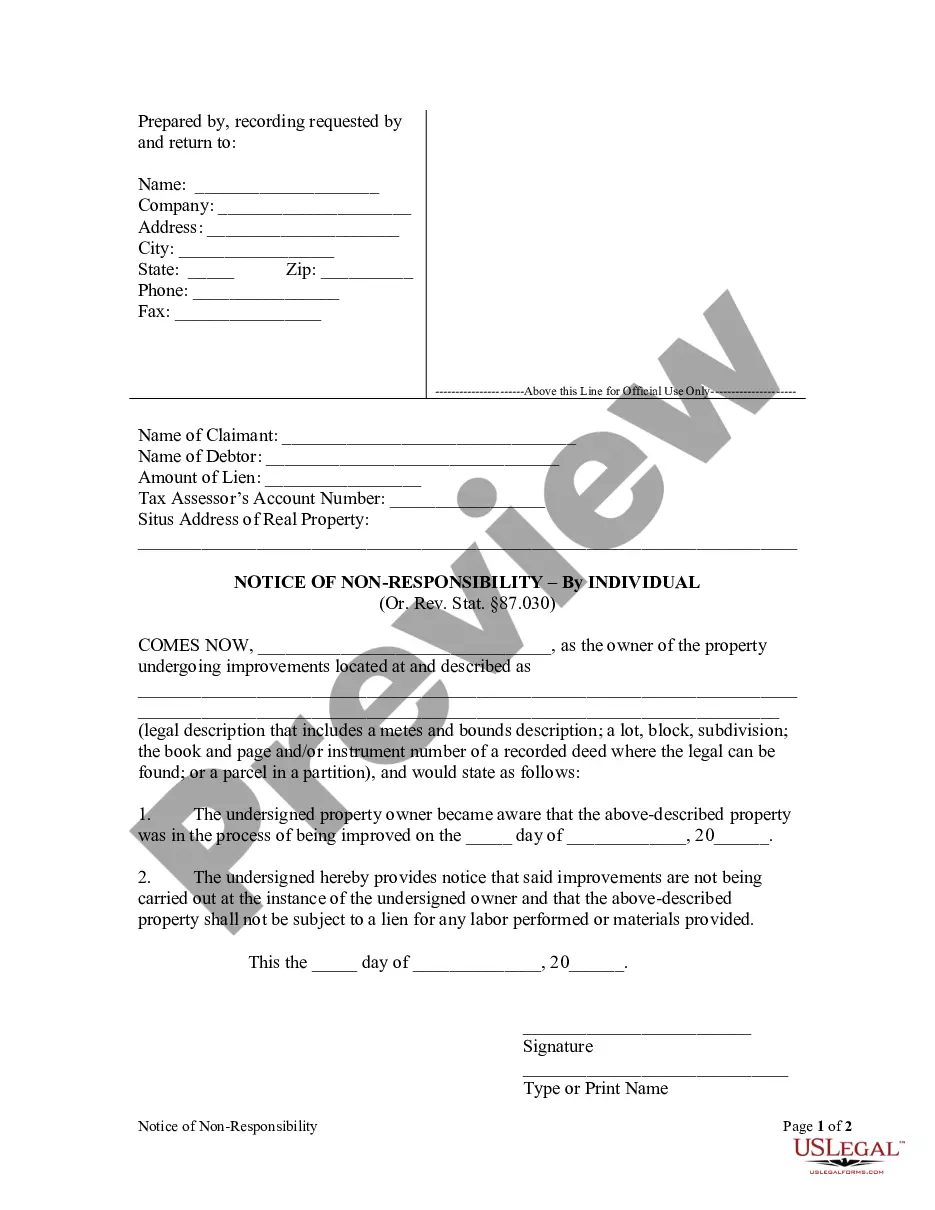

Notice of Nonresponsibility - Individual

Note: This summary is not

intended to be an all inclusive discussion of Oregon's construction or

mechanic's lien laws, but does include basic provisions.

What is a construction or mechanic's lien?

Every State permits

a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their State should always consult their State statutes directly.

Who can claim a lien in this State?

Any person performing labor

upon, transporting or furnishing any material to be used in, or renting

equipment used in the construction of any improvement shall have a lien

upon the improvement for the labor, transportation or material furnished

or equipment rented at the instance of the owner of the improvement or

the construction agent of the owner.

How long does a party have to claim a lien?

