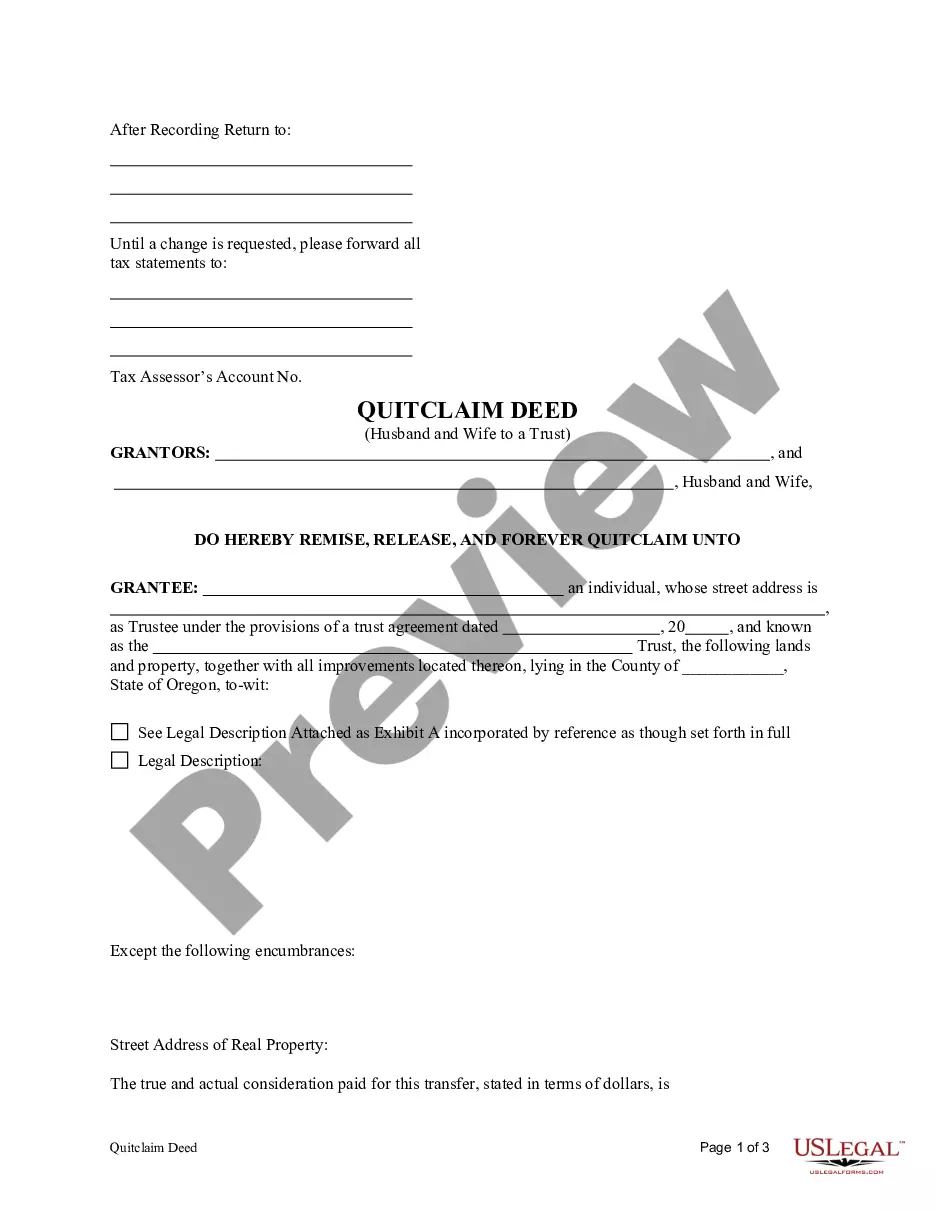

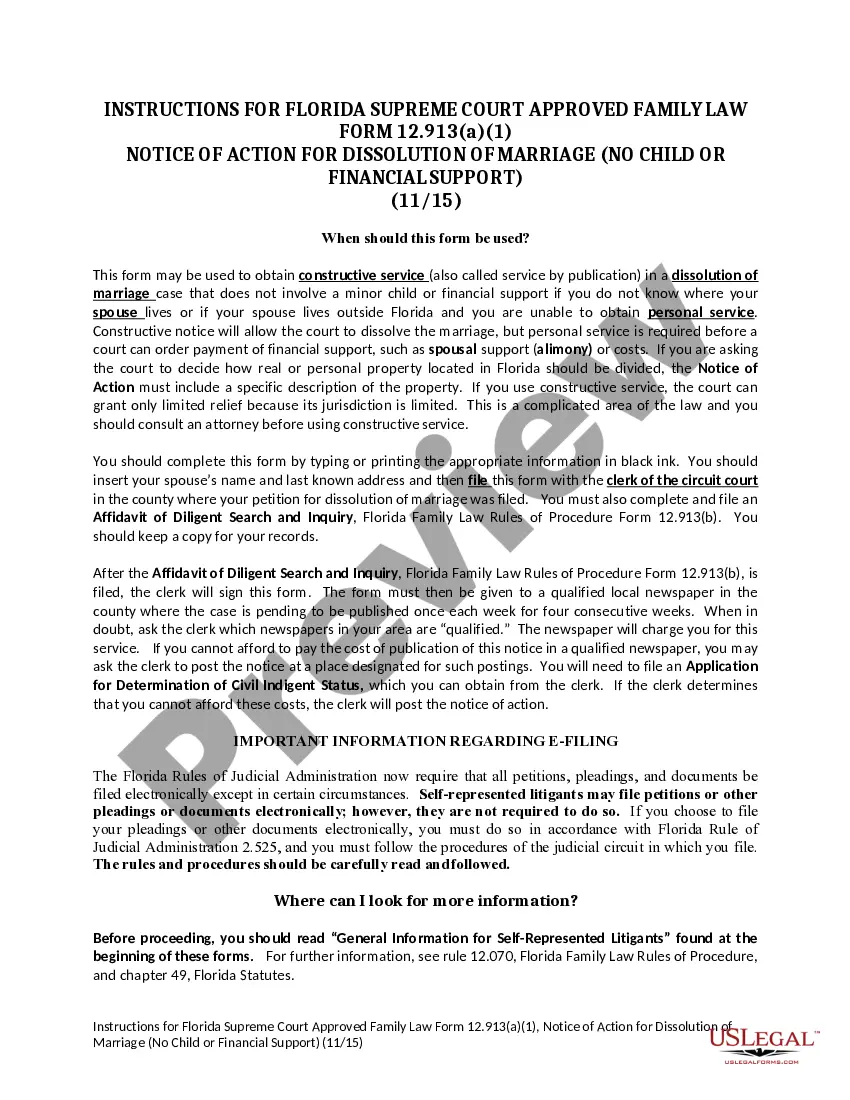

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Oregon Quitclaim Deed from Husband and Wife to Trust

