Oregon Report of Gross Annual Income

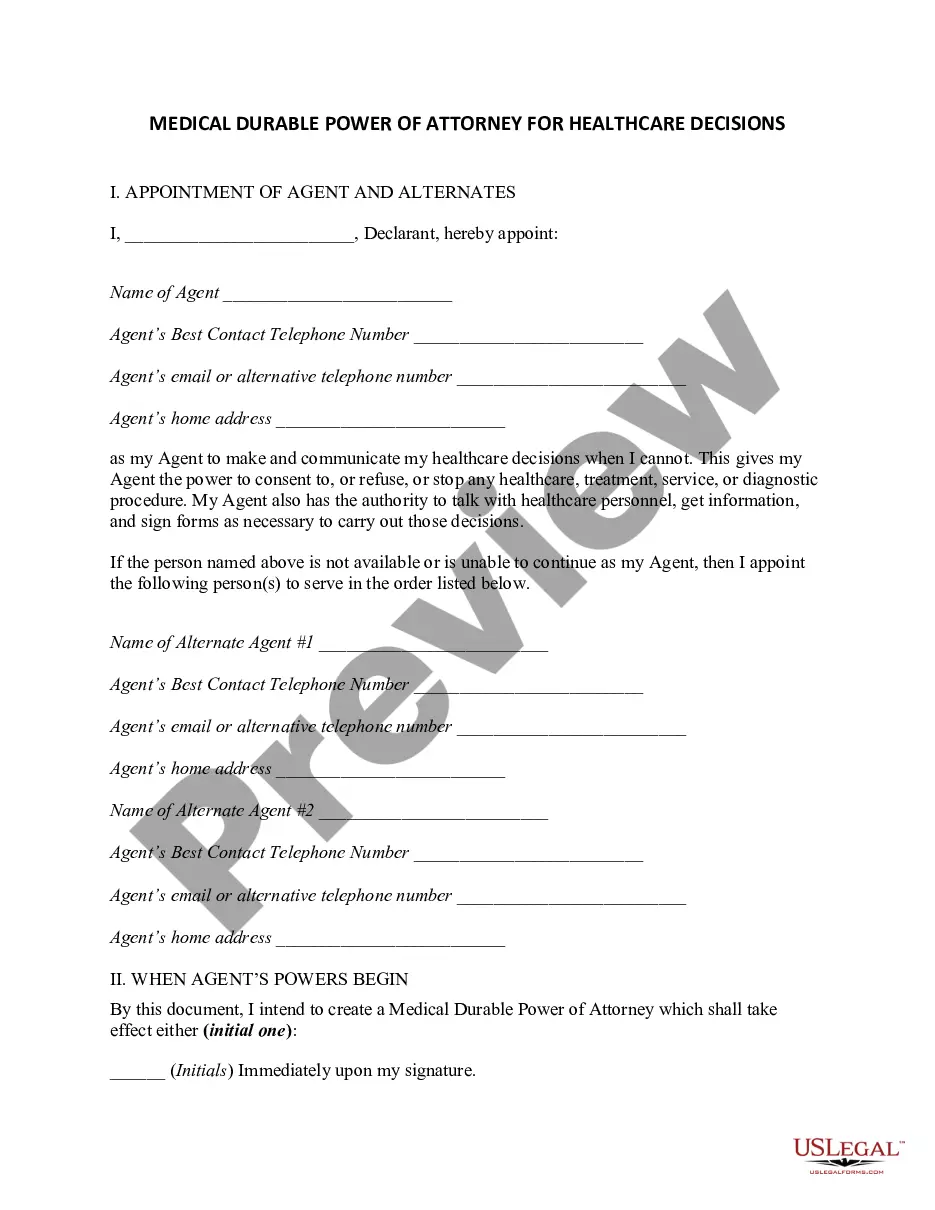

Description

How to fill out Oregon Report Of Gross Annual Income?

When it comes to completing Oregon Report of Gross Annual Income, you most likely imagine an extensive procedure that involves finding a appropriate form among numerous similar ones then having to pay legal counsel to fill it out for you. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific form within just clicks.

For those who have a subscription, just log in and click on Download button to get the Oregon Report of Gross Annual Income template.

In the event you don’t have an account yet but want one, follow the point-by-point manual below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do this by looking at the form’s description and by clicking on the Preview option (if accessible) to find out the form’s information.

- Simply click Buy Now.

- Select the appropriate plan for your budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Skilled lawyers work on creating our templates to ensure that after downloading, you don't have to bother about editing content outside of your personal info or your business’s details. Join US Legal Forms and get your Oregon Report of Gross Annual Income document now.

Form popularity

FAQ

If you have a Paid Family Leave claim or you are unable to access your information online, you can request a copy of your Form 1099G by calling the EDD's Interactive Voice Response (IVR) system at 1-866-333-4606. The IVR system is available 24 hours a day, 7 days a week. A copy of your Form 1099G will be mailed to you.

200bYou can now earn up to $300 without seeing any change to your benefit. To qualify, you cannot: Earn more than your weekly benefit amount, or. Work more than 39 hours.

Oregon source income of a nonresident includes compensation received for services performed as a fiduciary of an Oregon estate or trust.

Single: If you are single and under the age of 65, the minimum amount of annual gross income you can make that requires filing a tax return is $12,200. If you're 65 or older and plan on filing single, that minimum goes up to $13,850.

You don't usually attach the 1099-G form to your return. In general, most government agencies provide a paper copy of Form 1099-G to you by January 31 of the year following the year of payment. If you did not receive a Form 1099-G, check with the government agency that made the payments to you.

Generally, if your total income for the year doesn't exceed certain thresholds, then you don't need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

For single dependents who are under the age of 65 and not blind, you generally must file a federal income tax return if your unearned income (such as from ordinary dividends or taxable interest) was more than $1,050 or if your earned income (such as from wages or salary) was more than $12,000.

How will I get my 1099G? Your 1099G will be sent to the address we have on file. If you have moved but not updated your contact information, you can download the 1099G from the Online Claims System. We also encourage you to update your address on the Online Claims System.

If you are an Oregon resident (see above) but worked outside of Oregon, you are required to pay taxes in Oregon on that income. Oregon takes state income tax on any and all income that you made, even if it was out of state. You might also get taxed by the state in which you earned the income.