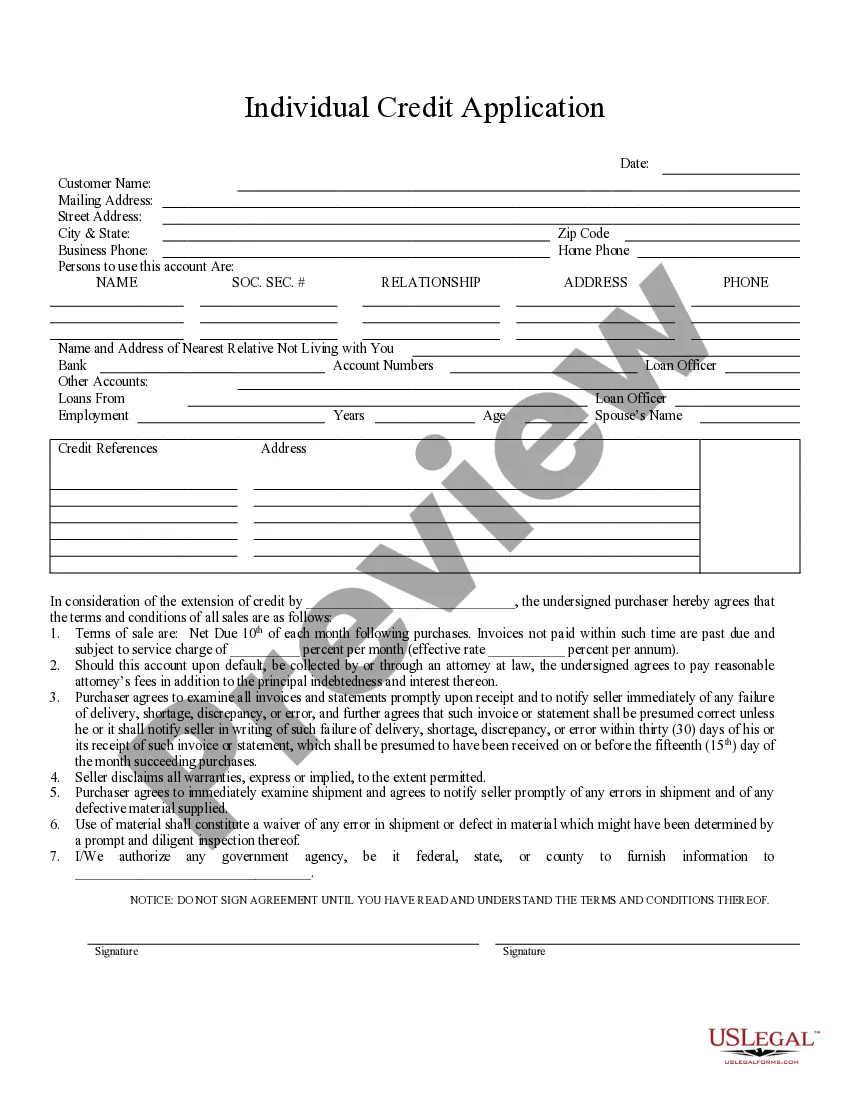

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Oregon Individual Credit Application

Description

How to fill out Oregon Individual Credit Application?

When it comes to completing Oregon Individual Credit Application, you most likely visualize an extensive process that requires getting a perfect form among countless very similar ones then being forced to pay out legal counsel to fill it out for you. In general, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form in just clicks.

If you have a subscription, just log in and click on Download button to have the Oregon Individual Credit Application sample.

If you don’t have an account yet but want one, stick to the step-by-step guide listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do so by reading the form’s description and by clicking on the Preview function (if offered) to see the form’s information.

- Click on Buy Now button.

- Find the proper plan for your financial budget.

- Sign up to an account and choose how you would like to pay out: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional lawyers work on drawing up our samples so that after downloading, you don't need to worry about editing and enhancing content outside of your individual information or your business’s info. Join US Legal Forms and get your Oregon Individual Credit Application sample now.

Form popularity

FAQ

2020 Child Tax Credit For 2020 tax returns, which are due by April 15 of this year, the child tax credit is worth $2,000 per kid under the age of 17 claimed as a dependent on your return.

In short, the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce your taxable income, while credits reduce your tax.

Show proof of earned income. Have investment income below $3,650 in the tax year you claim the credit. Have a valid Social Security number. Claim a certain filing status. Be a U.S. citizen or a resident alien all year.

For the 2020 tax year (the tax return due May 17, 2021), the earned income credit ranges from $538 to $6,660 depending on your filing status and how many children you have.

Use Form 40 to change (amend) your full-year resident return. Check the amended return box in the upper left corner of the form. You must also complete and include the Oregon Amended Schedule with your amended return. For prior year tax booklets or the Oregon Amended Schedule, please visit our website or contact us.

The annual tax credit amount per exemption has increased from $206 to $210. The annualized deduction for Federal tax withheld has increased from a maximum of $6,800 to $6,950. The tax tables have changed for all filers.

Oregon's personal exemption credit This credit is available to you if: You can't be claimed as a dependent on someone else's return, and. Your federal adjusted gross income isn't more than $100,000 if your filing status is single or married filing separately, or isn't more than $200,000 for all others.

$2,000: The maximum amount of the child tax credit per qualifying child. $1,400: The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax.

The EIC requires you to reduce your self-employment income by 1/2 of your self-employment tax bill.If your adjusted gross income is greater than your earned income your Earned Income Credit is calculated with your adjusted gross income and compared to the amount you would have received with your earned income.