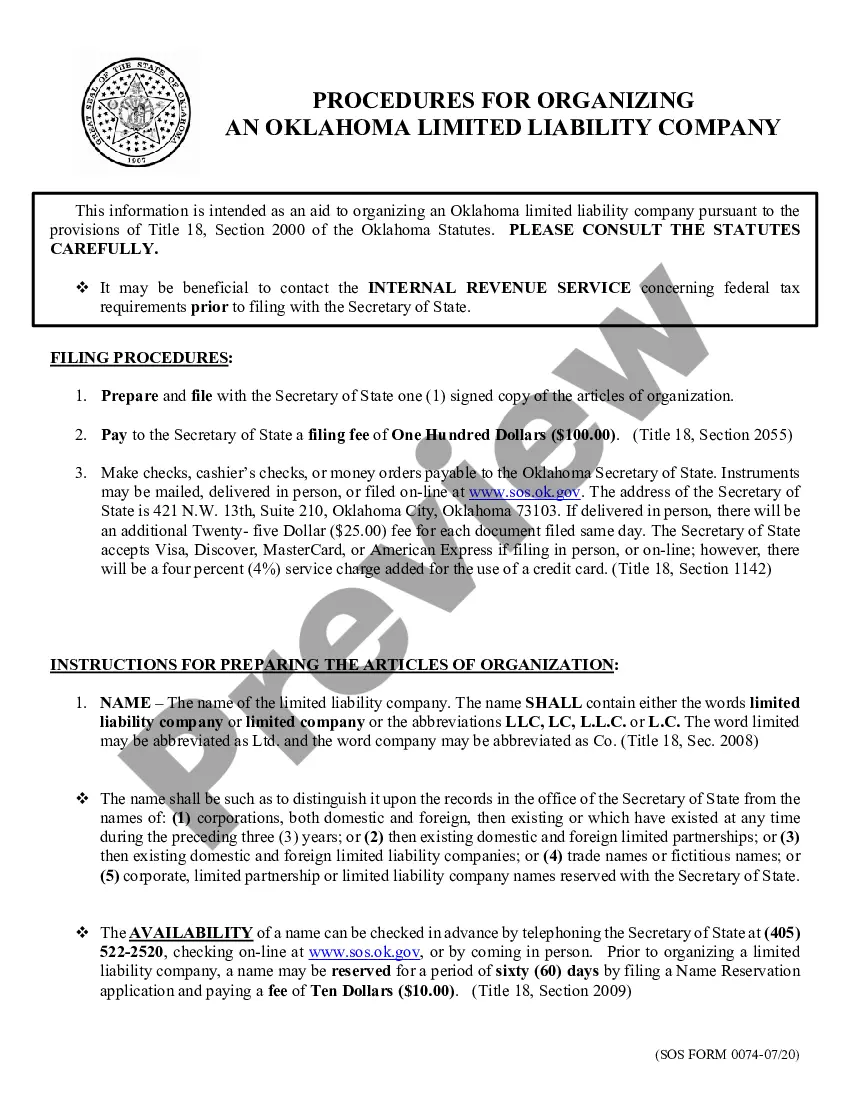

Description Or Llc Form

How to fill out Deed Limited Liability?