Every person claiming

a lien created under ORS 87.010 (1) or (2) shall perfect the lien not later

than 75 days after the person has ceased to provide labor, rent equipment

or furnish materials or 75 days after completion of construction, whichever

is earlier. Every other person claiming a lien created under ORS 87.010

shall perfect the lien not later than 75 days after the completion of construction.

How long is a lien good for?

No lien created under

ORS 87.010 shall bind any improvement for a longer period than 120 days

after the claim of lien is filed unless suit is brought in a proper court

within that time to enforce the lien, or if extended payment is provided

and the terms thereof are stated in the claim of lien, then 120 days after

the expiration of such extended payment, but no lien shall be continued

in force for a longer time than two years from the time the claim of lien

is filed under ORS 87.035 by any agreement to extend payment.

Does this State require or provide for a notice

from subcontractors and laborers to property owners?

Yes. a person furnishing

any materials, equipment, services or labor described in ORS 87.010 (1)

to (3), (5) and (6) for which a lien may be perfected under ORS 87.035

shall give a notice of right to a lien to the owner of the site.

A person filing a claim

of lien pursuant to ORS 87.035 shall mail to the owner and to the mortgagee

a notice in writing that the claim has been filed. A copy of the claim

of lien shall be attached to the notice. The notice shall be mailed not

later than 20 days after the date of filing.

Does this State require or provide for a notice

from the property owner to the contractor, subcontractor, or laborers?

An owner who receives

a notice of right to a lien in accordance with the provisions of ORS 87.021

may demand, in writing, from the person providing materials, equipment,

services or labor a list of materials or equipment or description of labor

or services supplied or a statement of the contractual basis for supplying

the materials, equipment, services or labor, including the percentage of

the contract completed, and the charge therefor to the date of the demand.

The supplier's statement shall be delivered to the owner within 15 days,

not including Saturdays, Sundays and other holidays as defined in ORS 187.010,

of receipt of the owner's written demand, as evidenced by a receipt or

a receipt of delivery of a certified or registered letter containing the

demand. Failure of the supplier to furnish the information requested constitutes

a loss of attorney fees and costs otherwise allowable in a suit to foreclose

a lien.

Also, every improvement

except an improvement made by a person other than the landowner in drilling

or boring for oil or gas, constructed upon lands with the knowledge of

the owner shall be deemed constructed at the instance of the owner, and

the interest owned shall be subject to any lien perfected pursuant to the

provisions of ORS 87.001 to 87.060 and 87.075 to 87.093, unless the owner

shall, within three days after the owner obtains knowledge of the construction,

give notice that the owner will not be responsible for the same by posting

a notice in writing to that effect in some conspicuous place upon the land

or the improvement situated thereon.

Does this State require a notice prior to starting

work, or after work has been completed?

The completion of construction

of an improvement shall occur when: (a) The improvement is substantially

complete; or (b) a completion notice is posted and recorded as provided

by subsections (2) and (3) of this section; or (c) the improvement is abandoned

as provided by subsection (5) of this section. When all original

contractors employed on the construction of an improvement have substantially

performed their contracts, any original contractor, the owner or mortgagee,

or an agent of any of them may post and record a completion notice.

Does this State permit a person with an interest

in property to deny responsibility for improvements?

Yes. Every improvement

except an improvement made by a person other than the landowner in drilling

or boring for oil or gas, constructed upon lands with the knowledge of

the owner shall be deemed constructed at the instance of the owner, and

the interest owned shall be subject to any lien perfected pursuant to the

provisions of ORS 87.001 to 87.060 and 87.075 to 87.093, unless the owner

shall, within three days after the owner obtains knowledge of the construction,

give notice that the owner will not be responsible for the same by posting

a notice in writing to that effect in some conspicuous place upon the land

or the improvement situated thereon.

Is a notice attesting to the satisfaction of a

lien provided for or required?

No. Oregon statutes

do not provide for or require that a lien holder who has been paid produce

or file a notice to that effect.

Does this State permit the use of a bond to release

a lien?

Yes.

The owner of an improvement or land against which a lien perfected under

ORS 87.035 is claimed, or any other interested person, may file with the

recording officer of the county in whose office the claim of lien is filed

a bond executed by a corporation authorized to issue surety bonds in the

State of Oregon to the effect that the principal or principals on the bond

shall pay the amount of the claim and all costs and attorney fees that

are awarded against the improvement or land on account of the lien. The

bond shall be in an amount not less than 150 percent of the amount claimed

under the lien, or in the amount of $1,000, whichever is greater.