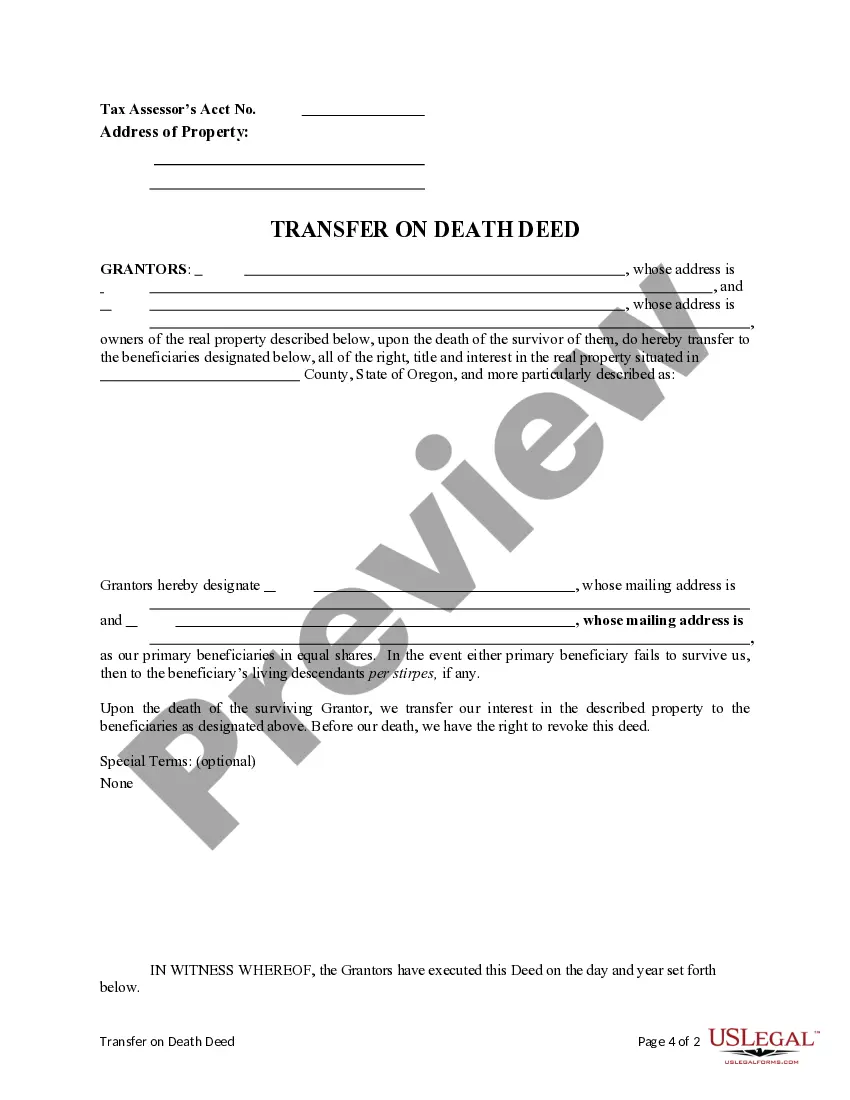

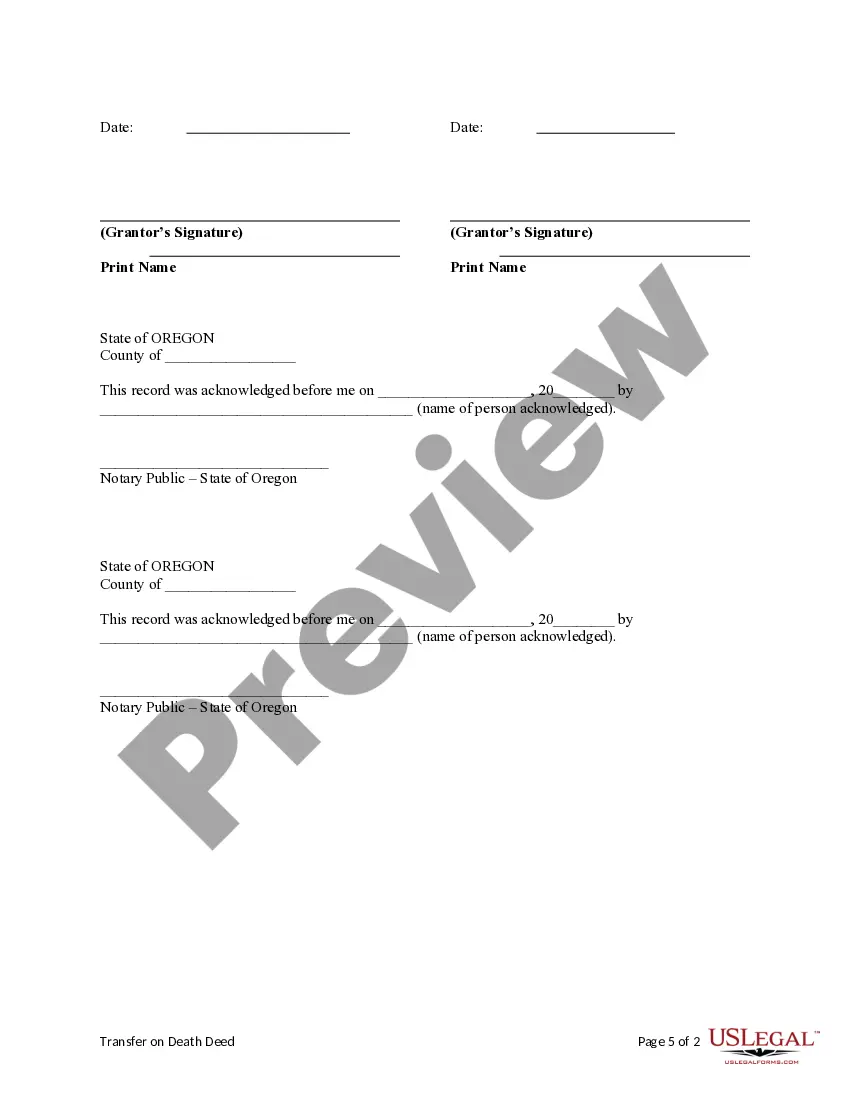

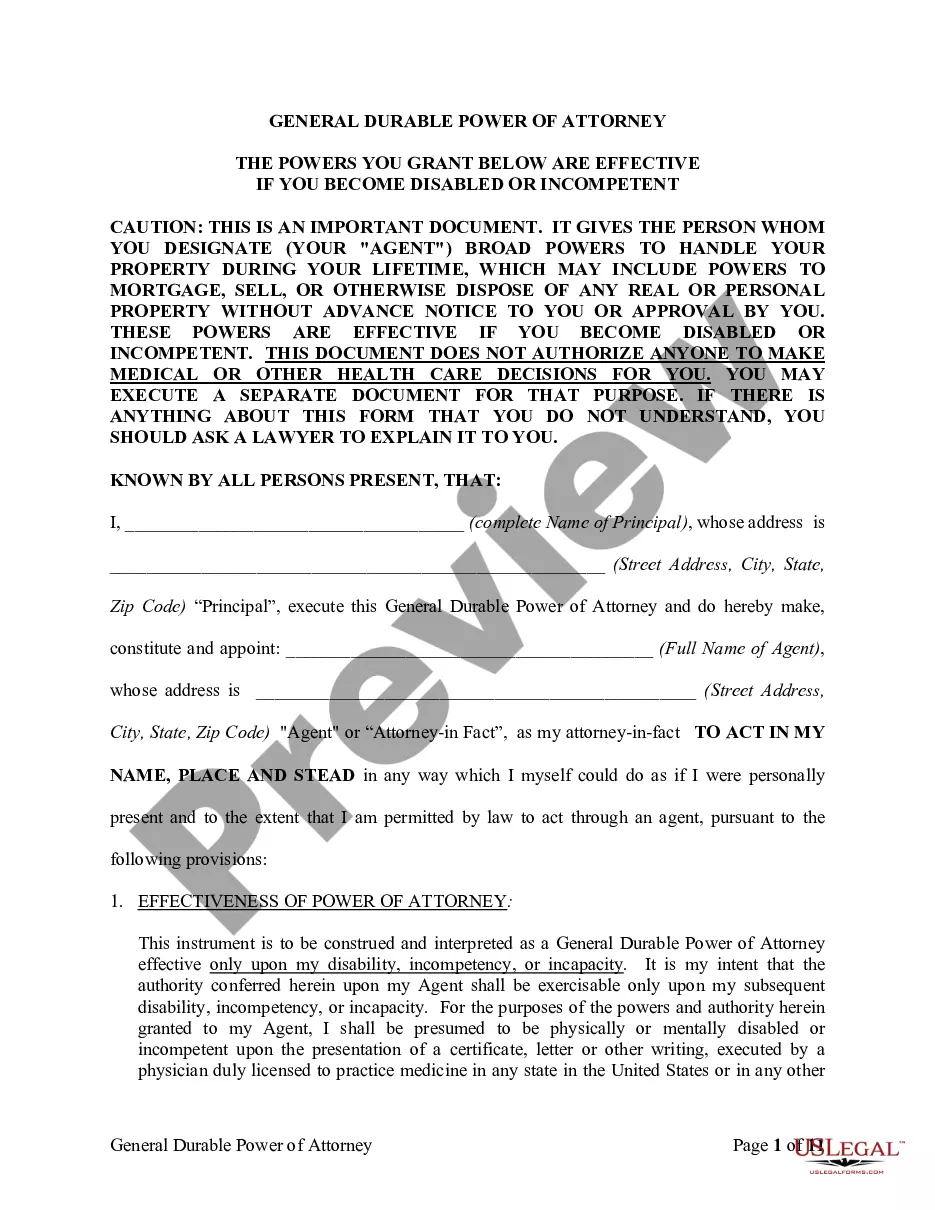

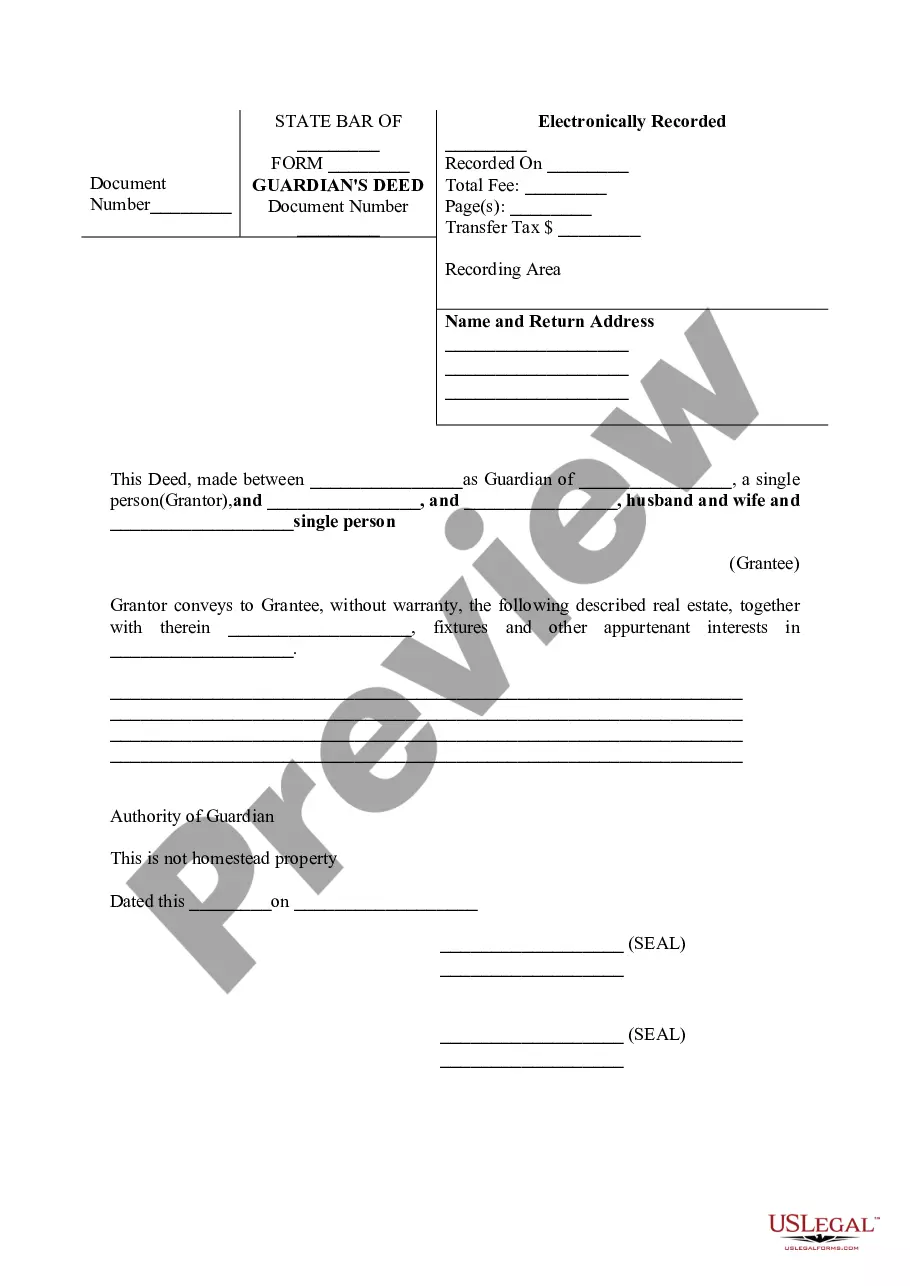

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantee Beneficiaries are two individuals, or Husband and Wife. This transfer is revocable until the last Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary Grantees takes the property in equal shares if the primary beneficiaries survive the Grantors. If a primary beneficiary fails to survive Grantors, their interest in the property would go to their descendants per stirpes, if any.

Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries.