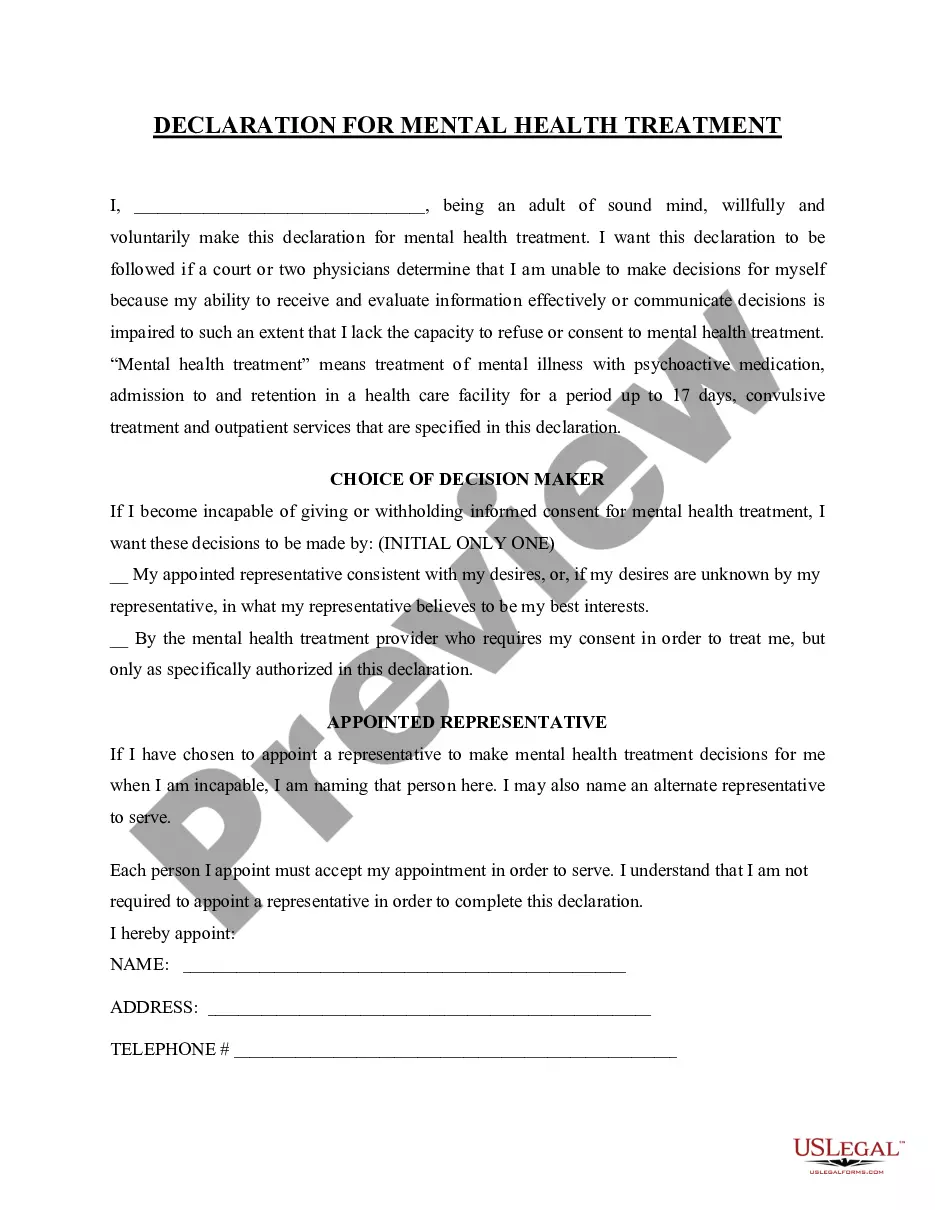

In terms of filling out Oregon Quitclaim Deed from Husband and Wife to Trust, you most likely think about an extensive process that requires finding a appropriate sample among numerous similar ones after which having to pay out a lawyer to fill it out for you. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific template in just clicks.

If you have a subscription, just log in and then click Download to have the Oregon Quitclaim Deed from Husband and Wife to Trust template.

In the event you don’t have an account yet but need one, stick to the step-by-step guide below:

- Be sure the document you’re downloading is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and through clicking the Preview option (if readily available) to view the form’s content.

- Click on Buy Now button.

- Find the proper plan for your budget.

- Sign up to an account and select how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Skilled attorneys draw up our templates to ensure after downloading, you don't need to bother about modifying content outside of your personal information or your business’s details. Sign up for US Legal Forms and receive your Oregon Quitclaim Deed from Husband and Wife to Trust example now.

