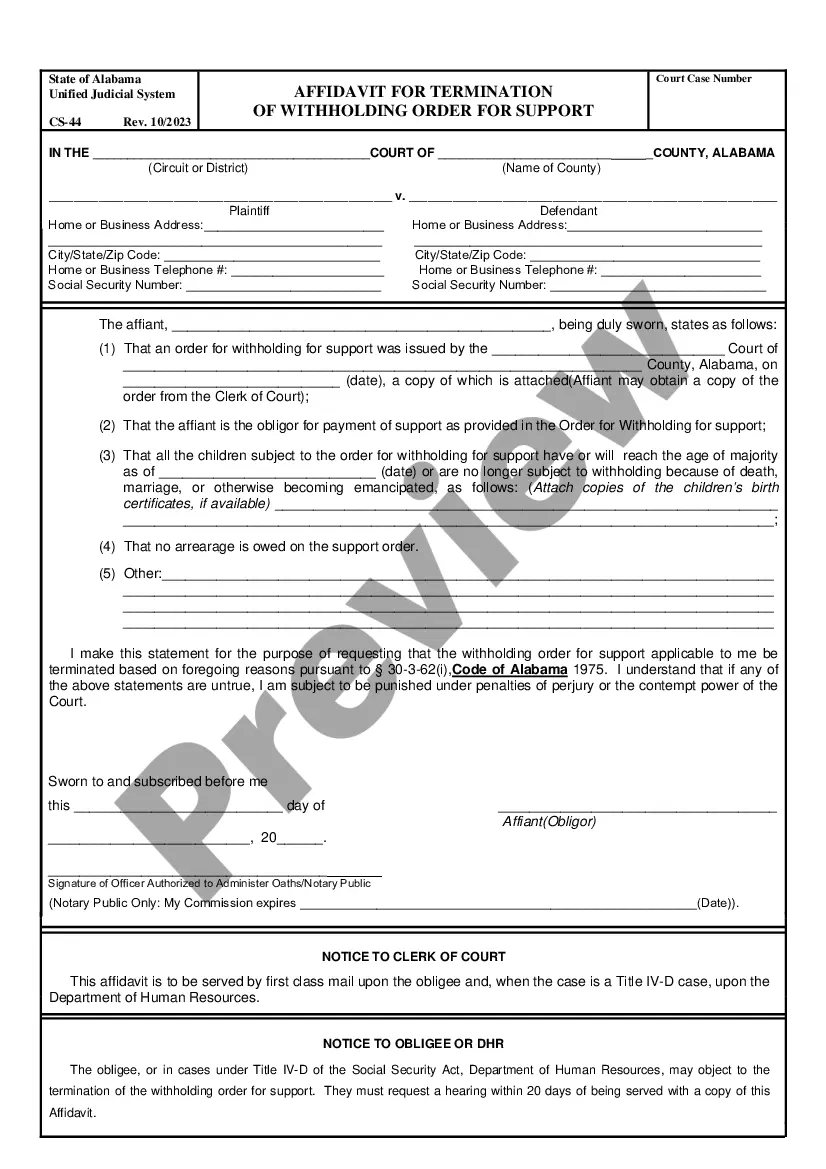

This form is a Renunciation and Disclaimer of a Real Property Interest where the beneficiary gained the interest upon the death of the decedent, but, pursuant to the Oregon Revised Statutes, Chapter 112, the beneficiary has chosen to disclaim his/her interest in the real property. Therefore, the property will pass to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Oregon Renunciation And Disclaimer of Real Property Interest

Description Ors Chapter 112

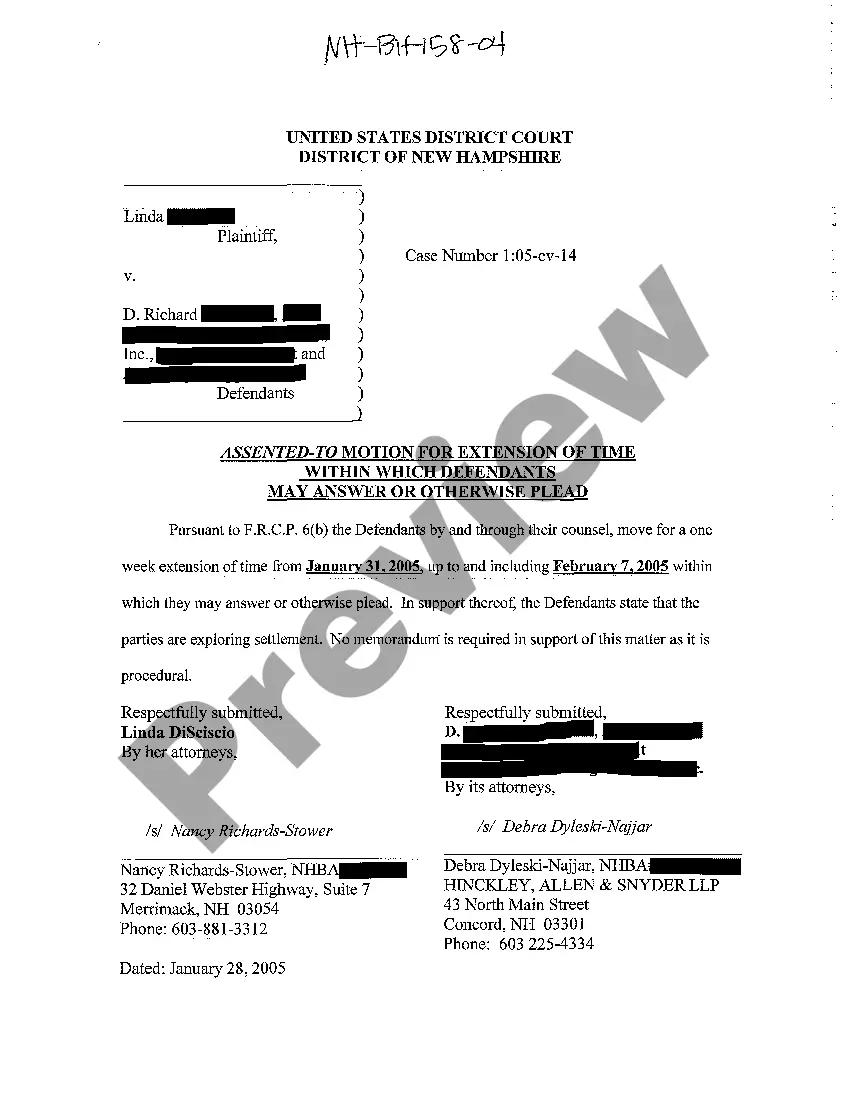

How to fill out Oregon Renunciation And Disclaimer Of Real Property Interest?

In terms of completing Oregon Renunciation And Disclaimer of Real Property Interest, you probably visualize a long procedure that consists of finding a suitable sample among hundreds of very similar ones and then needing to pay a lawyer to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific document in a matter of clicks.

In case you have a subscription, just log in and click on Download button to have the Oregon Renunciation And Disclaimer of Real Property Interest sample.

If you don’t have an account yet but want one, keep to the step-by-step guide listed below:

- Make sure the file you’re getting is valid in your state (or the state it’s needed in).

- Do it by reading the form’s description and through clicking on the Preview function (if available) to view the form’s information.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Subscribe to an account and select how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Skilled attorneys work on drawing up our templates to ensure after saving, you don't have to bother about editing content outside of your personal information or your business’s details. Sign up for US Legal Forms and get your Oregon Renunciation And Disclaimer of Real Property Interest example now.

Real Property Interest Form popularity

FAQ

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.