Description Deed 2 Individuals Blank

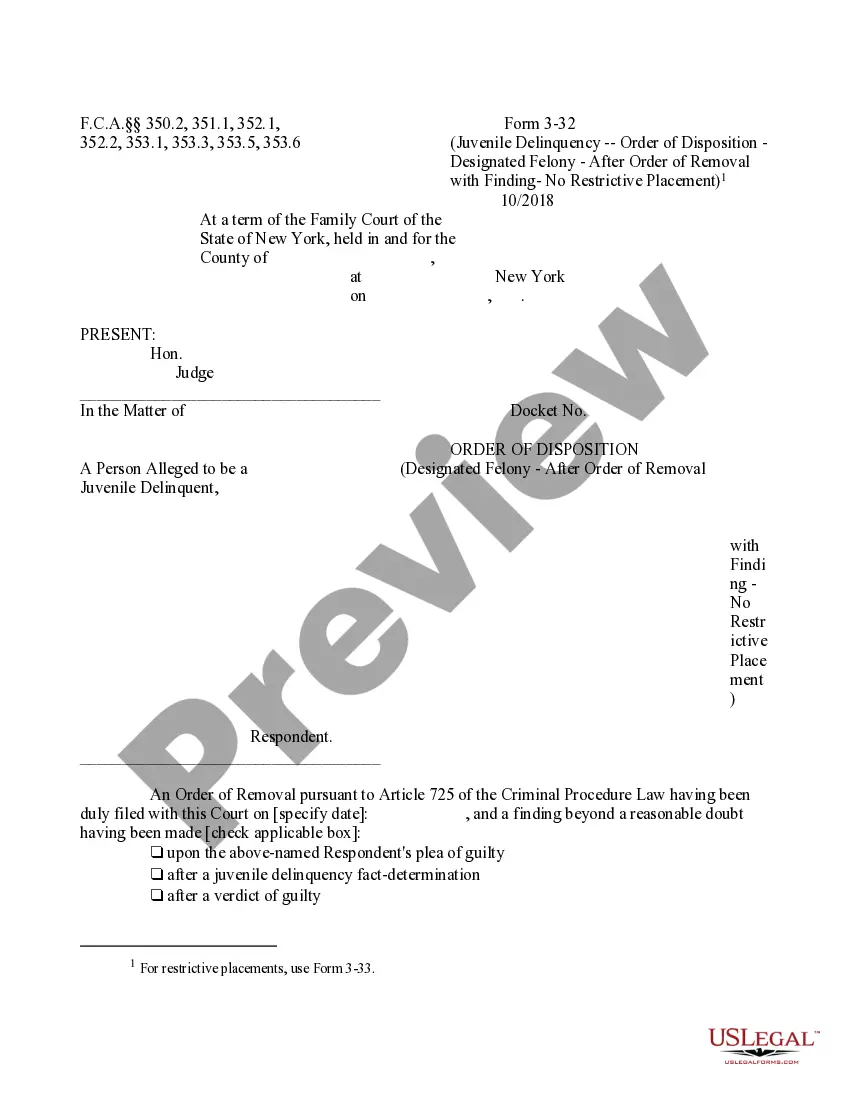

How to fill out Or Transfer Death Deed Document?

In terms of filling out Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries., you probably visualize an extensive procedure that requires getting a perfect sample among numerous very similar ones then needing to pay legal counsel to fill it out to suit your needs. In general, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific document in a matter of clicks.

For those who have a subscription, just log in and click on Download button to have the Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries. form.

If you don’t have an account yet but want one, follow the step-by-step guideline below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

- Do so by reading the form’s description and also by visiting the Preview function (if available) to find out the form’s content.

- Simply click Buy Now.

- Pick the proper plan for your budget.

- Sign up to an account and choose how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the record on your device or in your My Forms folder.

Skilled legal professionals work on creating our templates to ensure after saving, you don't have to worry about modifying content material outside of your individual info or your business’s details. Join US Legal Forms and get your Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries. document now.

Or Death Form Form popularity

Transfer Death Form Pdf Other Form Names

Or Transfer Death FAQ

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property. Each owner can leave their share of the property to whoever they choose.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

