This form is a Transfer on Death Deed where the Grantor/Owner is an individual and the Grantee beneficiaries are four individuals. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries.

Description Oregon Transfer On Death Deed

How to fill out What Is A Ladybird Deed?

When it comes to filling out Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries., you most likely visualize a long procedure that consists of getting a ideal sample among a huge selection of similar ones then being forced to pay out an attorney to fill it out for you. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific form within just clicks.

If you have a subscription, just log in and then click Download to have the Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries. sample.

If you don’t have an account yet but need one, stick to the point-by-point guide below:

- Be sure the document you’re getting applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and by clicking on the Preview option (if accessible) to view the form’s content.

- Simply click Buy Now.

- Find the proper plan for your financial budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Get the record on your device or in your My Forms folder.

Professional lawyers draw up our samples to ensure that after saving, you don't need to worry about editing content material outside of your personal information or your business’s information. Be a part of US Legal Forms and receive your Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries. sample now.

Oregon Tod Deed Form popularity

Transfer On Death Deed Form Oregon Other Form Names

Ladybird Deed And Medicaid FAQ

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

If you die without leaving a will, then your estate will be distributed in accordance with the law of succession. This also happens: When the will is not valid because it was not made properly.

If the property is to be transferred to a beneficiary the Executor or Administrator will need to submit a document called an 'Assent' to the Land Registry, with a copy of the Grant of Representation. The Land Registry will then transfer the property into the name of the new owner.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

When someone dies without a will, it's called dying intestate. When that happens, none of the potential heirs has any say over who gets the estate (the assets and property). When there's no will, the estate goes into probate.Legal fees are paid out of the estate and it often gets expensive.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

If it was inherited, succession law comes into play. Once the beneficiaries and their shares, rights and liabilities are decided, the property has to be transferred in their names. For this you need to apply for property transfer at the sub-registrar's office.

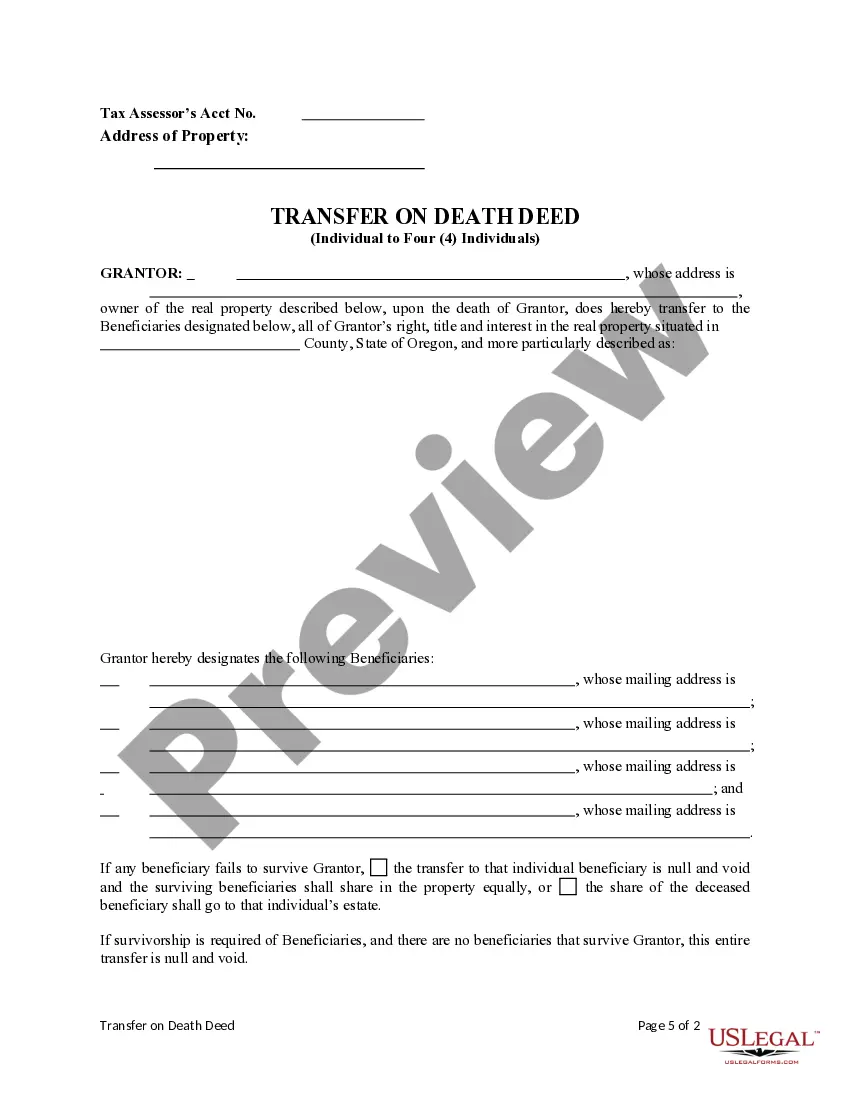

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.