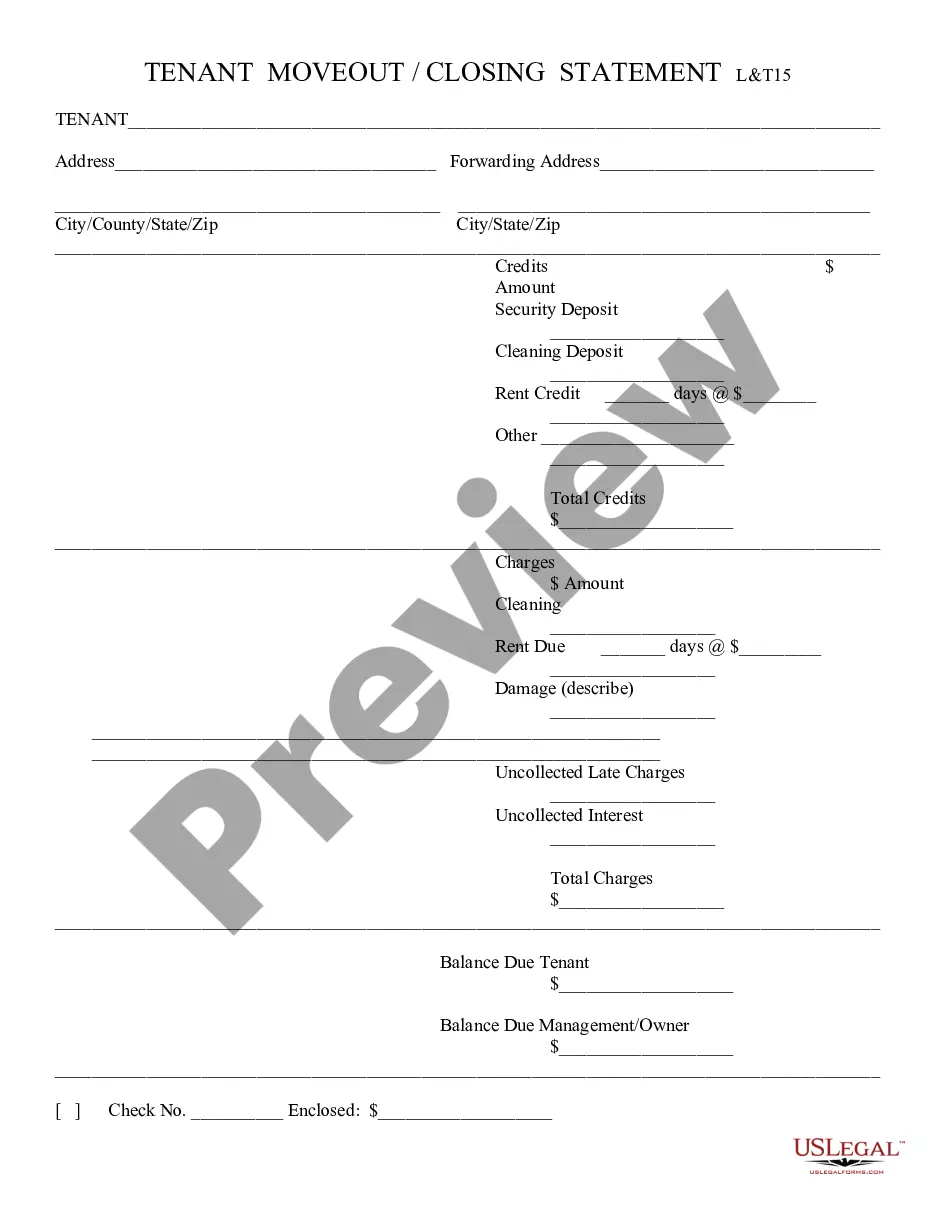

Llc Limited Liability Form popularity

Llc Limited Liability Form Other Form Names

