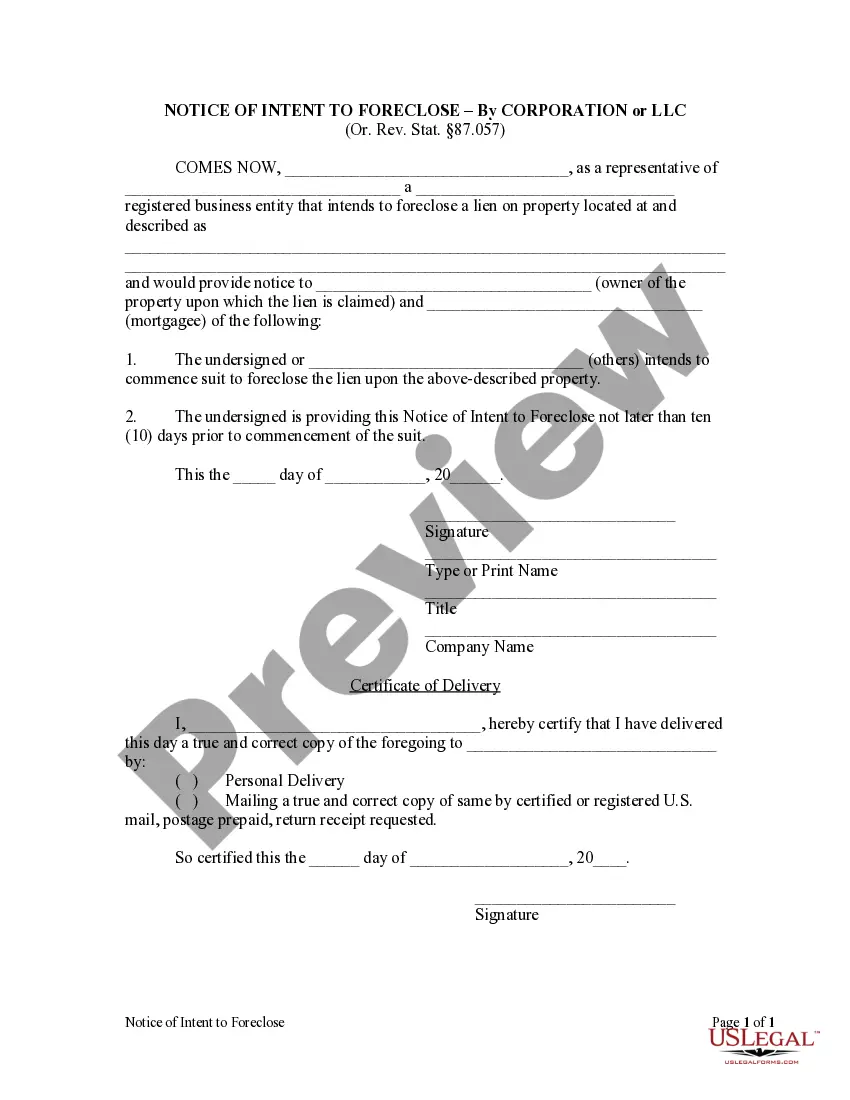

This Notice of Intent to Foreclose is for use by a corporation who intends to foreclose a lien on property to provide notice not later than ten days prior to commencement of the suit to the owner of the property upon which the lien is claimed and the mortgagee that the corporation intends to commence suit to foreclose the lien upon the described property.

Oregon Notice of Intent to Foreclose - Corporation

Description

How to fill out Oregon Notice Of Intent To Foreclose - Corporation?

In terms of submitting Oregon Notice of Intent to Foreclose - Corporation or LLC, you most likely think about a long procedure that involves choosing a ideal sample among numerous very similar ones and then being forced to pay legal counsel to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Oregon Notice of Intent to Foreclose - Corporation or LLC template.

In the event you don’t have an account yet but want one, keep to the step-by-step guide listed below:

- Be sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do so by reading through the form’s description and through clicking on the Preview function (if readily available) to view the form’s content.

- Simply click Buy Now.

- Pick the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the file on your device or in your My Forms folder.

Skilled attorneys draw up our templates to ensure that after saving, you don't have to worry about enhancing content outside of your individual information or your business’s details. Sign up for US Legal Forms and get your Oregon Notice of Intent to Foreclose - Corporation or LLC sample now.

Form popularity

FAQ

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Reports.

How long does it take to form an LLC in Oregon? Filing the Articles of Organization takes 24 hours online or about 3 to 5 days by mail.

A Limited Liability Company (LLC) is an entity created by state statute.A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

Step 1: Visit the Business Name Database. Go to the California Secretary of State's website. Step 2: Search your Business Name. Step 3: Review Results.

Log in to the official website of trademark registration in India: https://ipindiaonline.gov.in. Click on the trademarks tab and then click on public search.

With an S-corp tax status, a business avoids double taxation, which is when a corporation is taxed on its profits and then again on the dividends that shareholders receive as their personal earnings.In an LLC, members must pay self-employment taxes, which are Social Security and Medicare taxes, directly to the IRS.

How much does it cost to form an LLC in Oregon? The Oregon Secretary of State charges a $100 fee to file the Articles of Organization. Oregon LLCs are also required to file an annual report each year with the Secretary of State. The filing fee for domestic LLCs is $100 and the fee for foreign LLCs is $275.