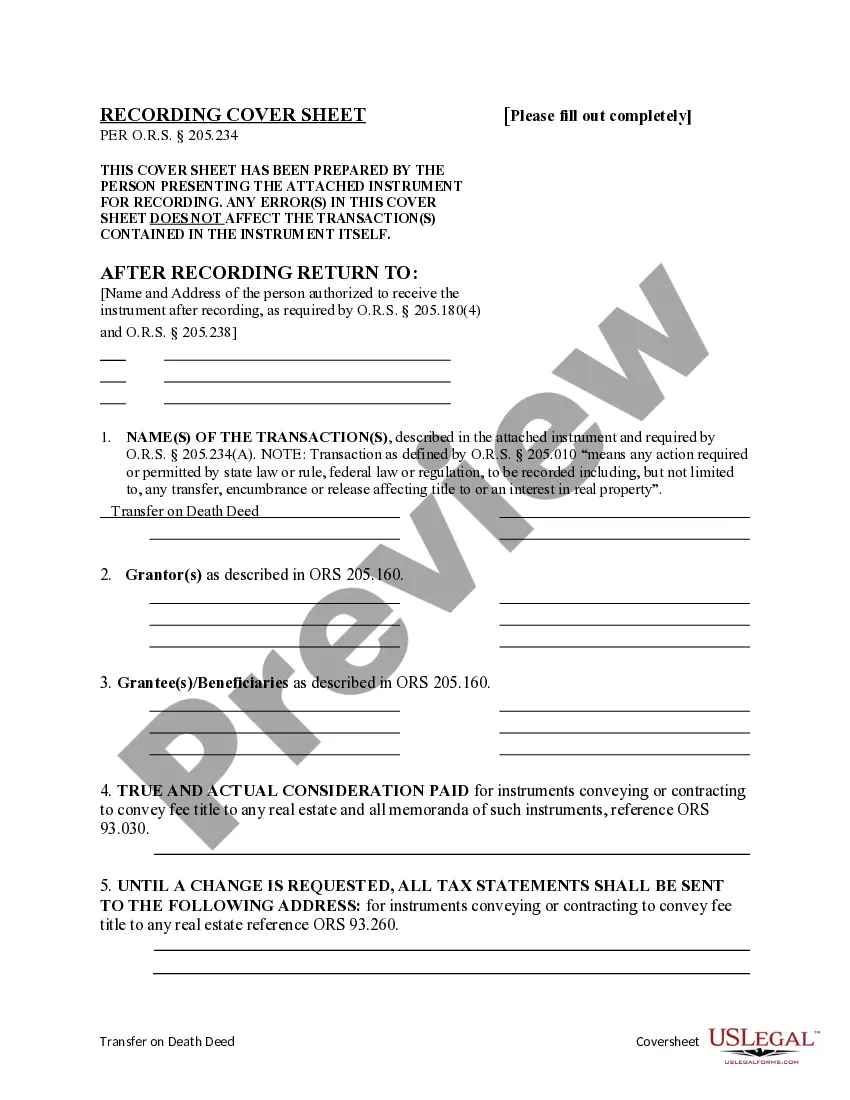

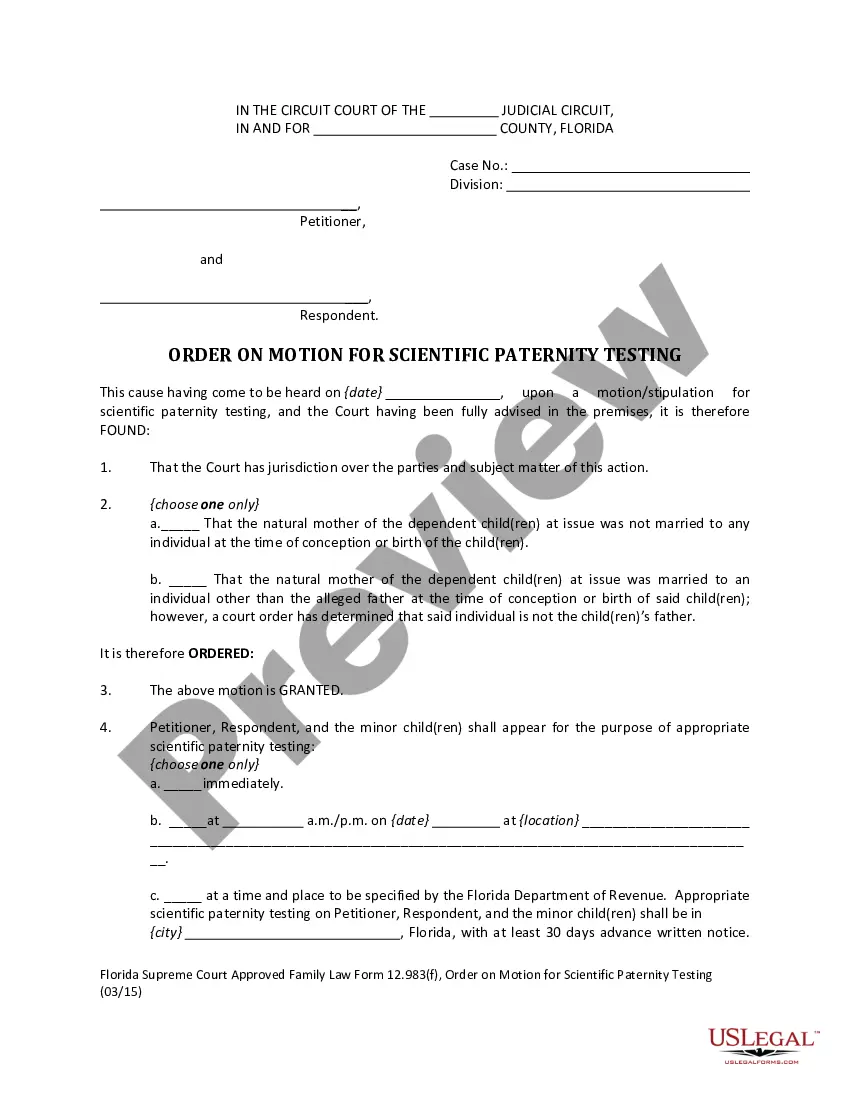

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.