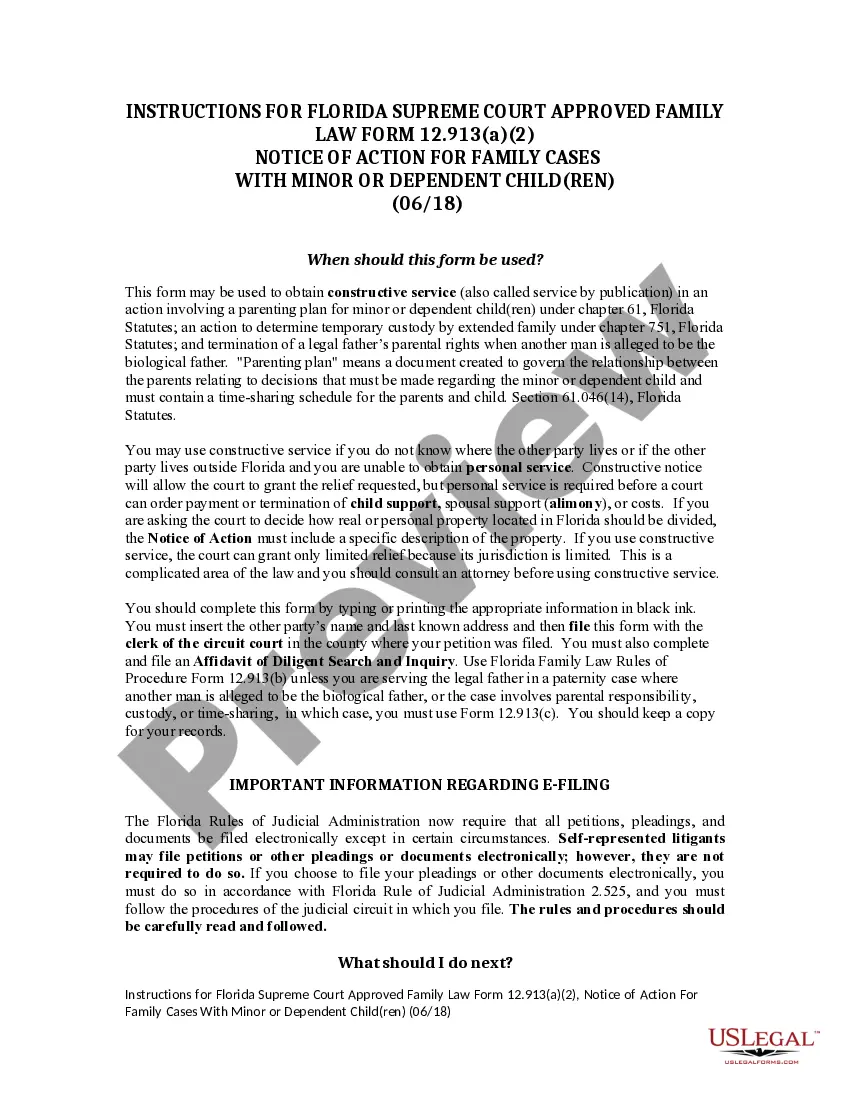

Or Deed Trust FAQ

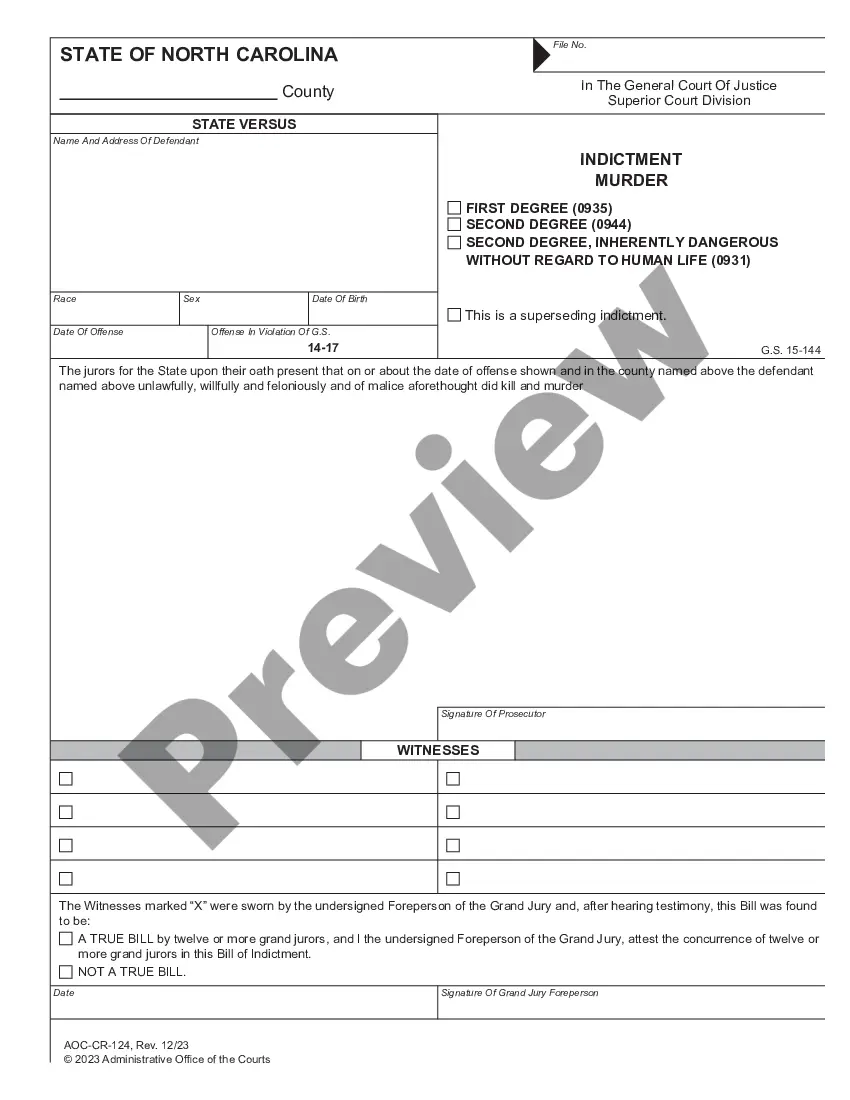

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.