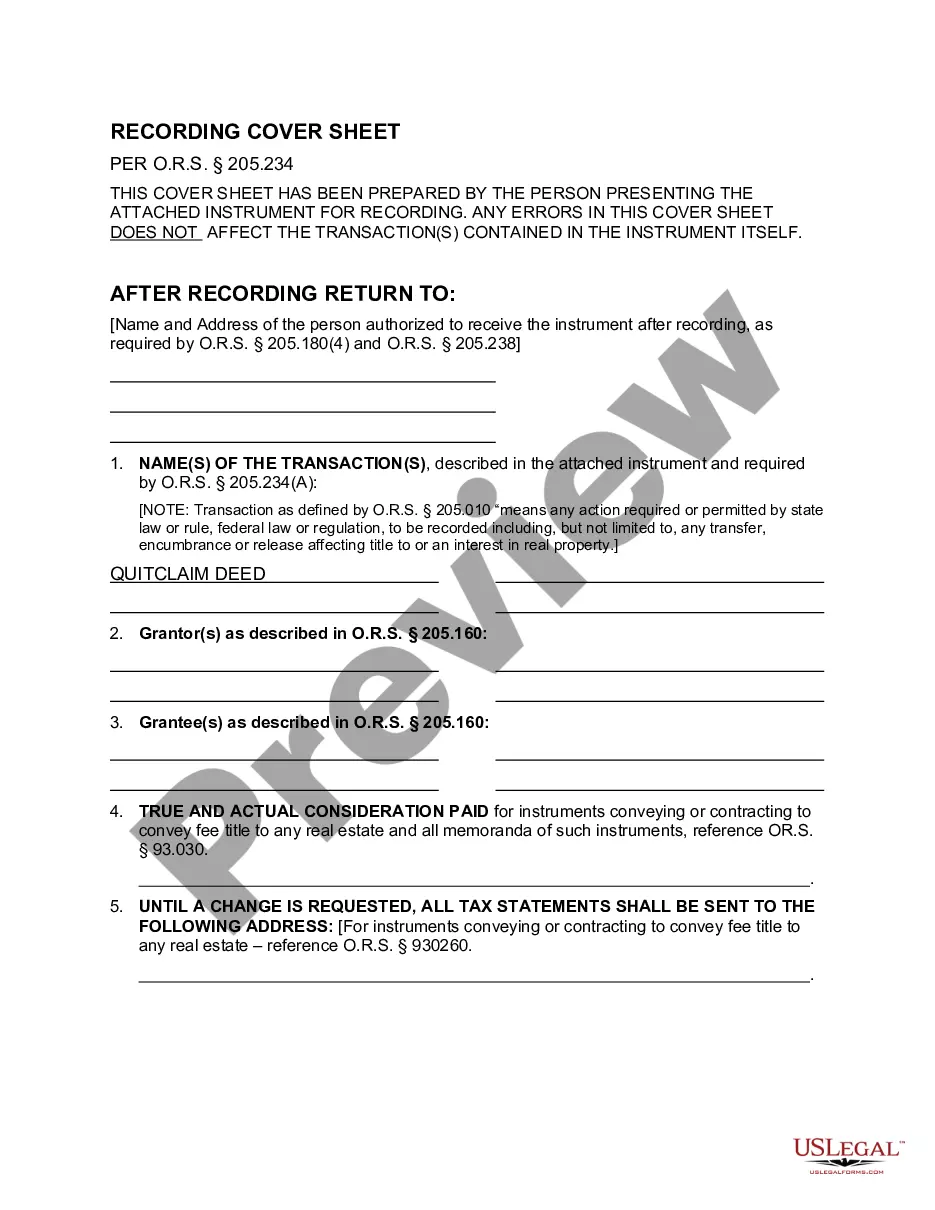

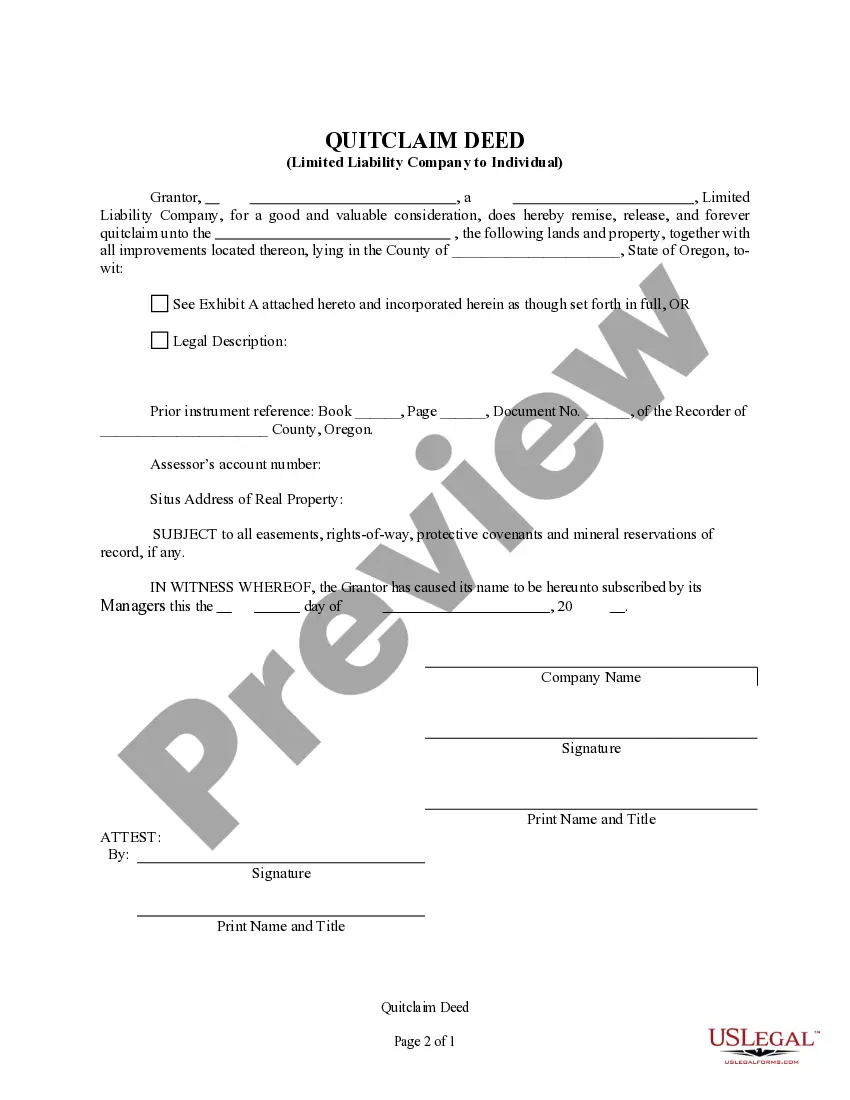

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Oregon Quitclaim Deed - Limited Liability Company to Individual

Description

How to fill out Oregon Quitclaim Deed - Limited Liability Company To Individual?

When it comes to submitting Oregon Quitclaim Deed - Limited Liability Company to Individual, you probably visualize an extensive procedure that involves getting a perfect sample among numerous similar ones after which being forced to pay a lawyer to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template within just clicks.

For those who have a subscription, just log in and then click Download to have the Oregon Quitclaim Deed - Limited Liability Company to Individual sample.

If you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and by clicking the Preview option (if readily available) to view the form’s information.

- Click on Buy Now button.

- Find the suitable plan for your financial budget.

- Join an account and select how you would like to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Skilled attorneys work on creating our templates so that after downloading, you don't have to worry about modifying content material outside of your individual details or your business’s details. Be a part of US Legal Forms and receive your Oregon Quitclaim Deed - Limited Liability Company to Individual sample now.

Form popularity

FAQ

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Step 1: Form an LLC or Corporation. You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity. Step 2: Complete a Quitclaim Deed. Step 3: Record Your Quitclaim Deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.